Budgeting Templates: Ditch the Drudgery and Embrace Financial Fun with Creative Categories

Budgeting. The word itself can conjure up images of spreadsheets, restrictions, and a general sense of financial deprivation. But what if I told you that budgeting could actually be… dare I say… fun? The key lies in ditching the boring, generic categories and embracing a budgeting template with creative, engaging, and personalized expense tracking. A well-designed budgeting template, complete with fun categories, can transform your financial management from a chore into an empowering and even enjoyable experience.

Why Traditional Budgeting Falls Flat

Let’s face it: most traditional budgeting approaches are doomed from the start. They rely on broad, uninspiring categories like "Food," "Transportation," and "Entertainment." These categories are so vague that they fail to capture the nuances of our spending habits. "Food" could encompass everything from groceries to takeout to fancy restaurant meals. "Entertainment" might include movie tickets, concerts, streaming subscriptions, and even that impulse buy at the bookstore. This lack of granularity makes it difficult to identify areas where you can realistically cut back or optimize your spending.

Furthermore, traditional budgets often feel restrictive and punitive. They focus on what you can’t do, rather than what you can achieve. This negative framing can lead to feelings of resentment and ultimately, abandonment of the budgeting process altogether.

The Power of Fun and Personalized Categories

The solution? Infuse your budget with personality and make it reflective of your individual lifestyle and values. This means creating categories that are specific, relevant, and even a little bit whimsical.

Here’s why fun categories work:

- Increased Awareness: When you track your spending in detailed, personalized categories, you become more aware of where your money is actually going. This heightened awareness is the first step towards making informed financial decisions.

- Enhanced Motivation: A budget that reflects your passions and priorities is far more motivating than a generic one. When you see how your spending aligns with your goals, you’re more likely to stick to your budget and make progress towards your financial objectives.

- Greater Control: Fun categories give you a greater sense of control over your finances. You’re not just mindlessly tracking expenses; you’re actively managing your money in a way that supports your lifestyle and values.

- Improved Enjoyment: Let’s be honest: budgeting can be tedious. But when you inject some fun and creativity into the process, it becomes less of a chore and more of an engaging activity.

Examples of Fun Budgeting Categories

Ready to ditch the drudgery and embrace financial fun? Here are some examples of fun and personalized budgeting categories to get you started:

-

For the Foodie:

- Coffee Fix: Track your daily coffee shop visits.

- Culinary Adventures: Allocate funds for trying new restaurants or cuisines.

- Grocery Goodness: Separate this from "Eating Out" to track actual grocery costs.

- Takeout Temptations: Specifically for those nights you don’t feel like cooking.

- Farmer’s Market Finds: Support local producers and enjoy fresh, seasonal produce.

-

For the Travel Enthusiast:

- Wanderlust Fund: Dedicated savings for your next big adventure.

- Weekend Getaways: Budget for short trips and local explorations.

- Travel Treats: Souvenirs, experiences, and little indulgences while traveling.

- Passport to Paradise: Savings for specific travel goals (e.g., "Passport to Italy").

-

For the Self-Care Seeker:

- Zen Zone: Yoga classes, meditation apps, and other wellness expenses.

- Pamper Me Please: Spa treatments, massages, and other self-care indulgences.

- Retail Therapy (in Moderation!): Set a limit for discretionary spending on clothes, shoes, or accessories.

- Mind & Body Boost: Gym memberships, fitness classes, or personal training.

-

For the Hobbyist:

- Creative Outlet: Art supplies, craft materials, or musical instruments.

- Gaming Gauntlet: Video games, consoles, and online subscriptions.

- Bookworm Burrow: New books, e-readers, or library fines (oops!).

- Green Thumb Garden: Plants, seeds, and gardening supplies.

- Cosplay Creations: Materials and accessories for cosplay activities.

-

For the Social Butterfly:

- Friendship Fuel: Drinks, snacks, and activities with friends.

- Date Night Delights: Budget for romantic outings with your partner.

- Gifting Goodness: Presents for birthdays, holidays, and special occasions.

- Charity Cheers: Donations to your favorite causes.

-

For Home and Living:

- Home Sweet Home Improvements: Budget for home repairs and upgrades.

- Cozy Comforts: New blankets, pillows, or home decor items.

- Pet Pal Provisions: Food, toys, and vet care for your furry friends.

- Greener Living: Eco-friendly products and sustainable choices.

Creating Your Own Fun Budgeting Template

The best budgeting template is one that you create yourself, tailored to your specific needs and preferences. Here’s how to get started:

-

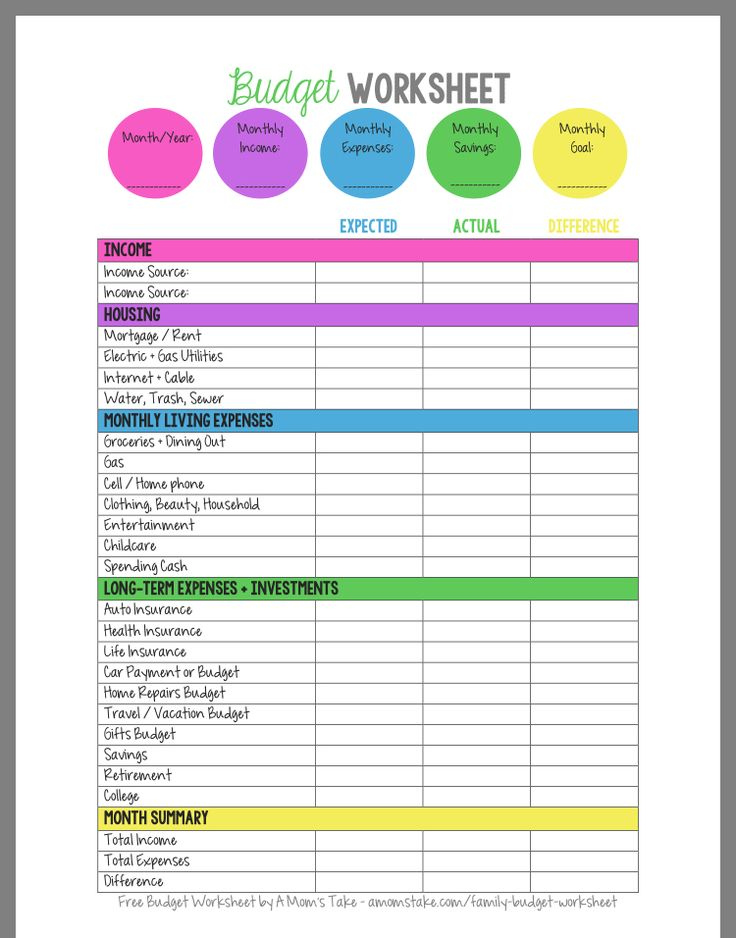

Choose Your Tool: Select a budgeting tool that works for you. This could be a spreadsheet program like Excel or Google Sheets, a dedicated budgeting app (like Mint, YNAB, or Personal Capital), or even a good old-fashioned notebook and pen.

-

Identify Your Fixed Expenses: Start by listing your fixed expenses, such as rent/mortgage, utilities, insurance, and loan payments. These are the expenses that remain relatively consistent each month.

-

Brainstorm Fun Categories: Now comes the fun part! Brainstorm a list of categories that reflect your lifestyle, hobbies, and values. Don’t be afraid to get creative and personalize your categories to make them more engaging.

-

Estimate Your Spending: For each category, estimate how much you typically spend each month. Use your past bank statements, credit card bills, and receipts to get a realistic picture of your spending habits.

-

Track Your Spending: The key to successful budgeting is consistent tracking. Record your expenses in your chosen tool as you incur them. This will give you a clear picture of where your money is going and help you identify areas where you can cut back or optimize your spending.

-

Review and Adjust: Regularly review your budget and make adjustments as needed. Your spending habits and financial goals may change over time, so it’s important to keep your budget up-to-date.

Tips for Sticking to Your Fun Budget

- Set Realistic Goals: Don’t try to cut back too drastically all at once. Start with small, achievable goals and gradually increase your savings as you become more comfortable with the budgeting process.

- Automate Your Savings: Set up automatic transfers from your checking account to your savings account each month. This will help you build your savings without having to think about it.

- Reward Yourself (in Moderation!): Budget for small rewards to keep yourself motivated. This could be anything from a fancy coffee to a new book to a weekend getaway.

- Find an Accountability Partner: Share your budgeting goals with a friend or family member and ask them to hold you accountable.

- Don’t Be Afraid to Adjust: Life happens! If you overspend in one category, don’t beat yourself up. Simply adjust your budget for the following month and keep moving forward.

- Remember Your "Why": Keep your financial goals in mind to stay motivated. Why are you budgeting? What are you trying to achieve? Visualizing your goals will help you stay on track.

Conclusion

Budgeting doesn’t have to be a dreaded chore. By embracing a budgeting template with fun and personalized categories, you can transform your financial management into an empowering and even enjoyable experience. So, ditch the boring spreadsheets, unleash your creativity, and start budgeting your way to financial freedom – one fun category at a time! Remember, the key is to make it personal, make it engaging, and most importantly, make it fun!