Absolutely! Here’s an article outline for humor-based finance blog topics, along with a sample article incorporating humor.

Outline: Humor-Based Finance Blog Topics

I. Introduction

- Hook: Start with a relatable financial struggle (debt, budgeting woes, etc.) presented humorously.

- Briefly explain the importance of humor in dealing with financial stress.

- Thesis statement: Humor can make complex financial topics more approachable, engaging, and memorable.

II. Why Humor Works in Finance

- Stress Relief: Finance is often stressful; humor offers a release.

- Relatability: Everyone makes financial mistakes; humor normalizes them.

- Engagement: Funny content is more likely to be shared and discussed.

- Retention: People remember funny things; humor helps financial lessons stick.

III. Humor-Based Finance Blog Topic Ideas

- Budgeting Bloopers: Share common budgeting mistakes with a humorous twist.

- Debt Disaster Stories: Collect and share (anonymized) funny debt stories.

- Investment Fails: Discuss investment failures with a lighthearted approach.

- Savings Shenanigans: Explore creative and funny ways to save money.

- Financial Stereotypes: Poke fun at common financial stereotypes (e.g., penny-pinchers, big spenders).

- The Absurdity of Financial Advice: Satirize overly complicated or contradictory financial advice.

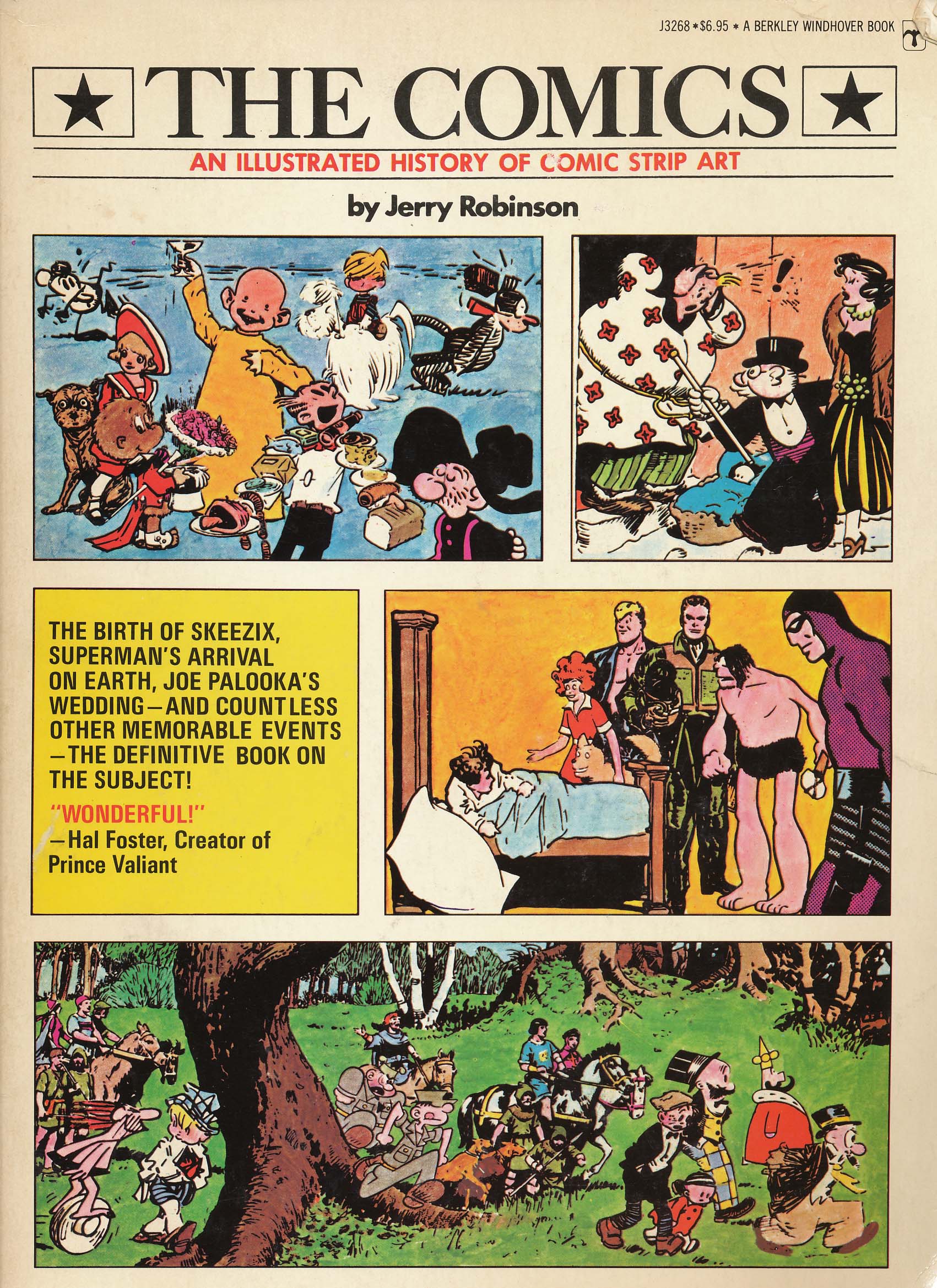

- Finance in Pop Culture: Review how finance is portrayed in movies, TV, or books with a humorous lens.

- Ask a (Fake) Financial Advisor: Create a fictional, comical financial advisor who gives terrible (but funny) advice.

- Financial Resolutions Gone Wrong: Discuss New Year’s financial resolutions that inevitably fail, with a humorous analysis.

- The "If I Won the Lottery" Game: Explore the fantasy of winning the lottery and the ridiculous ways people might spend the money.

IV. Examples of Successful Humor in Finance Blogs

- Identify blogs or articles that have successfully used humor.

- Analyze what makes their humor effective (e.g., self-deprecation, relatable anecdotes, clever wordplay).

V. Tips for Incorporating Humor into Your Finance Blog

- Know Your Audience: Understand what your readers find funny.

- Be Relatable: Focus on common financial experiences.

- Use Anecdotes: Personal stories can be very effective.

- Don’t Punch Down: Avoid making fun of people in vulnerable financial situations.

- Be Authentic: Let your own sense of humor shine through.

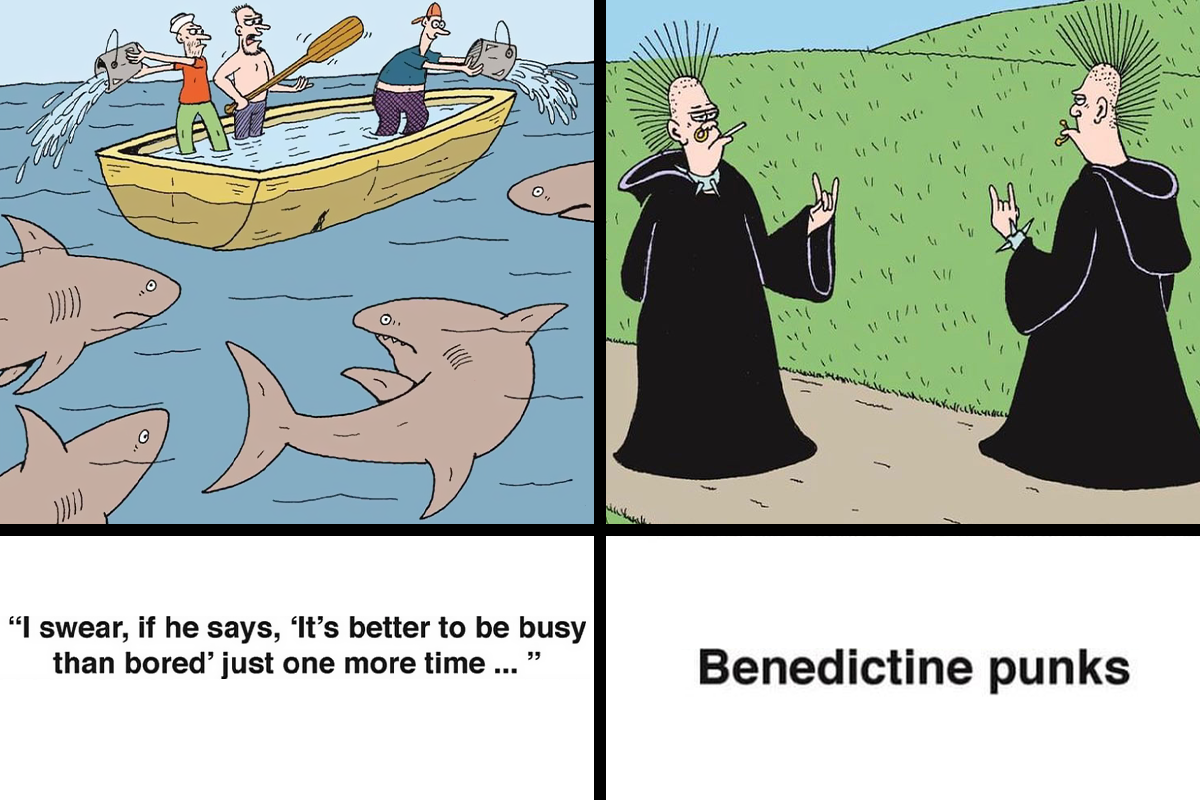

- Use Visuals: Memes, GIFs, and comics can enhance humor.

- Balance Humor with Information: Ensure that your content is still informative and valuable.

VI. Potential Pitfalls to Avoid

- Being Offensive: Avoid humor that is sexist, racist, or otherwise discriminatory.

- Trivializing Serious Issues: Don’t make light of serious financial problems like bankruptcy or foreclosure.

- Being Unclear: Ensure that your financial advice is still clear and accurate, even with humor.

- Overdoing It: Too much humor can distract from the message.

VII. Conclusion

- Reiterate the benefits of using humor in finance content.

- Encourage readers to explore humorous approaches to managing their finances.

- End with a final humorous thought or call to action.

Sample Article: Budgeting Bloopers: We’ve All Been There, Right?

Introduction

Let’s face it: budgeting is about as fun as a root canal performed by a chimpanzee. We all know we should do it, but the reality is often a messy, guilt-ridden affair filled with half-hearted attempts and receipts stuffed into the glove compartment like a financial crime scene. I mean, who hasn’t sworn they’d cut back on coffee only to find themselves cradling a venti caramel macchiato by 9 AM? Yeah, me neither… cough. But fear not, fellow financial fumble-fingers! Today, we’re diving headfirst into the hilarious world of budgeting bloopers – because if we can’t laugh at our mistakes, we’ll just cry (and probably impulse-buy a new pair of shoes to make ourselves feel better).

Why Humor Works (When Your Budget Doesn’t)

Look, finance is stressful. We’re constantly bombarded with headlines about inflation, interest rates, and the looming robot apocalypse that will probably steal our jobs. A little humor can be the financial equivalent of a stress ball – a way to squeeze out some tension and remember that we’re all in this messy, unpredictable game together. It makes complex topics approachable and memorable. Who’s going to remember the intricacies of compound interest? Nobody. But a funny anecdote about accidentally investing in a company that makes edible underwear? Now that sticks with you.

Budgeting Blooper Bonanza

Alright, let’s get down to the nitty-gritty of financial fails. Here are a few classic budgeting bloopers we’ve all likely committed at some point:

-

The "I’ll Just Round Down" Fallacy: You meticulously track your expenses, but when you get to the end of the month, you "round down" those pesky extra cents. "Oh, what’s 47 cents here or there?" you ask yourself innocently. Fast forward a few months, and you’ve magically lost the equivalent of a small vacation fund in rounded-down pennies. It’s like financial pixie dust, but instead of sprinkling wealth, it vanishes into thin air.

-

The "Emergency Fund" Shopping Spree: You diligently build up an emergency fund – hooray! You pat yourself on the back for being a responsible adult. Then, a "sale" pops up at your favorite store, and suddenly, that emergency fund is funding a brand-new wardrobe. "But it’s an emergency! I needed those shoes!" you rationalize. It’s the financial equivalent of using a fire extinguisher to toast marshmallows.

-

The "Subscription Service Black Hole": You sign up for a free trial of something – a streaming service, a fitness app, a cheese-of-the-month club (yes, that’s a thing). You fully intend to cancel before the trial ends. You don’t. Months later, you’re still paying for a service you haven’t used since that initial free week, and your bank account is slowly bleeding to death. It’s like a financial vampire, silently sucking your money while you binge-watch cat videos.

-

The "Cash is King… Except When I’m Lazy" Method: You vow to use cash for everyday purchases to better track your spending. You withdraw a wad of bills from the ATM and proudly stuff them into your wallet. Then, you get tired of counting change and start using your credit card again. The cash sits untouched, mocking you from your wallet as you rack up more credit card debt.

-

The "Budget? What Budget?" Approach: This is the classic. You have the best intentions, but life happens. You get busy, distracted, and the budget falls by the wayside. You tell yourself you’ll get back to it next month. Next month turns into next year, and your finances resemble a chaotic Jackson Pollock painting.

Don’t Be a Finance Funnyman (or Funnywoman): Tips for Humor

- Know your audience: Is your audience young adults struggling with student loan debt? Or are they seasoned investors?

- Be Relatable: The best humor comes from shared experiences. Everyone understands the pain of unexpected expenses or the temptation of impulse buys.

- Self-Deprecation is Your Friend: Making fun of your own financial blunders is a great way to connect with your audience and show that you don’t take yourself too seriously.

- Avoid punching down: Don’t make fun of people in difficult financial situations. The goal is to lighten the mood, not to belittle anyone.

Conclusion: Laugh Your Way to Financial Freedom (Maybe)

Look, personal finance is hard. But it doesn’t have to be a humorless slog. By embracing the absurdity of our financial mistakes and laughing at ourselves along the way, we can make the journey a little less stressful and a lot more enjoyable. So, go forth, budget bravely, and don’t be afraid to laugh when you inevitably mess up. After all, a little humor might just be the secret ingredient to finally getting your finances in order (or at least making them slightly less chaotic). And if all else fails, remember: retail therapy is always an option… just kidding! (Mostly.)