Unleash Your Financial Potential: The Power of Money Motivation Trackers

In the quest for financial well-being, we often get bogged down in spreadsheets, budgets, and complex investment strategies. While these tools are essential, they can sometimes feel impersonal and detached from the emotional drivers that truly fuel our financial decisions. That’s where money motivation trackers come in – a powerful tool to bridge the gap between logic and emotion, helping you stay engaged, focused, and inspired on your journey to financial success.

What is a Money Motivation Tracker?

At its core, a money motivation tracker is a system or tool designed to help you visualize, monitor, and reinforce your financial goals. It goes beyond simply tracking income and expenses; it delves into the "why" behind your money management, connecting your actions to your deepest aspirations.

Think of it as a personal cheerleader, a visual reminder of what you’re working towards, and a source of inspiration to keep you on track when the financial road gets bumpy. A money motivation tracker can take many forms:

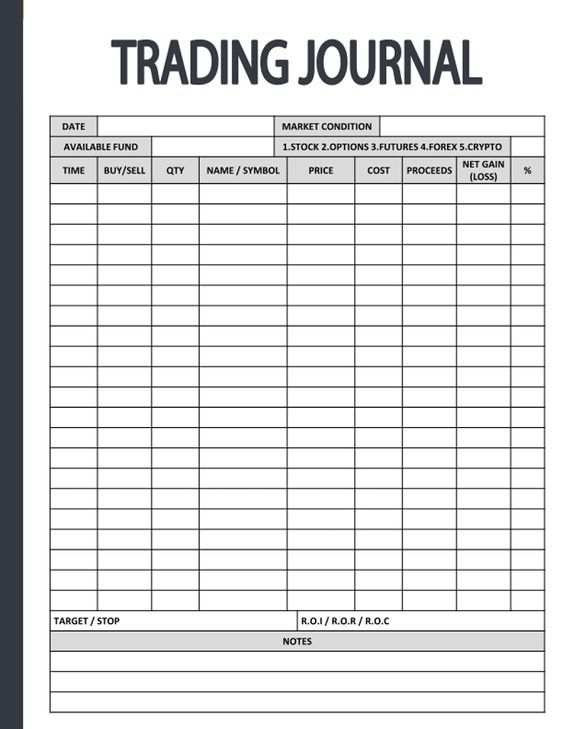

- Physical Tracker: A journal, a whiteboard, a vision board, or a custom-designed printable.

- Digital Tracker: A spreadsheet, a budgeting app, a dedicated motivation app, or a customized dashboard.

Why Use a Money Motivation Tracker?

The benefits of incorporating a money motivation tracker into your financial routine are numerous:

-

Enhanced Goal Clarity:

- Money motivation trackers force you to define your financial goals with precision. Vague aspirations like "save more money" become concrete targets like "save $5,000 for a down payment on a house by next year."

- By breaking down large goals into smaller, manageable steps, you create a roadmap that feels less daunting and more achievable.

-

Increased Motivation and Engagement:

- Seeing your progress visually is incredibly motivating. Whether it’s filling in a chart, ticking off milestones, or watching your savings grow on a digital dashboard, visual feedback reinforces positive behavior.

- The act of actively tracking your progress creates a sense of ownership and accountability, making you more invested in your financial journey.

-

Improved Financial Awareness:

- Money motivation trackers encourage you to pay closer attention to your spending habits and financial decisions. You become more mindful of where your money is going and how your choices impact your goals.

- This heightened awareness can lead to better budgeting, smarter spending, and a greater sense of control over your finances.

-

Emotional Connection to Your Money:

- Unlike traditional budgeting methods that can feel restrictive, money motivation trackers help you connect your financial actions to your values and aspirations.

- By focusing on the "why" behind your goals, you create a deeper emotional connection to your money, making it easier to resist impulse purchases and stay committed to your long-term plans.

-

Behavioral Reinforcement:

- Money motivation trackers provide a feedback loop that reinforces positive financial behaviors. When you see the direct impact of your savings or debt repayment efforts, you’re more likely to repeat those behaviors in the future.

- This positive reinforcement can help you break bad financial habits and develop new, healthier ones.

Designing Your Money Motivation Tracker:

The key to creating an effective money motivation tracker is to tailor it to your specific goals, personality, and preferences. Here’s a step-by-step guide to help you get started:

-

Define Your Financial Goals:

- Start by identifying your most important financial goals. These could include saving for a down payment, paying off debt, investing for retirement, or building an emergency fund.

- Be specific and measurable. Instead of "save for retirement," aim for "save $10,000 per year for retirement."

-

Choose Your Tracking Method:

- Decide whether you prefer a physical or digital tracker. Consider your lifestyle, tech savviness, and personal preferences.

- If you’re a visual person, a physical tracker like a vision board or a chart might be more appealing. If you prefer convenience and automation, a digital tracker like a budgeting app or spreadsheet might be a better fit.

-

Select Key Metrics:

- Determine the metrics you want to track. These could include:

- Savings progress (amount saved, percentage of goal achieved)

- Debt repayment progress (amount paid off, remaining balance)

- Investment performance (portfolio value, returns)

- Income (salary, side hustle earnings)

- Expenses (total spending, spending by category)

- Determine the metrics you want to track. These could include:

-

Create Visual Representations:

- Design visual representations that resonate with you. This could include:

- Bar graphs to track savings progress

- Pie charts to visualize spending categories

- Progress bars to show debt repayment

- Thermometers to track progress towards a specific goal

- Use colors, images, and fonts that inspire and motivate you.

- Design visual representations that resonate with you. This could include:

-

Set Milestones and Rewards:

- Break down your goals into smaller milestones and set rewards for achieving each one. This will help you stay motivated and celebrate your progress along the way.

- Rewards don’t have to be expensive. They could be as simple as treating yourself to a nice dinner, buying a new book, or taking a weekend getaway.

-

Incorporate Affirmations and Visualizations:

- Add affirmations and visualizations to your tracker to reinforce your positive mindset and keep your goals top of mind.

- Write down positive statements about your ability to achieve your financial goals, and visualize yourself enjoying the benefits of your success.

-

Regularly Review and Adjust:

- Make it a habit to review your tracker regularly, at least once a week. This will help you stay on track and identify areas where you need to make adjustments.

- Don’t be afraid to modify your tracker as your goals and circumstances change.

Examples of Money Motivation Trackers:

- The "Savings Thermometer": A visual representation of your savings goal, where you fill in the thermometer as you get closer to your target.

- The "Debt Snowball Chart": A chart that tracks your progress in paying off your debts, starting with the smallest balance and working your way up.

- The "Vision Board": A collage of images and words that represent your financial goals and aspirations.

- The "Goal Jar": A physical jar where you deposit money towards a specific goal, like a vacation or a new car.

- Digital Budgeting Apps: Apps like Mint, YNAB (You Need a Budget), and Personal Capital offer features to track your progress, set goals, and visualize your financial data.

Tips for Success:

- Be Consistent: The key to success with any money motivation tracker is consistency. Make it a habit to update your tracker regularly, even if it’s just for a few minutes each day.

- Be Honest: Don’t sugarcoat your progress or hide your setbacks. Honesty is essential for identifying areas where you need to improve.

- Be Patient: Building wealth and achieving financial goals takes time. Don’t get discouraged if you don’t see results immediately.

- Celebrate Your Wins: Acknowledge and celebrate your progress along the way. This will help you stay motivated and reinforce your positive behaviors.

- Seek Support: If you’re struggling to stay motivated, consider seeking support from a financial advisor, a friend, or a family member.

Conclusion:

Money motivation trackers are more than just tools; they’re powerful allies in your quest for financial freedom. By connecting your financial actions to your deepest aspirations, they help you stay engaged, focused, and inspired on your journey to financial success. So, take the time to design a tracker that resonates with you, and watch as your financial dreams become a tangible reality.