The Enduring Power of Time: Unveiling the Benefits of Long-Term Investing

In the fast-paced world of finance, where get-rich-quick schemes and fleeting trends often dominate headlines, the concept of long-term investing can seem almost quaint. Yet, beneath the surface of instant gratification lies a powerful strategy that has consistently proven its worth over decades: long-term investing. This approach, characterized by patience, discipline, and a focus on enduring value, offers a wealth of benefits that can help individuals build substantial wealth and achieve their financial goals.

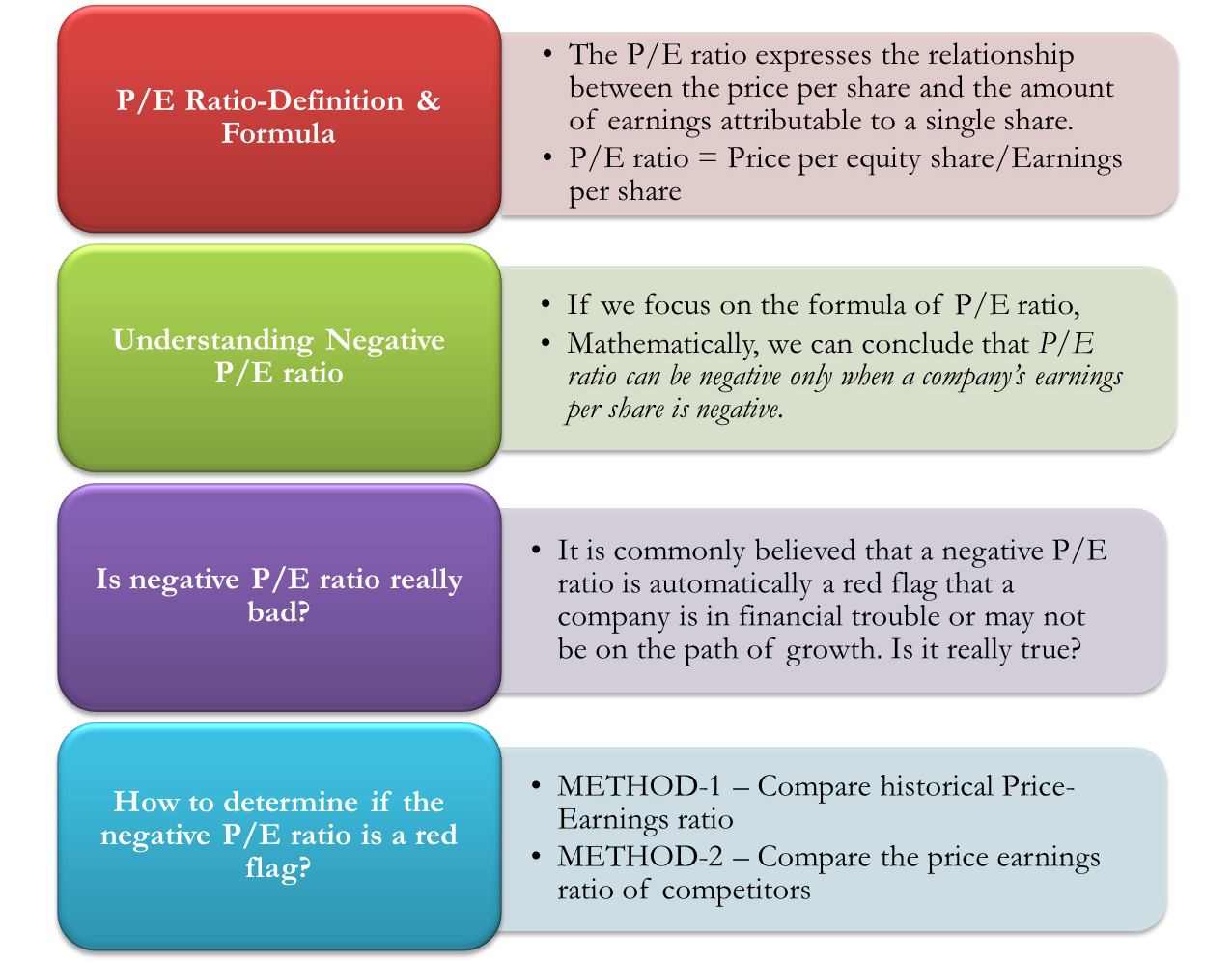

What is Long-Term Investing?

At its core, long-term investing is a strategy that involves purchasing assets with the intention of holding them for an extended period, typically several years or even decades. Unlike short-term trading, which seeks to profit from rapid price fluctuations, long-term investing focuses on the underlying fundamentals of the assets and their potential for long-term growth.

Key Benefits of Long-Term Investing

-

The Magic of Compounding:

Perhaps the most significant advantage of long-term investing is the power of compounding. Compounding refers to the process of earning returns on your initial investment, as well as on the accumulated interest or gains. Over time, this snowball effect can lead to exponential growth, turning modest investments into substantial wealth.

Albert Einstein famously called compounding "the eighth wonder of the world." To illustrate its power, consider this: If you invest $10,000 and earn an average annual return of 8%, after 30 years, your investment would grow to over $100,000, thanks to the magic of compounding. The longer you stay invested, the more pronounced the effects of compounding become.

-

Mitigating Market Volatility:

Financial markets are inherently volatile, subject to fluctuations driven by economic news, geopolitical events, and investor sentiment. Short-term traders are often at the mercy of these fluctuations, attempting to time the market and profit from short-term price swings. However, long-term investors are better positioned to weather these storms.

By focusing on the long-term fundamentals of their investments, long-term investors can ride out periods of market volatility without panicking and selling their assets at a loss. In fact, market downturns can even present opportunities for long-term investors to buy quality assets at discounted prices.

-

Reduced Transaction Costs:

Frequent trading can lead to significant transaction costs, including brokerage fees, commissions, and taxes. These costs can eat into your returns and diminish your overall investment performance. Long-term investors, on the other hand, trade less frequently, minimizing these costs and allowing more of their capital to work for them.

-

Tax Advantages:

In many countries, long-term capital gains are taxed at a lower rate than short-term gains. By holding investments for longer periods, long-term investors can take advantage of these tax benefits, further enhancing their returns.

-

Time to Recover from Mistakes:

Even the most seasoned investors make mistakes from time to time. However, long-term investors have the advantage of time to recover from these mistakes. If an investment underperforms in the short term, there is still time for it to rebound and deliver positive returns over the long run.

-

Less Stress and Time Commitment:

Short-term trading can be incredibly stressful, requiring constant monitoring of market news and price fluctuations. Long-term investing, on the other hand, is a much more relaxed approach. Once you have selected your investments, you can simply sit back and let them grow over time, without the need for constant attention.

-

Disciplined Investing:

Long-term investing encourages discipline. It forces you to think about the future and stick to your investment plan, even when the market is volatile. This discipline can be invaluable in helping you achieve your financial goals.

-

Diversification Benefits:

Long-term investing allows you to diversify your portfolio across a range of asset classes, industries, and geographic regions. Diversification helps to reduce risk by spreading your investments across different areas, so that if one investment underperforms, the others can help to offset the losses.

-

Inflation Hedge:

Historically, stocks and real estate have outpaced inflation over the long term. By investing in these asset classes, long-term investors can protect their purchasing power and ensure that their investments grow faster than the rate of inflation.

-

Building Wealth for Retirement:

Long-term investing is an ideal strategy for building wealth for retirement. By starting early and investing consistently over time, you can accumulate a substantial nest egg that will provide you with financial security in your golden years.

How to Get Started with Long-Term Investing

-

Set Clear Financial Goals:

Before you start investing, it’s important to define your financial goals. What are you saving for? How much will you need? When will you need it? Having clear goals will help you to determine your investment strategy and risk tolerance.

-

Assess Your Risk Tolerance:

Risk tolerance refers to your ability and willingness to withstand losses in your investments. If you are risk-averse, you may want to focus on more conservative investments, such as bonds and dividend-paying stocks. If you are more risk-tolerant, you may be comfortable investing in higher-growth assets, such as stocks and real estate.

-

Choose the Right Investments:

There are a wide variety of investments to choose from, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate. It’s important to do your research and choose investments that align with your financial goals and risk tolerance.

-

Diversify Your Portfolio:

As mentioned earlier, diversification is key to reducing risk. Make sure to diversify your portfolio across a range of asset classes, industries, and geographic regions.

-

Invest Regularly:

The key to long-term investing is consistency. Invest regularly, even if it’s just a small amount each month. Over time, these small investments can add up to a substantial sum.

-

Stay Patient and Disciplined:

Long-term investing requires patience and discipline. Don’t get caught up in short-term market fluctuations. Stick to your investment plan and let your investments grow over time.

The Bottom Line

In a world obsessed with instant gratification, long-term investing stands as a testament to the enduring power of patience, discipline, and a focus on enduring value. By embracing this strategy, individuals can unlock the magic of compounding, mitigate market volatility, reduce transaction costs, and build substantial wealth over time. While it may not offer the thrill of quick wins, long-term investing provides a solid foundation for achieving financial security and realizing your dreams.