Crafting Your Financial Future: A Comprehensive Guide to Monthly Saving and Investing

In the pursuit of financial security and long-term wealth, few strategies are as effective as consistent saving and strategic investing. A well-structured monthly saving and investing plan acts as a roadmap, guiding you toward your financial goals with discipline and purpose. This article provides a comprehensive guide to building a successful plan, empowering you to take control of your financial future.

Why a Monthly Saving and Investing Plan Matters

- Building a Financial Foundation: Saving and investing regularly establishes a solid financial foundation. It creates an emergency fund, reduces debt, and provides capital for future investments.

- Compounding Returns: The earlier you start investing, the more time your money has to grow through the power of compounding. Even small, consistent investments can yield significant returns over the long term.

- Achieving Financial Goals: Whether it’s buying a home, funding your retirement, or starting a business, a saving and investing plan helps you define and achieve your financial aspirations.

- Peace of Mind: Knowing that you’re actively working towards your financial goals can reduce stress and provide a sense of security.

Step 1: Assessing Your Current Financial Situation

Before diving into saving and investing, it’s crucial to understand your current financial landscape. This involves:

- Calculating Your Net Worth: Determine your assets (what you own) and liabilities (what you owe). The difference between the two is your net worth.

- Tracking Your Income and Expenses: Monitor your income and spending habits for at least a month. Identify areas where you can reduce expenses.

- Evaluating Your Debt: Assess your outstanding debts, including credit card balances, loans, and mortgages. Prioritize high-interest debt for repayment.

- Reviewing Your Credit Score: A good credit score is essential for obtaining favorable interest rates on loans and credit cards.

Step 2: Setting Clear Financial Goals

Clearly defined goals provide direction and motivation for your saving and investing efforts. Consider both short-term and long-term objectives:

- Short-Term Goals (1-3 years):

- Building an emergency fund (3-6 months of living expenses)

- Paying off high-interest debt

- Saving for a down payment on a car or small purchase

- Mid-Term Goals (3-10 years):

- Saving for a down payment on a home

- Funding a child’s education

- Investing in real estate

- Long-Term Goals (10+ years):

- Retirement planning

- Building a substantial investment portfolio

- Leaving a legacy for future generations

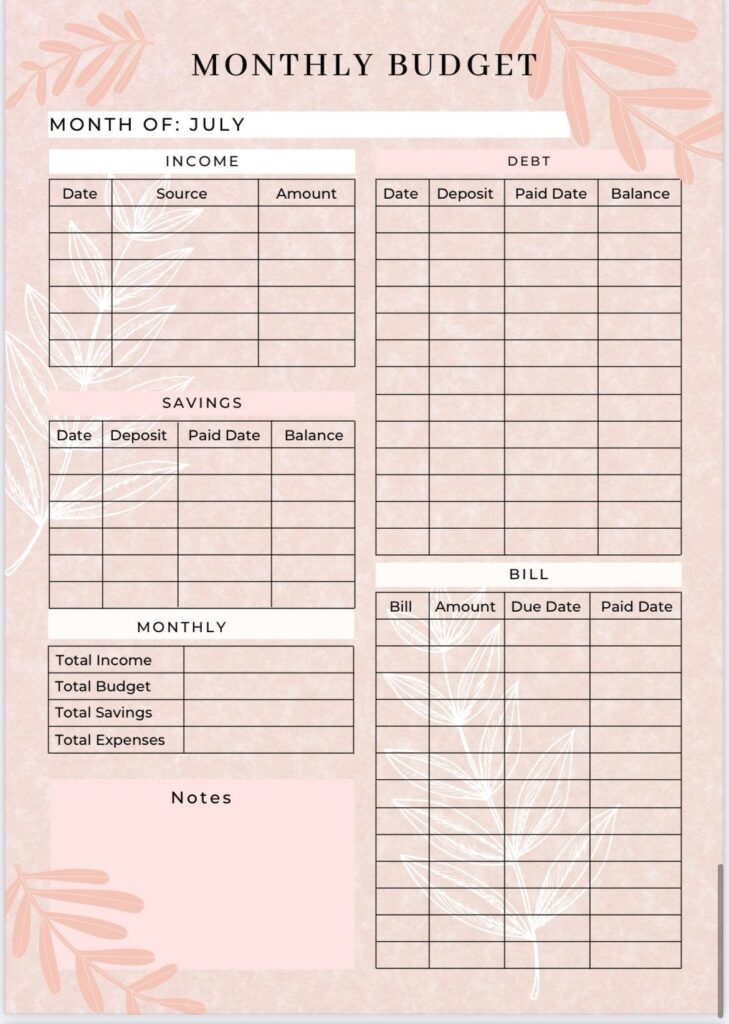

Step 3: Creating a Budget

A budget is a roadmap for your spending, ensuring that you allocate funds effectively towards your financial goals. Consider these budgeting methods:

- The 50/30/20 Rule: Allocate 50% of your income to needs (essentials), 30% to wants (discretionary spending), and 20% to savings and debt repayment.

- Zero-Based Budgeting: Assign every dollar a purpose, ensuring that your income minus expenses equals zero.

- Envelope Budgeting: Use physical envelopes to allocate cash for specific spending categories, helping you stay within your limits.

Step 4: Automating Your Savings

Automation is key to consistent saving. Set up automatic transfers from your checking account to your savings and investment accounts on a regular basis.

- Pay Yourself First: Schedule transfers to occur on payday, ensuring that saving is a priority.

- Gradually Increase Savings: As your income increases, gradually increase the amount you save each month.

- Take Advantage of Employer-Sponsored Retirement Plans: Contribute to your 401(k) or other retirement plans, especially if your employer offers matching contributions.

Step 5: Choosing the Right Investments

Selecting appropriate investments is crucial for achieving your financial goals. Consider your risk tolerance, investment time horizon, and financial knowledge.

- Asset Allocation: Diversify your investments across different asset classes, such as stocks, bonds, and real estate.

- Stocks: Offer higher potential returns but also carry greater risk. Suitable for long-term goals.

- Bonds: Generally less risky than stocks, providing a steady stream of income.

- Mutual Funds: Offer diversification by pooling money from multiple investors to invest in a variety of securities.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but trade on stock exchanges, offering greater flexibility.

- Real Estate: Can provide rental income and potential appreciation, but requires significant capital and management.

Step 6: Developing a Monthly Investment Strategy

- Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of market fluctuations. This helps reduce the risk of buying high and selling low.

- Reinvest Dividends: Reinvest any dividends or interest earned from your investments to accelerate growth.

- Stay Informed: Keep up-to-date on market trends and economic news, but avoid making impulsive decisions based on short-term fluctuations.

- Consider Consulting a Financial Advisor: If you’re unsure about investment choices, seek guidance from a qualified financial advisor.

Step 7: Monitoring and Adjusting Your Plan

Your saving and investing plan should be a living document, reviewed and adjusted regularly to reflect changes in your financial situation and goals.

- Track Your Progress: Monitor your savings and investment performance on a monthly or quarterly basis.

- Rebalance Your Portfolio: Periodically rebalance your portfolio to maintain your desired asset allocation.

- Adjust for Life Changes: Update your plan to account for significant life events, such as marriage, children, or job changes.

- Stay Disciplined: Stick to your plan as much as possible, even during market downturns.

Tips for Success

- Start Small: Begin with a manageable amount and gradually increase your savings and investments over time.

- Stay Consistent: Consistency is key to long-term success. Make saving and investing a habit.

- Automate Your Savings: Set up automatic transfers to ensure that saving is a priority.

- Avoid Impulse Spending: Resist the urge to spend money on unnecessary items.

- Celebrate Milestones: Acknowledge and celebrate your financial achievements to stay motivated.

- Educate Yourself: Continuously learn about personal finance and investing to make informed decisions.

Conclusion

A monthly saving and investing plan is a powerful tool for building wealth and achieving financial security. By assessing your current situation, setting clear goals, creating a budget, automating your savings, choosing the right investments, and monitoring your progress, you can take control of your financial future and work towards a brighter tomorrow. Remember, the journey to financial freedom is a marathon, not a sprint. Stay disciplined, stay focused, and enjoy the rewards of your hard work.