Okay, here’s a 1200-word article on making money talks less boring, focusing on practical tips and actionable strategies.

Making Money Talks Less Boring: Engage, Educate, and Empower

For many, the mere mention of "money" can trigger a yawn, a glazed-over look, or even outright avoidance. Finance, budgets, investments, and debt – these topics often conjure images of complex spreadsheets, dry lectures, and a general sense of unease. However, the reality is that money talks are essential for financial well-being, personal growth, and even building stronger relationships. The challenge lies in making these conversations engaging, informative, and, dare we say, even enjoyable. This article explores practical strategies to transform boring money talks into productive and empowering experiences.

1. Understand the Underlying Resistance: Empathy First

Before launching into a financial discussion, it’s crucial to understand why people find the topic boring or uncomfortable in the first place. Common reasons include:

- Lack of Knowledge: Many individuals feel intimidated by financial jargon and complex concepts. They fear looking foolish or being judged for their lack of understanding.

- Past Trauma: Experiences with financial hardship, debt, or poor financial decisions can create anxiety and avoidance.

- Conflicting Values: People may have different values and priorities regarding money, leading to disagreements and tension.

- Fear of Restriction: Budgeting and financial planning can feel restrictive and limit spontaneity, which some people resist.

- Cultural Taboos: In some cultures, discussing money is considered impolite or even vulgar.

Acknowledging these potential barriers is the first step. Begin by expressing empathy and creating a safe space for open communication. Instead of lecturing, start by asking questions like:

- "What are your biggest concerns about our finances?"

- "What are your financial goals and dreams?"

- "What makes you feel anxious or stressed when we talk about money?"

By understanding the underlying resistance, you can tailor your approach and address specific concerns.

2. Focus on the "Why" Before the "How": Connect to Goals

Money is merely a tool, a means to an end. Instead of diving directly into budgets and spreadsheets, start by connecting money talks to personal goals and aspirations.

- Visualize the Future: Discuss what you want to achieve in the future – a dream vacation, a new home, early retirement, supporting a cause you care about, or providing for your children’s education.

- Define Shared Goals: If you’re discussing finances with a partner or family member, identify shared goals and priorities. This creates a sense of unity and motivation.

- Quantify Your Dreams: Once you’ve identified your goals, quantify them in terms of cost and timeline. This makes them more tangible and actionable.

By focusing on the "why" – the reasons behind your financial decisions – you make money talks more meaningful and engaging. People are more likely to pay attention when they see how their financial choices contribute to achieving their dreams.

3. Simplify the Language: Ditch the Jargon

Financial jargon can be a major barrier to understanding and engagement. Avoid using complex terms like "asset allocation," "derivatives," or "amortization" without explaining them clearly.

- Use Plain English: Translate financial concepts into everyday language. For example, instead of saying "diversify your portfolio," say "spread your investments across different areas."

- Provide Examples: Illustrate abstract concepts with concrete examples. For instance, instead of explaining compound interest theoretically, show how a small investment can grow over time.

- Encourage Questions: Create a safe space for questions and encourage people to ask for clarification whenever they’re confused.

Remember, the goal is to educate and empower, not to impress with your financial knowledge.

4. Make it Interactive: Games, Tools, and Scenarios

Passive listening is a recipe for boredom. Make money talks more interactive by incorporating games, tools, and real-life scenarios.

- Budgeting Apps and Tools: Use budgeting apps or online calculators to track income, expenses, and savings. These tools provide visual representations of your financial situation and make it easier to identify areas for improvement.

- Financial Games: Play financial games like Monopoly, Cashflow 101, or online budgeting simulations. These games can make learning about money more fun and engaging.

- Scenario Planning: Discuss hypothetical scenarios and how you would respond financially. For example, "What would we do if we lost our jobs?" or "How would we handle a medical emergency?"

- Role-Playing: Practice negotiating salaries, managing debt, or making investment decisions through role-playing exercises.

By actively participating in the discussion, people are more likely to retain information and develop a better understanding of financial concepts.

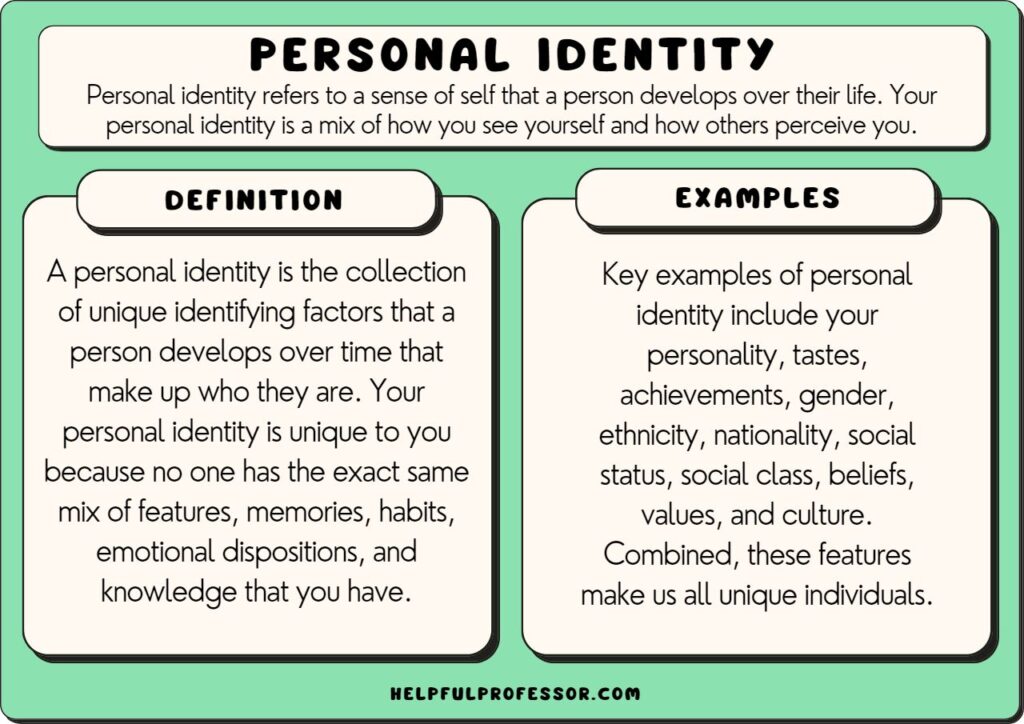

5. Visual Aids: Charts, Graphs, and Infographics

Visual aids can make complex information easier to understand and remember.

- Create Charts and Graphs: Use charts and graphs to illustrate income, expenses, savings, and debt. Visual representations can reveal trends and patterns that might not be apparent from looking at raw numbers.

- Use Infographics: Infographics can summarize key financial concepts in a visually appealing and easy-to-digest format.

- Present Data in a Story: Instead of simply presenting numbers, tell a story with the data. For example, "This chart shows how our savings have grown over the past year, thanks to our consistent efforts."

Visual aids can break up the monotony of text and make money talks more engaging and memorable.

6. Break it Down: Short, Frequent Sessions

Marathon money talks are likely to be overwhelming and counterproductive. Instead of trying to cover everything at once, break the discussion into short, frequent sessions.

- Schedule Regular Check-ins: Set aside a specific time each week or month for a brief financial check-in.

- Focus on One Topic at a Time: Instead of trying to cover everything, focus on one specific topic, such as budgeting, saving, or investing.

- Keep it Concise: Aim for sessions that are no longer than 30-60 minutes.

By breaking the discussion into smaller, more manageable chunks, you can prevent information overload and maintain engagement.

7. Celebrate Successes: Positive Reinforcement

Financial progress can be slow and incremental. It’s important to celebrate successes, no matter how small, to maintain motivation and build momentum.

- Acknowledge Achievements: Recognize and acknowledge progress towards financial goals, such as paying off debt, increasing savings, or making wise investments.

- Reward Yourself: Set up small rewards for achieving milestones, such as a special dinner or a fun activity.

- Focus on the Positive: Emphasize the positive aspects of financial planning, such as increased security, freedom, and peace of mind.

Positive reinforcement can make money talks more enjoyable and encourage continued progress.

8. Seek Professional Help: Don’t Be Afraid to Ask

If you’re struggling to have productive money talks, don’t hesitate to seek professional help.

- Financial Advisor: A financial advisor can provide personalized guidance on budgeting, saving, investing, and debt management.

- Financial Counselor: A financial counselor can help you develop a budget, manage debt, and improve your financial literacy.

- Couples Therapist: If financial disagreements are straining your relationship, a couples therapist can help you communicate more effectively and resolve conflicts.

Seeking professional help can provide valuable insights and support, making money talks less stressful and more productive.

9. Tailor the Approach: Know Your Audience

Not everyone learns and communicates in the same way. Tailor your approach to the individual’s learning style and personality.

- Visual Learners: Use charts, graphs, and videos.

- Auditory Learners: Engage in discussions and listen to podcasts.

- Kinesthetic Learners: Use interactive tools and games.

- Introverts: Provide written materials and allow time for reflection.

- Extroverts: Encourage group discussions and brainstorming sessions.

By tailoring your approach, you can increase engagement and ensure that everyone is comfortable and receptive to the information.

10. Make it a Continuous Process: Lifelong Learning

Money talks are not a one-time event. They should be an ongoing process of learning, adapting, and evolving.

- Stay Informed: Keep up-to-date on financial news and trends.

- Review and Adjust: Regularly review your financial plan and make adjustments as needed.

- Embrace Lifelong Learning: Continue to learn about personal finance through books, articles, podcasts, and courses.

By making money talks a continuous process, you can build financial literacy, make informed decisions, and achieve your financial goals.

In conclusion, making money talks less boring requires empathy, a focus on goals, simplified language, interactive elements, visual aids, short sessions, positive reinforcement, professional help when needed, tailored approaches, and a commitment to lifelong learning. By implementing these strategies, you can transform financial discussions from dreaded chores into empowering experiences that contribute to financial well-being, stronger relationships, and a brighter future.