Beyond the Numbers: Unleashing the Power of Storytelling in Finance Blogs

Finance. The very word can evoke images of complex spreadsheets, jargon-laden reports, and emotionless analysis. For many, it’s a realm of daunting complexity, a world away from the warmth and accessibility of everyday life. As a finance blogger, your mission is to bridge that gap, to demystify the world of money and empower your audience with knowledge. But how do you break through the noise and capture their attention? The answer lies in the art of storytelling.

Storytelling is a timeless and universal method of communication. It’s how we make sense of the world, connect with others, and remember information. By weaving narratives into your finance blog, you can transform dry data into compelling insights, turning passive readers into engaged followers.

Why Storytelling Matters in Finance

Before diving into specific techniques, let’s explore why storytelling is so crucial for finance blogs:

- Humanizes Complex Topics: Finance can feel impersonal and intimidating. Stories add a human element, making concepts relatable and understandable.

- Enhances Engagement: A well-told story captivates readers, keeping them on your page longer and encouraging them to return.

- Improves Comprehension: Stories provide context and make abstract ideas concrete, aiding memory and comprehension.

- Builds Trust and Connection: Sharing personal anecdotes or client success stories fosters trust and establishes a connection with your audience.

- Differentiates Your Blog: In a sea of finance blogs, storytelling helps you stand out and create a unique voice.

Storytelling Techniques for Finance Blogs

Here are several techniques you can use to inject storytelling into your finance blog posts:

-

The Personal Anecdote:

- Description: Share a personal experience related to the topic. This could be a financial mistake you made, a lesson you learned, or a success story.

- Example: If you’re writing about the importance of emergency funds, start with a story about a time you faced an unexpected expense and how having an emergency fund saved you.

- Benefit: Makes you relatable and demonstrates that you understand your audience’s struggles.

- How to Use: Be honest, vulnerable, and focus on the lessons learned. Don’t just brag about successes; share failures too.

-

The Case Study:

- Description: Present a real-life example of a financial situation, challenge, or success. This could involve a client, a historical event, or a fictional character.

- Example: In a post about retirement planning, showcase a case study of a couple who successfully retired early by following a specific strategy.

- Benefit: Provides concrete evidence to support your arguments and demonstrates the practical application of your advice.

- How to Use: Maintain confidentiality when using client stories. Focus on the problem, the solution, and the results.

-

The Historical Narrative:

- Description: Use historical events or figures to illustrate financial principles or trends.

- Example: Explain the impact of inflation by discussing the hyperinflation in Weimar Germany in the 1920s.

- Benefit: Adds depth and context to your analysis, making complex topics more engaging.

- How to Use: Ensure accuracy and cite your sources. Focus on the lessons learned from the past and how they apply to the present.

-

The "What If" Scenario:

- Description: Create hypothetical scenarios to explore different financial outcomes and illustrate the importance of planning.

- Example: "What if you lost your job tomorrow? How would you cover your expenses?" Use this scenario to discuss the importance of having an emergency fund and multiple income streams.

- Benefit: Helps readers visualize potential risks and encourages them to take proactive steps.

- How to Use: Make the scenarios realistic and relatable. Provide actionable advice for each scenario.

-

The Metaphor or Analogy:

- Description: Use metaphors and analogies to explain complex concepts in a simple and memorable way.

- Example: "Investing in the stock market is like planting a tree. It takes time and patience to see the fruits of your labor."

- Benefit: Makes abstract ideas easier to grasp and remember.

- How to Use: Choose metaphors and analogies that are relevant to your audience and easy to understand.

-

The Character-Driven Narrative:

- Description: Create fictional characters facing financial challenges or pursuing financial goals.

- Example: Tell the story of "Sarah," a young professional struggling to pay off student loans while saving for a down payment on a house.

- Benefit: Allows readers to empathize with the characters and see themselves in their situations.

- How to Use: Develop relatable characters with clear goals, obstacles, and motivations.

-

The Problem-Solution Narrative:

- Description: Present a common financial problem and then offer a step-by-step solution.

- Example: Start with the problem of high credit card debt and then outline a strategy for paying it off, such as the snowball or avalanche method.

- Benefit: Provides practical advice and empowers readers to take action.

- How to Use: Clearly define the problem, explain the solution in detail, and provide actionable steps.

-

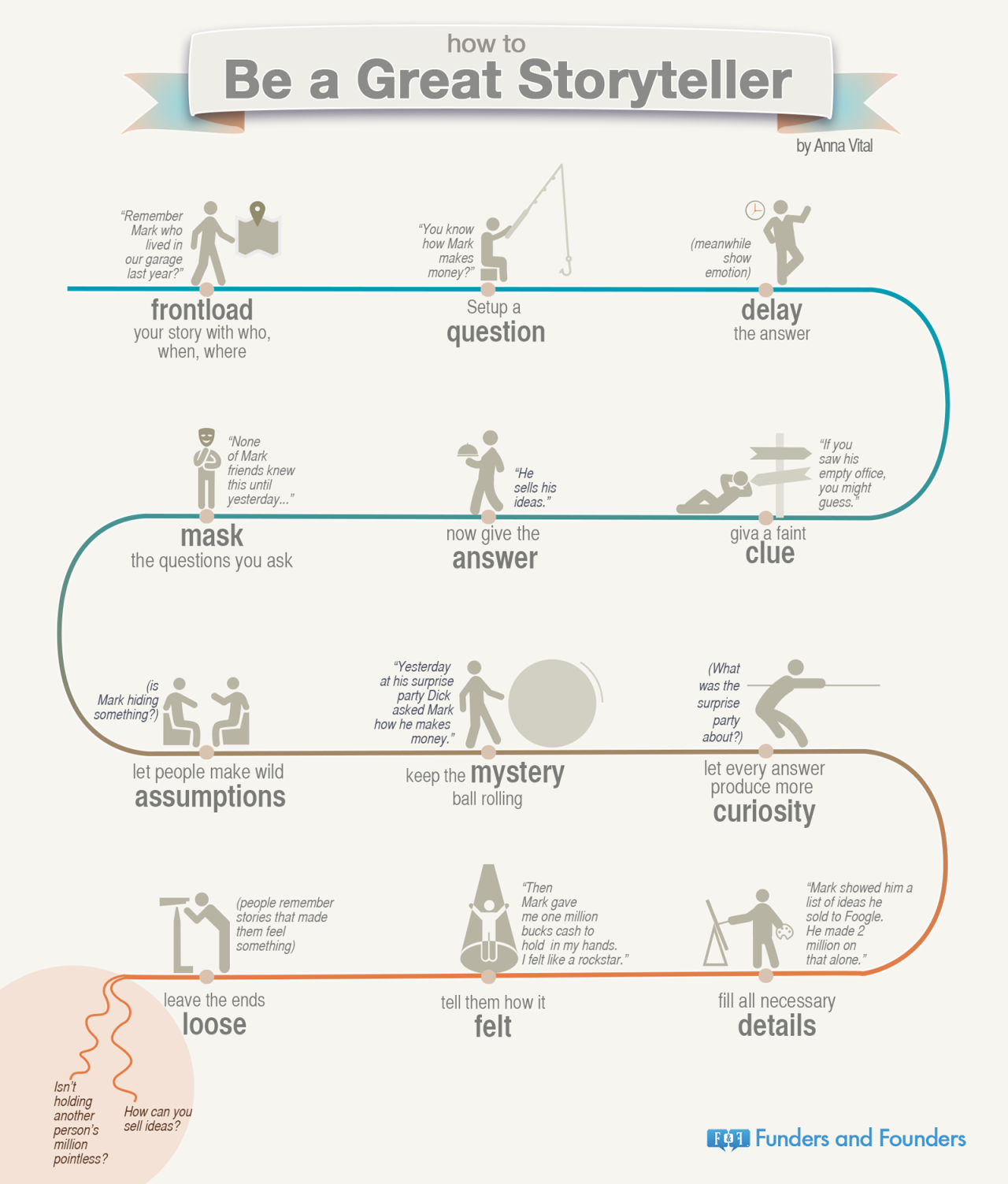

The Data Visualization Story:

- Description: Use charts, graphs, and infographics to tell a story with data.

- Example: Create a visual representation of how compound interest works over time, showing the power of long-term investing.

- Benefit: Makes data more engaging and easier to understand.

- How to Use: Choose visuals that are clear, concise, and relevant to your message.

Tips for Effective Storytelling

- Know Your Audience: Tailor your stories to resonate with their interests, values, and financial situations.

- Keep it Simple: Avoid jargon and complex language. Use clear and concise language.

- Focus on Emotions: Connect with your audience on an emotional level by sharing relatable experiences and feelings.

- Be Authentic: Share your own experiences and perspectives. Let your personality shine through.

- Use Visuals: Incorporate images, videos, and other visuals to enhance your stories.

- End with a Call to Action: Encourage readers to take action by providing clear and specific next steps.

- Practice, Practice, Practice: The more you tell stories, the better you’ll become at it.

Examples in Practice

- Budgeting: Instead of just listing budgeting tips, tell the story of how you or someone you know transformed their finances by creating a budget. Highlight the struggles, the breakthroughs, and the ultimate sense of empowerment.

- Investing: Rather than simply explaining asset allocation, share a case study of how a diversified portfolio helped a client weather a market downturn and achieve their financial goals.

- Debt Management: Illustrate the impact of compound interest by telling the story of two people – one who pays off their credit card debt diligently and another who only makes minimum payments.

Conclusion

In the competitive landscape of finance blogging, storytelling is your secret weapon. By mastering the art of narrative, you can transform complex financial concepts into engaging and relatable stories. This approach will not only capture your audience’s attention but also build trust, foster deeper connections, and empower them to take control of their financial futures. So, embrace the power of storytelling and watch your finance blog thrive.

I hope this helps! Let me know if you’d like any revisions or further elaborations.