Budgeting: The Ultimate Couple’s Adventure

Forget candlelit dinners and weekend getaways. Want to truly spice up your relationship? Try budgeting together! I know, it doesn’t sound romantic, but hear me out. Budgeting as a couple isn’t about restriction; it’s about building a shared vision for your future, strengthening communication, and achieving financial freedom together. When done right, it can be a fun, engaging, and even intimate activity that brings you closer as a couple.

Why Budgeting Should Be a Couple’s Thing

-

Shared Goals, Shared Success:

- When you budget together, you’re creating a unified financial roadmap. Whether it’s buying a house, traveling the world, starting a family, or retiring early, aligning your financial goals ensures you’re both working towards the same dreams.

- The sense of accomplishment when you hit a savings milestone or pay off debt is amplified when shared. You’re a team, celebrating each other’s contributions and supporting each other through challenges.

-

Open Communication:

- Money is a leading cause of stress and conflict in relationships. Budgeting forces you to talk openly about your financial situation, habits, and concerns. This transparency builds trust and understanding.

- You’ll learn about each other’s spending triggers, financial fears, and money management styles. This knowledge helps you support each other and avoid financial pitfalls.

-

Fairness and Equity:

- Budgeting allows you to create a fair and equitable financial arrangement, especially if one partner earns more than the other.

- You can decide how to split expenses, allocate funds for individual spending, and ensure that both partners feel valued and respected in the financial partnership.

-

Reduced Stress and Anxiety:

- Financial uncertainty can be a major source of stress. Budgeting provides a sense of control and predictability, reducing anxiety about money.

- Knowing where your money is going and having a plan for the future can bring peace of mind and improve your overall well-being as a couple.

-

A Foundation for a Secure Future:

- Budgeting isn’t just about managing your current finances; it’s about building a secure future together.

- You can plan for retirement, save for emergencies, and invest in your future, ensuring that you’re both financially prepared for whatever life throws your way.

Making Budgeting Fun: Turning a Chore into an Adventure

-

Set the Mood:

- Treat your budgeting sessions like dates. Order takeout, pour some wine, put on some music, and create a relaxed atmosphere.

- Avoid distractions like TV or social media. Focus on each other and the task at hand.

-

Make it a Regular Thing:

- Schedule regular budgeting sessions, whether it’s weekly, bi-weekly, or monthly. Consistency is key to staying on track.

- Make it a habit, like your regular date night or workout routine.

-

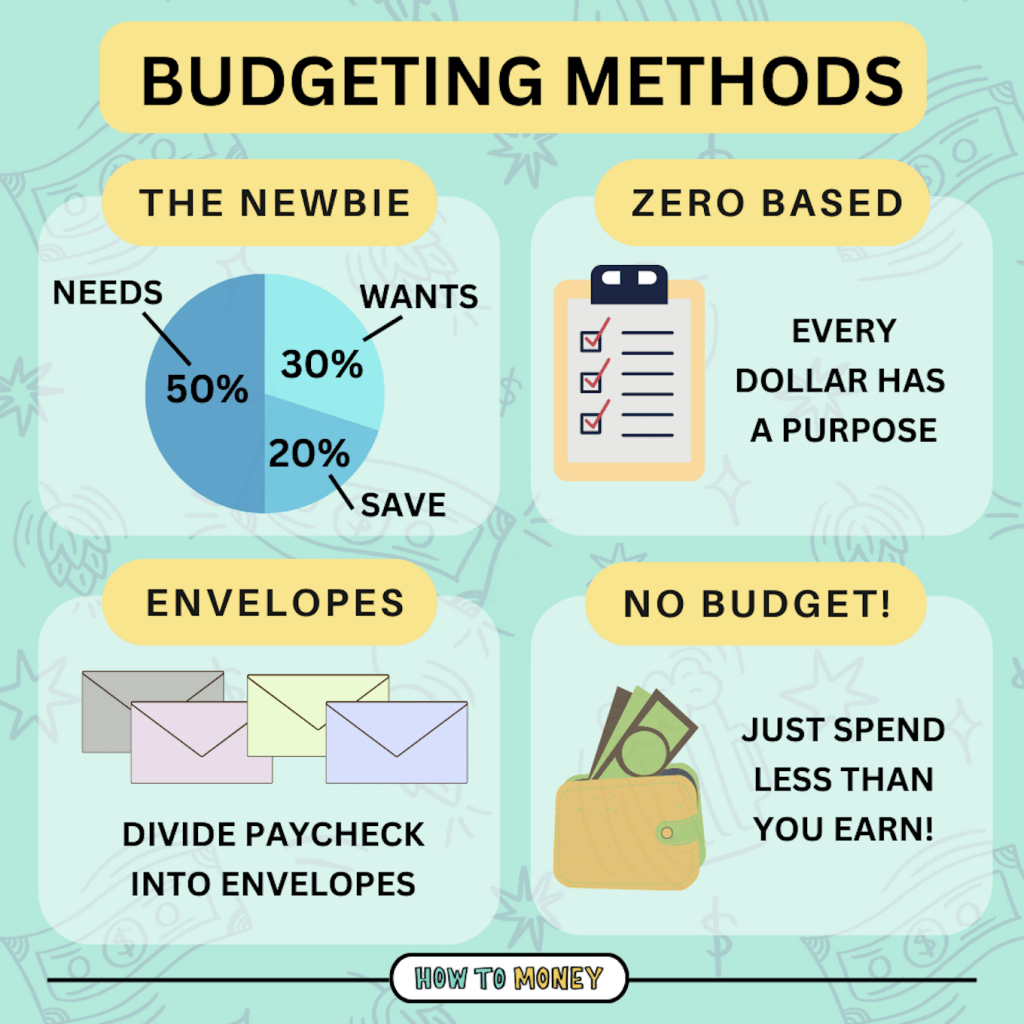

Use Budgeting Tools that Excite You:

- There are countless budgeting apps and tools available. Experiment with different options to find one that you both enjoy using.

- Consider tools that offer visual aids, gamification, or personalized insights to make budgeting more engaging.

- Some popular options include:

- YNAB (You Need a Budget): A zero-based budgeting app that helps you allocate every dollar.

- Mint: A free app that tracks your spending and provides insights into your financial habits.

- Personal Capital: A comprehensive financial management tool that helps you track your net worth and investments.

-

Set Goals Together:

- Brainstorm a list of financial goals that you both want to achieve. These could be short-term goals like saving for a vacation or long-term goals like buying a house.

- Break down your goals into smaller, achievable steps. This makes them feel less daunting and more attainable.

- Visualize your goals. Create a vision board or a list of pictures that represent what you want to achieve.

-

Make it a Game:

- Turn budgeting into a friendly competition. Challenge each other to find ways to save money or earn extra income.

- Reward yourselves when you hit your goals. This could be anything from a special dinner to a weekend getaway.

- Use gamification features in budgeting apps to earn points or badges for completing tasks.

-

Celebrate Your Successes:

- Acknowledge and celebrate your progress. This reinforces positive financial habits and keeps you motivated.

- Plan a special activity or treat yourselves to something you’ve been wanting when you reach a savings milestone.

- Share your successes with friends or family to inspire others and stay accountable.

-

Be Flexible and Adaptable:

- Life happens, and your budget may need to be adjusted from time to time. Be flexible and willing to adapt to changing circumstances.

- Review your budget regularly and make adjustments as needed. This ensures that it remains relevant and effective.

- Don’t get discouraged if you have setbacks. Learn from your mistakes and get back on track.

-

Don’t Be Afraid to Seek Help:

- If you’re struggling to budget effectively, consider seeking help from a financial advisor or counselor.

- They can provide personalized guidance and support to help you achieve your financial goals.

- There are also many online resources and communities that can provide valuable information and support.

Common Budgeting Challenges and How to Overcome Them

-

Different Spending Habits:

- It’s common for couples to have different spending habits. One partner may be a saver, while the other is a spender.

- Compromise is key. Find a balance that works for both of you.

- Allocate funds for individual spending so that each partner has some autonomy.

-

Lack of Communication:

- If you’re not communicating openly about your finances, it’s difficult to budget effectively.

- Schedule regular budgeting sessions and make them a safe space for open and honest communication.

- Listen to each other’s concerns and be willing to compromise.

-

Unrealistic Goals:

- Setting unrealistic goals can lead to frustration and discouragement.

- Start with small, achievable goals and gradually increase the challenge as you progress.

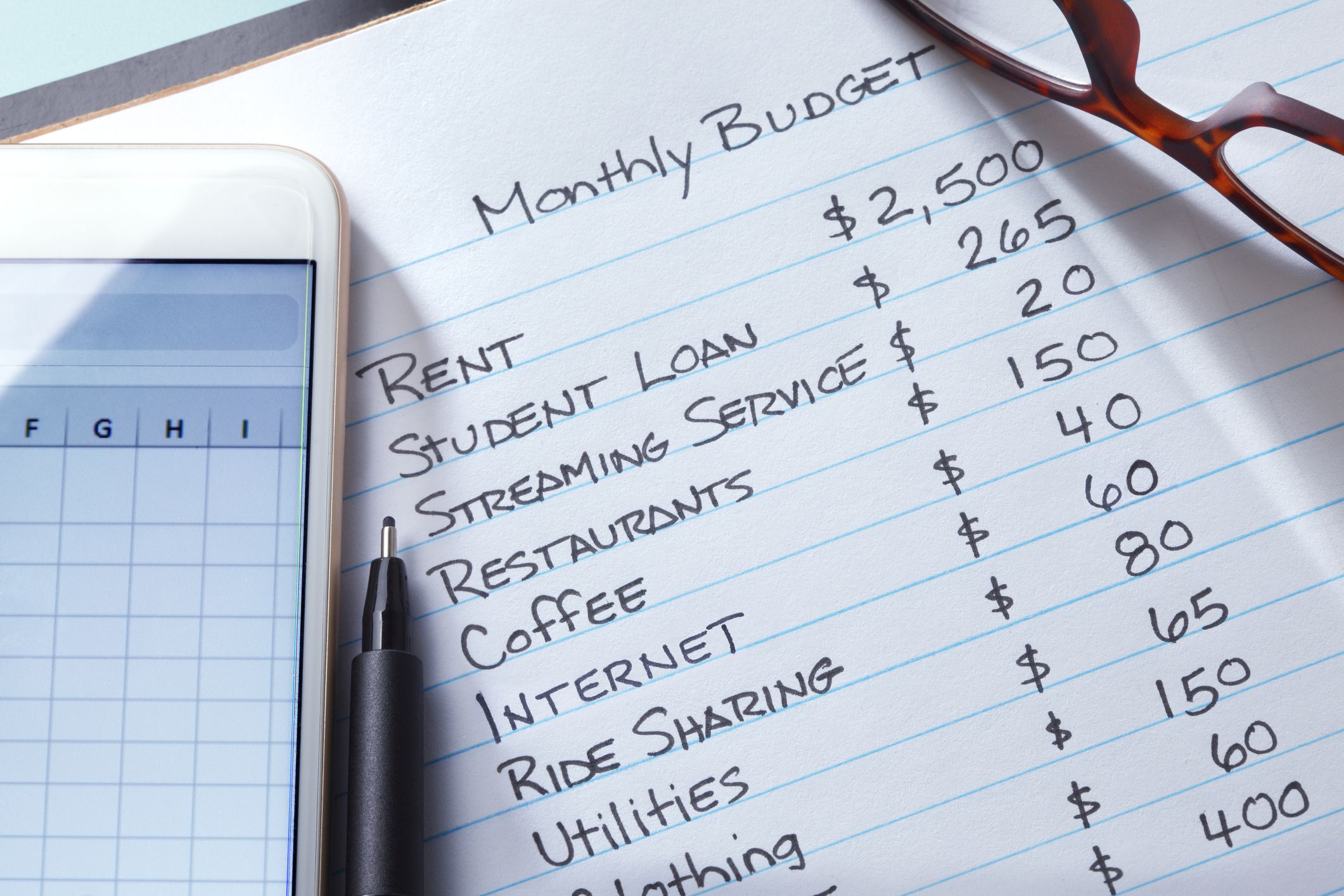

- Be realistic about your income and expenses.

-

Lack of Discipline:

- It takes discipline to stick to a budget.

- Create a system of accountability. Check in with each other regularly to track your progress.

- Reward yourselves for staying on track.

-

Unexpected Expenses:

- Life is full of surprises. Be prepared for unexpected expenses by creating an emergency fund.

- Review your budget regularly and make adjustments as needed.

- Don’t get discouraged if you have setbacks. Learn from your mistakes and get back on track.

The Rewards of Budgeting Together

Budgeting as a couple isn’t always easy, but the rewards are well worth the effort. You’ll build a stronger, more resilient relationship, achieve your financial goals, and create a secure future together.

Here are just a few of the benefits you can expect:

- Reduced stress and anxiety about money

- Improved communication and trust

- A stronger sense of teamwork and partnership

- Increased financial security and freedom

- The ability to achieve your dreams together

So, ditch the dinner reservations and try something truly adventurous: Budgeting together. You might be surprised at how much fun you have and how much closer you become as a couple.

Let me know if you’d like me to make any revisions or additions!