Decoding the P/E Ratio: A Comprehensive Guide for Investors

The Price-to-Earnings (P/E) ratio is one of the most widely used and scrutinized metrics in the world of finance. It offers a quick snapshot of how much investors are willing to pay for each dollar of a company’s earnings. While seemingly simple, the P/E ratio is a powerful tool that can help investors assess valuation, compare companies, and make informed investment decisions. However, it’s essential to understand its nuances and limitations to avoid misinterpretations and potential investment pitfalls.

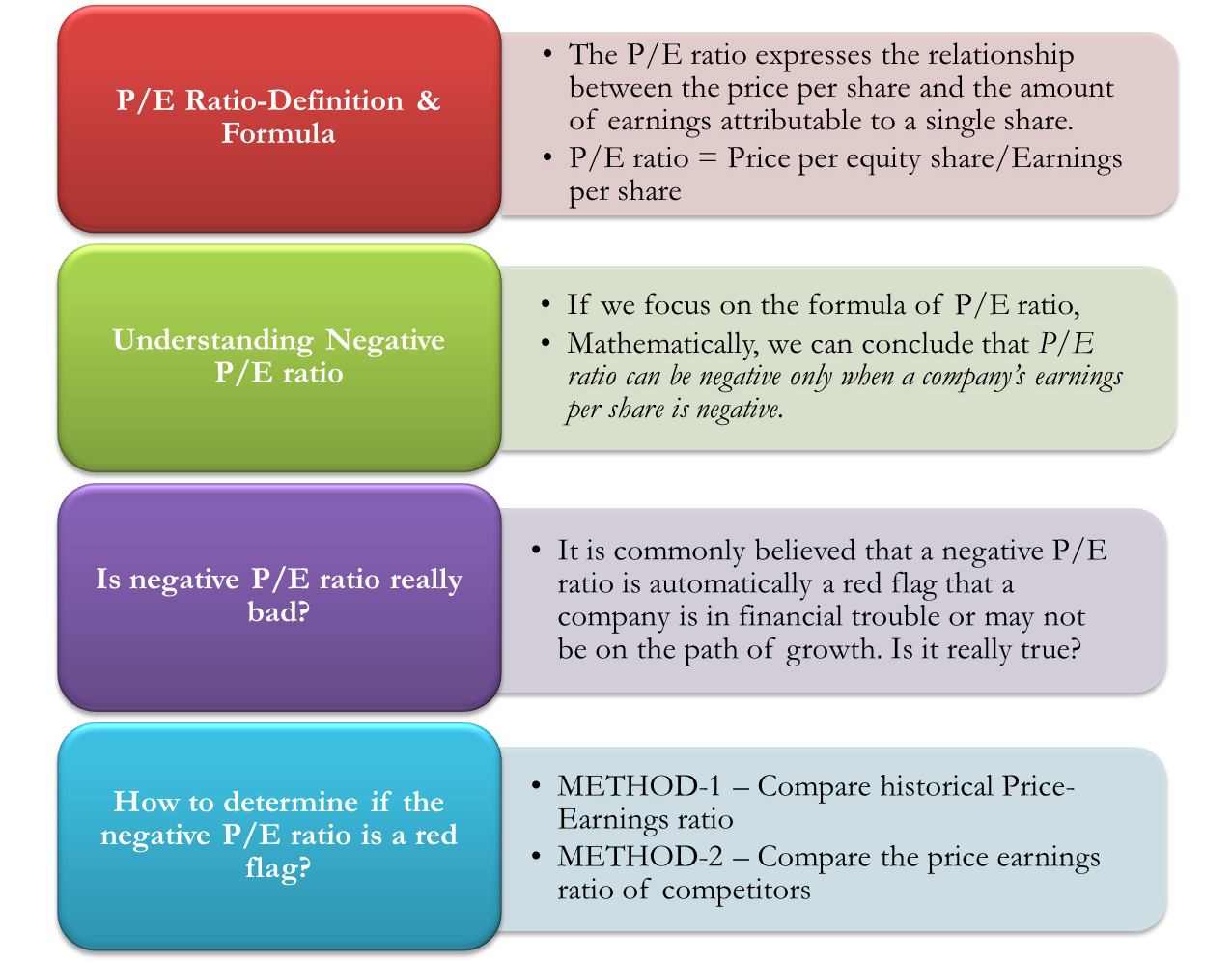

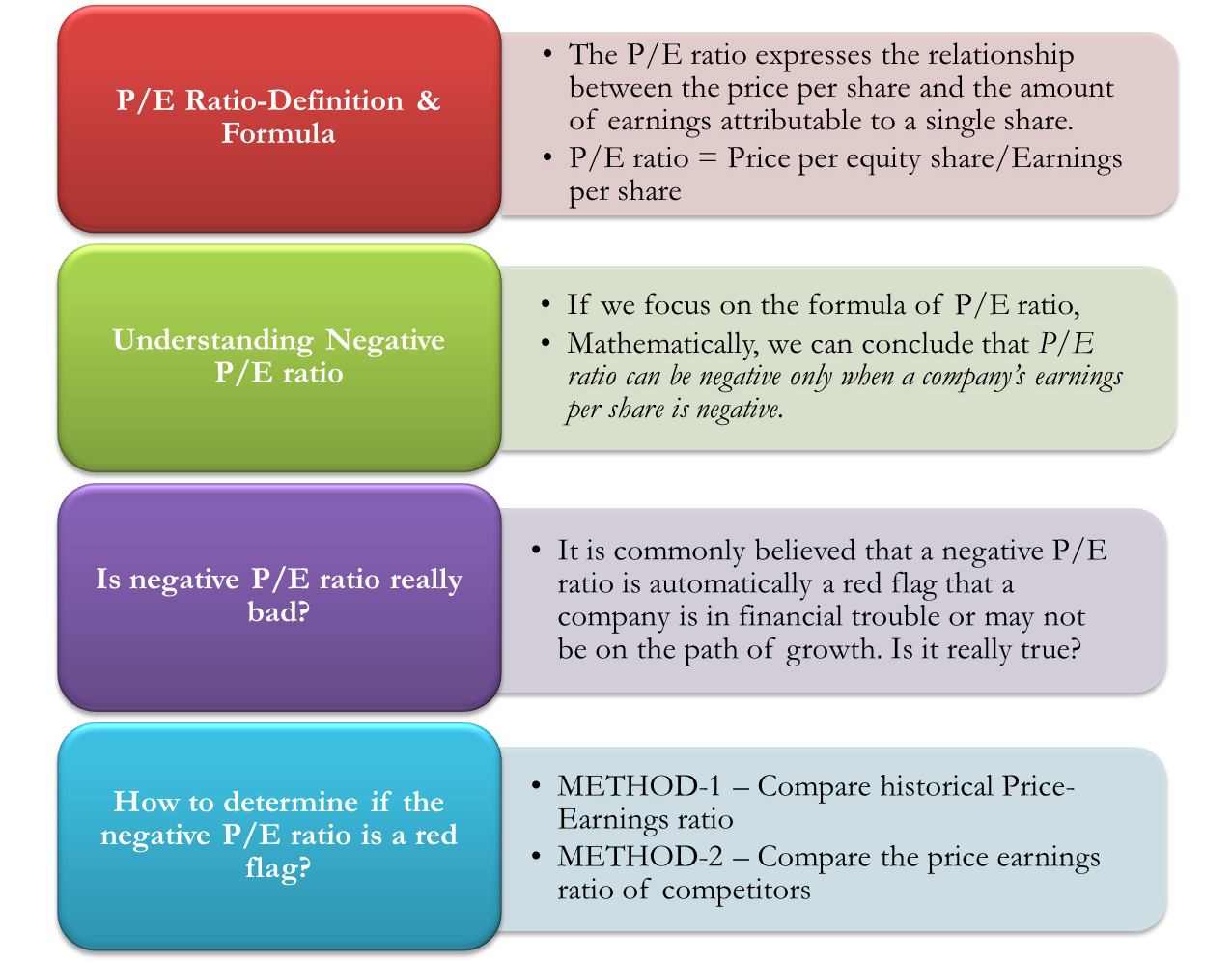

What is the P/E Ratio?

The P/E ratio, at its core, is a valuation metric that compares a company’s stock price to its earnings per share (EPS). It answers the question: "How much are investors willing to pay for each dollar of the company’s earnings?"

The formula for calculating the P/E ratio is straightforward:

- P/E Ratio = Market Price per Share / Earnings per Share (EPS)

Understanding the Components

-

Market Price per Share: This is the current price at which the company’s stock is trading on the open market. It reflects the collective sentiment and expectations of investors regarding the company’s future prospects.

-

Earnings per Share (EPS): This represents the portion of a company’s profit allocated to each outstanding share of common stock. It’s calculated by dividing the company’s net income (after preferred dividends) by the number of outstanding shares. EPS is a key indicator of a company’s profitability.

Types of P/E Ratios

There are primarily two types of P/E ratios that investors commonly use:

-

Trailing P/E Ratio: This uses the company’s earnings from the past 12 months. It’s based on actual, historical data, making it a more concrete and reliable measure. However, it may not accurately reflect the company’s current or future performance if there have been significant changes in its business or industry.

-

Forward P/E Ratio: This uses analysts’ estimates of the company’s earnings for the next 12 months. It offers a more forward-looking perspective, but it’s subject to the accuracy of those estimates. If the estimates prove to be overly optimistic or pessimistic, the forward P/E ratio can be misleading.

Interpreting the P/E Ratio

The interpretation of the P/E ratio is relative and depends on several factors, including the industry, the company’s growth prospects, and the overall market conditions. Here are some general guidelines:

-

High P/E Ratio: A high P/E ratio suggests that investors are willing to pay a premium for the company’s earnings. This could be because they expect the company to grow rapidly in the future, or because they perceive the company to be of high quality and low risk. However, a high P/E ratio can also indicate that the stock is overvalued.

-

Low P/E Ratio: A low P/E ratio suggests that investors are less willing to pay for the company’s earnings. This could be because they expect the company to grow slowly, or because they perceive the company to be of low quality and high risk. However, a low P/E ratio can also indicate that the stock is undervalued.

-

Negative P/E Ratio: A negative P/E ratio occurs when a company has negative earnings (i.e., a loss). In this case, the P/E ratio is not meaningful and cannot be used for valuation purposes.

Using the P/E Ratio for Comparison

The P/E ratio is most useful when used to compare companies within the same industry or sector. This helps to normalize for industry-specific factors that can influence earnings and valuations. For example, a technology company might typically have a higher P/E ratio than a utility company, due to the higher growth potential of the technology sector.

When comparing P/E ratios, it’s important to consider the following:

-

Growth Rate: Companies with higher expected growth rates typically have higher P/E ratios. Investors are willing to pay more for future earnings potential.

-

Profitability: Companies with higher profit margins and returns on equity (ROE) tend to have higher P/E ratios. This reflects their ability to generate more earnings from their operations.

-

Risk: Companies with lower levels of risk, such as those with stable earnings and strong balance sheets, tend to have higher P/E ratios. Investors are willing to pay more for certainty.

-

Industry Dynamics: Different industries have different growth prospects, profitability levels, and risk profiles. These factors can influence the typical P/E ratios observed in those industries.

Limitations of the P/E Ratio

While the P/E ratio is a valuable tool, it has several limitations that investors should be aware of:

-

Accounting Distortions: Earnings can be manipulated through accounting practices, which can distort the P/E ratio. It’s important to scrutinize a company’s financial statements to ensure that earnings are accurately reported.

-

Negative Earnings: As mentioned earlier, the P/E ratio is not meaningful when a company has negative earnings. In this case, other valuation metrics, such as the price-to-sales ratio or the price-to-book ratio, may be more appropriate.

-

Cyclical Industries: Companies in cyclical industries, such as commodities or construction, can experience significant fluctuations in earnings depending on the economic cycle. This can make the P/E ratio unreliable for valuation purposes.

-

Growth Companies: High-growth companies often have high P/E ratios, which can make them appear overvalued. However, their high growth rates may justify the premium valuation. It’s important to assess whether the growth is sustainable and whether the company can continue to meet expectations.

-

Interest Rates and Inflation: Changes in interest rates and inflation can affect the overall market valuation and, consequently, the P/E ratios of individual companies.

Using the P/E Ratio in Conjunction with Other Metrics

To overcome the limitations of the P/E ratio, it’s best to use it in conjunction with other valuation metrics and financial analysis tools. Some complementary metrics include:

-

Price-to-Sales (P/S) Ratio: Compares the company’s market capitalization to its revenue. It can be useful for valuing companies with negative earnings or high growth rates.

-

Price-to-Book (P/B) Ratio: Compares the company’s market capitalization to its book value of equity. It can be useful for valuing companies with tangible assets.

-

Dividend Yield: Measures the annual dividend payment as a percentage of the stock price. It can be useful for valuing income-generating stocks.

-

PEG Ratio: Divides the P/E ratio by the company’s expected growth rate. It provides a more comprehensive valuation metric that considers both earnings and growth.

Conclusion

The P/E ratio is a fundamental tool for assessing the valuation of a company. By understanding its components, types, interpretations, and limitations, investors can use it to make more informed investment decisions. However, it’s important to remember that the P/E ratio is just one piece of the puzzle. It should be used in conjunction with other valuation metrics, financial analysis tools, and a thorough understanding of the company’s business and industry. By taking a holistic approach, investors can increase their chances of identifying undervalued or overvalued stocks and achieving their investment goals.