Engaging Students with Investing: Building Financial Literacy and Future Prosperity

In an increasingly complex financial landscape, equipping students with a solid understanding of investing is no longer a luxury, but a necessity. Early exposure to investing principles can empower young people to make informed financial decisions, build wealth, and secure their future. However, engaging students with the topic of investing can be challenging. Many find it intimidating, confusing, or simply irrelevant to their current lives. This article explores practical strategies and innovative approaches to make investing accessible, exciting, and relevant for students of all ages and backgrounds.

Why Investing Education Matters for Students

Before diving into engagement strategies, it’s essential to understand the profound impact that early investing education can have on students’ lives:

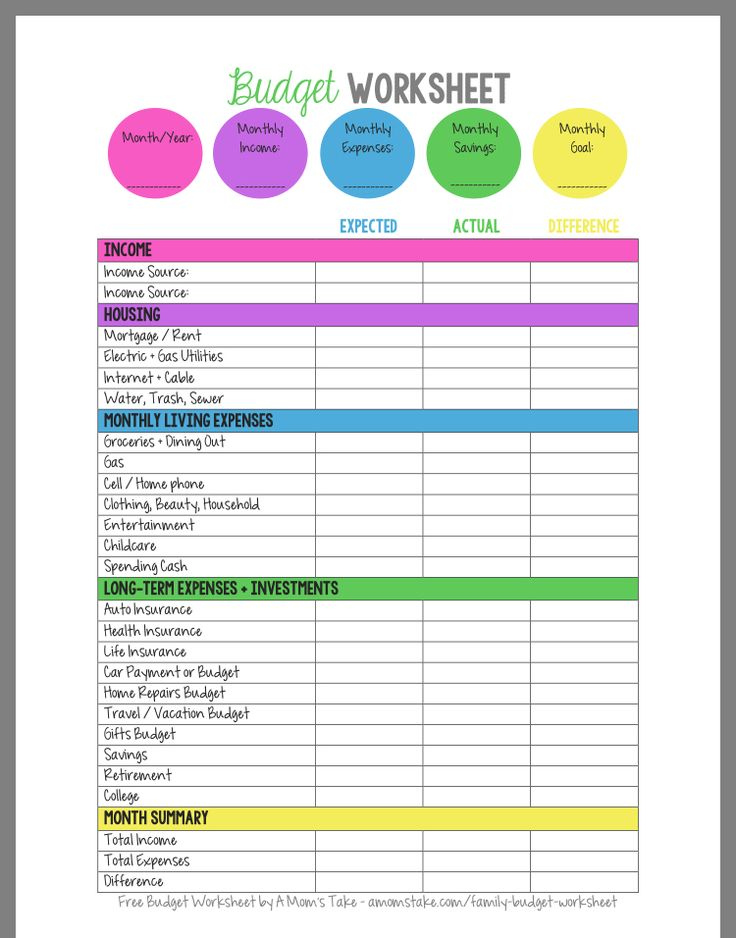

- Financial Literacy: Investing education fosters a broader understanding of personal finance, including budgeting, saving, debt management, and the importance of financial planning.

- Long-Term Wealth Building: Starting to invest early, even with small amounts, allows students to harness the power of compounding, where returns generate further returns over time. This can lead to significant wealth accumulation over the long term.

- Empowerment and Confidence: Understanding investing concepts empowers students to take control of their financial future, reducing anxiety and increasing confidence in their ability to achieve their goals.

- Critical Thinking and Problem-Solving: Investing involves analyzing information, assessing risks, and making informed decisions. These skills are valuable in all aspects of life, not just finance.

- Economic Awareness: Learning about investing provides students with a deeper understanding of how the economy works, including the role of businesses, markets, and government policies.

Strategies for Engaging Students with Investing

Here are several strategies that educators, parents, and community organizations can use to engage students with investing:

-

Start with the Basics:

- Demystify Investing: Avoid using complex jargon or technical terms. Explain basic concepts like stocks, bonds, mutual funds, and ETFs in simple, relatable language.

- Focus on Real-World Examples: Use real-world examples of companies students are familiar with, such as Apple, Disney, or Nike, to illustrate how investing works.

- Emphasize the "Why": Explain the benefits of investing in terms of students’ future goals, such as buying a car, paying for college, or traveling the world.

-

Make it Interactive and Fun:

- Investing Simulations: Use online stock market simulators or virtual trading platforms that allow students to invest with virtual money. This provides a risk-free way to learn about market dynamics and investment strategies.

- Games and Competitions: Incorporate games and competitions that test students’ knowledge of investing concepts. This can make learning more engaging and memorable.

- Case Studies: Present real-life case studies of successful investors or companies. Encourage students to analyze the decisions made and discuss the outcomes.

-

Connect Investing to Students’ Interests:

- Personalized Portfolios: Encourage students to create hypothetical investment portfolios based on their interests and values. For example, a student interested in environmental issues might invest in renewable energy companies.

- Invest in What You Know: Explain that students can invest in companies whose products or services they use and understand. This can make investing more relatable and less intimidating.

- Socially Responsible Investing: Introduce the concept of socially responsible investing (SRI), where investors consider environmental, social, and governance (ESG) factors when making investment decisions. This can appeal to students who are passionate about social and environmental issues.

-

Incorporate Technology:

- Online Resources: Utilize online resources such as educational websites, videos, and podcasts that explain investing concepts in an engaging and accessible way.

- Mobile Apps: Explore mobile apps that allow students to track their investments, research companies, and learn about financial news.

- Virtual Reality (VR): Consider using VR simulations to immerse students in realistic investing scenarios.

-

Bring in Guest Speakers:

- Financial Professionals: Invite financial advisors, investment managers, or entrepreneurs to speak to students about their experiences in the world of finance.

- Successful Young Investors: Feature young investors who have achieved success in the market. This can inspire students and demonstrate that investing is possible at any age.

- Alumni: Invite former students who have pursued careers in finance to share their insights and advice.

-

Encourage Parental Involvement:

- Family Discussions: Encourage students to discuss investing with their parents or guardians. This can create a supportive environment for learning and exploration.

- Joint Investing Accounts: Consider setting up joint investing accounts with students, allowing them to participate in real-world investing decisions under adult supervision.

- Financial Literacy Workshops: Offer financial literacy workshops for parents and guardians to help them support their children’s investing education.

-

Address Common Concerns and Misconceptions:

- Investing is Only for the Rich: Emphasize that investing is accessible to everyone, regardless of income level. Explain that it’s possible to start with small amounts and gradually increase investments over time.

- Investing is Too Risky: Teach students about risk management strategies, such as diversification and dollar-cost averaging. Explain that investing involves risks, but it’s possible to mitigate those risks through careful planning and research.

- Investing is Too Complicated: Break down complex concepts into simpler, more manageable pieces. Provide students with clear and concise explanations of investment strategies.

-

Promote Long-Term Thinking:

- Focus on Goals: Encourage students to set long-term financial goals, such as saving for retirement or buying a home. Explain how investing can help them achieve those goals.

- Avoid Short-Term Speculation: Warn students about the dangers of short-term speculation and "get-rich-quick" schemes. Emphasize the importance of investing for the long term.

- Regular Investing Habits: Encourage students to develop regular investing habits, such as contributing a fixed amount to their investment account each month.

Conclusion

Engaging students with investing is an investment in their future. By adopting creative and practical strategies, educators, parents, and community organizations can empower young people to become financially literate, confident, and prosperous individuals. As students develop a solid understanding of investing principles, they will be better equipped to navigate the complexities of the financial world and achieve their long-term goals. Remember, the key is to make investing accessible, relevant, and enjoyable for students, fostering a lifelong interest in financial planning and wealth building.