Ethical Investing Simplified: Aligning Your Money with Your Values

In an increasingly interconnected world, where awareness of social and environmental issues is growing, people are seeking ways to make a positive impact beyond their daily lives. One powerful avenue for change lies in how we invest our money. Ethical investing, also known as socially responsible investing (SRI) or impact investing, offers a way to align your financial goals with your personal values, supporting companies and initiatives that contribute to a better future.

What is Ethical Investing?

At its core, ethical investing is about making investment decisions based on more than just financial returns. It involves considering the environmental, social, and governance (ESG) factors of a company or investment, ensuring that your money is used in a way that aligns with your moral compass.

This can mean:

- Avoiding investments in industries or companies that are deemed harmful, such as those involved in weapons manufacturing, tobacco, fossil fuels, or gambling.

- Investing in companies that are actively working to solve social and environmental problems, such as those focused on renewable energy, sustainable agriculture, or affordable housing.

- Using your power as an investor to encourage companies to improve their ESG performance through shareholder advocacy and engagement.

Why Choose Ethical Investing?

The reasons for choosing ethical investing are diverse and personal, but often include:

- Making a Positive Impact: Many investors want their money to contribute to a better world, supporting companies that are making a difference in areas they care about.

- Reducing Risk: Companies with strong ESG practices are often better managed and more resilient in the long run. They are less likely to face regulatory fines, reputational damage, or other risks that can negatively impact their financial performance.

- Improved Financial Performance: Studies have shown that ethical investing can, in many cases, deliver competitive or even superior financial returns compared to traditional investing. This is because companies with strong ESG practices are often more innovative, efficient, and responsive to changing market demands.

- Personal Alignment: Ethical investing allows you to invest in companies that reflect your values, creating a sense of satisfaction and purpose.

Getting Started with Ethical Investing

Ethical investing doesn’t have to be complicated. Here are some steps to get started:

-

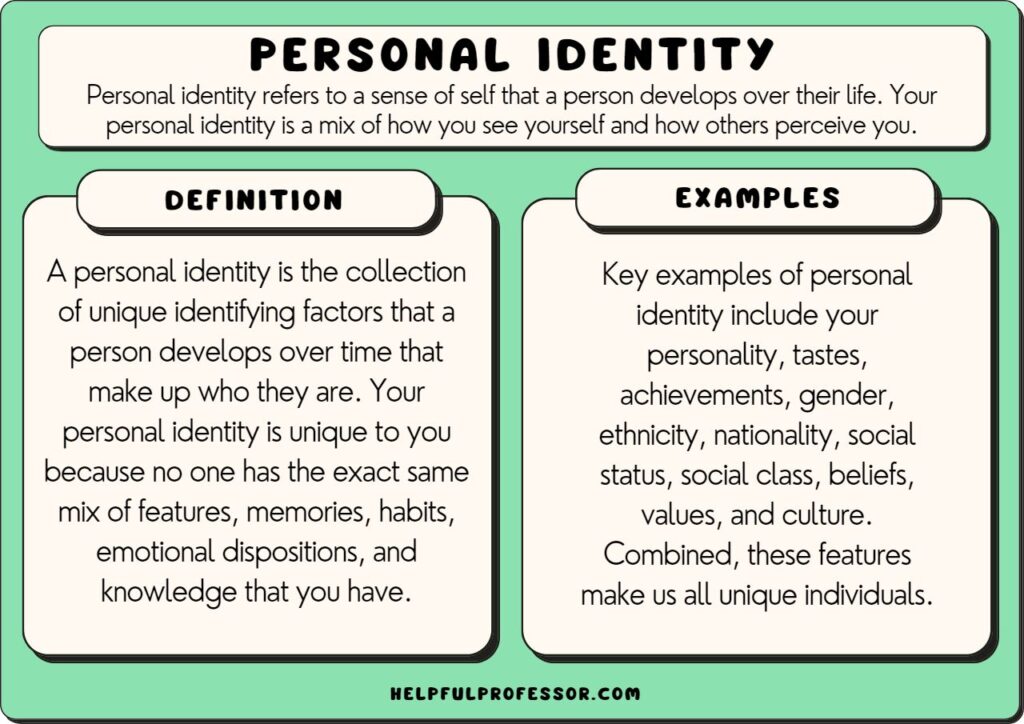

Define Your Values: What issues are most important to you? Are you passionate about climate change, social justice, animal welfare, or something else? Identifying your core values will help you narrow down your investment options.

-

Research Your Options: There are many different ways to invest ethically, including:

- ESG Funds: These are mutual funds or exchange-traded funds (ETFs) that focus on companies with strong ESG performance. Look for funds that align with your values and have a track record of solid financial performance.

- Impact Investing: This involves investing directly in companies or projects that are specifically designed to address social or environmental problems. Impact investments often have a measurable social or environmental return alongside a financial return.

- Individual Stocks and Bonds: You can research individual companies and invest in those that have strong ESG practices. This requires more research and due diligence, but it allows you to have more control over your investments.

-

Consider Negative Screening: This involves excluding companies or industries that you don’t want to support. Common negative screens include those related to weapons, tobacco, fossil fuels, and gambling.

-

Look for Positive Screening: This involves actively seeking out companies that are making a positive impact in areas you care about. This could include companies that are developing renewable energy technologies, promoting diversity and inclusion, or providing affordable healthcare.

-

Engage with Companies: As a shareholder, you have the right to engage with companies and encourage them to improve their ESG performance. This can be done through shareholder resolutions, letters to management, or direct dialogue.

-

Work with a Financial Advisor: If you’re unsure where to start, consider working with a financial advisor who specializes in ethical investing. They can help you develop a personalized investment strategy that aligns with your values and financial goals.

Challenges and Considerations

While ethical investing offers many benefits, it’s important to be aware of the challenges and considerations:

- Greenwashing: Some companies may exaggerate their ESG credentials to attract ethical investors. It’s important to do your research and look for evidence of genuine commitment to sustainability and social responsibility.

- Data and Measurement: ESG data can be inconsistent and difficult to compare across companies. Be sure to use multiple sources of information and consider the limitations of the data.

- Trade-offs: Ethical investing may involve making trade-offs between financial returns and social or environmental impact. It’s important to be clear about your priorities and what you’re willing to sacrifice.

- Expense Ratios: Some ESG funds may have higher expense ratios than traditional funds. Be sure to compare the costs of different options before making a decision.

The Future of Ethical Investing

Ethical investing is a rapidly growing field, driven by increasing awareness of social and environmental issues and a desire to create a more sustainable and equitable world. As more investors demand ethical options, companies will be under increasing pressure to improve their ESG performance. This, in turn, will lead to more innovation and investment in solutions to global challenges.

Conclusion

Ethical investing is a powerful way to align your money with your values, supporting companies and initiatives that are making a positive impact on the world. While it may involve some challenges and trade-offs, the benefits of investing ethically can be significant, both for your portfolio and for the planet. By taking the time to research your options and define your values, you can make informed investment decisions that contribute to a better future for all. It’s not just about making money; it’s about making a difference.