From Pennies to Prosperity: Mastering the Art of Growing Your Savings

Saving money is a cornerstone of financial security and future prosperity. Whether you’re saving for a down payment on a house, a comfortable retirement, or simply to build a financial safety net, the principles of growing your savings remain the same. This guide will provide a comprehensive roadmap to help you maximize your savings potential, transforming your financial landscape from one of scarcity to one of abundance.

1. Laying the Foundation: Understanding Your Financial Landscape

Before you can effectively grow your savings, you need to understand your current financial position. This involves a thorough assessment of your income, expenses, assets, and liabilities.

- Track Your Income and Expenses: The first step is to meticulously track where your money is coming from and where it’s going. Use budgeting apps, spreadsheets, or even a simple notebook to record every dollar earned and spent. Categorize your expenses (housing, transportation, food, entertainment, etc.) to identify areas where you can potentially cut back.

- Calculate Your Net Worth: Your net worth is the difference between your assets (what you own) and your liabilities (what you owe). Calculate your net worth regularly to monitor your financial progress. A positive and growing net worth indicates that you’re on the right track.

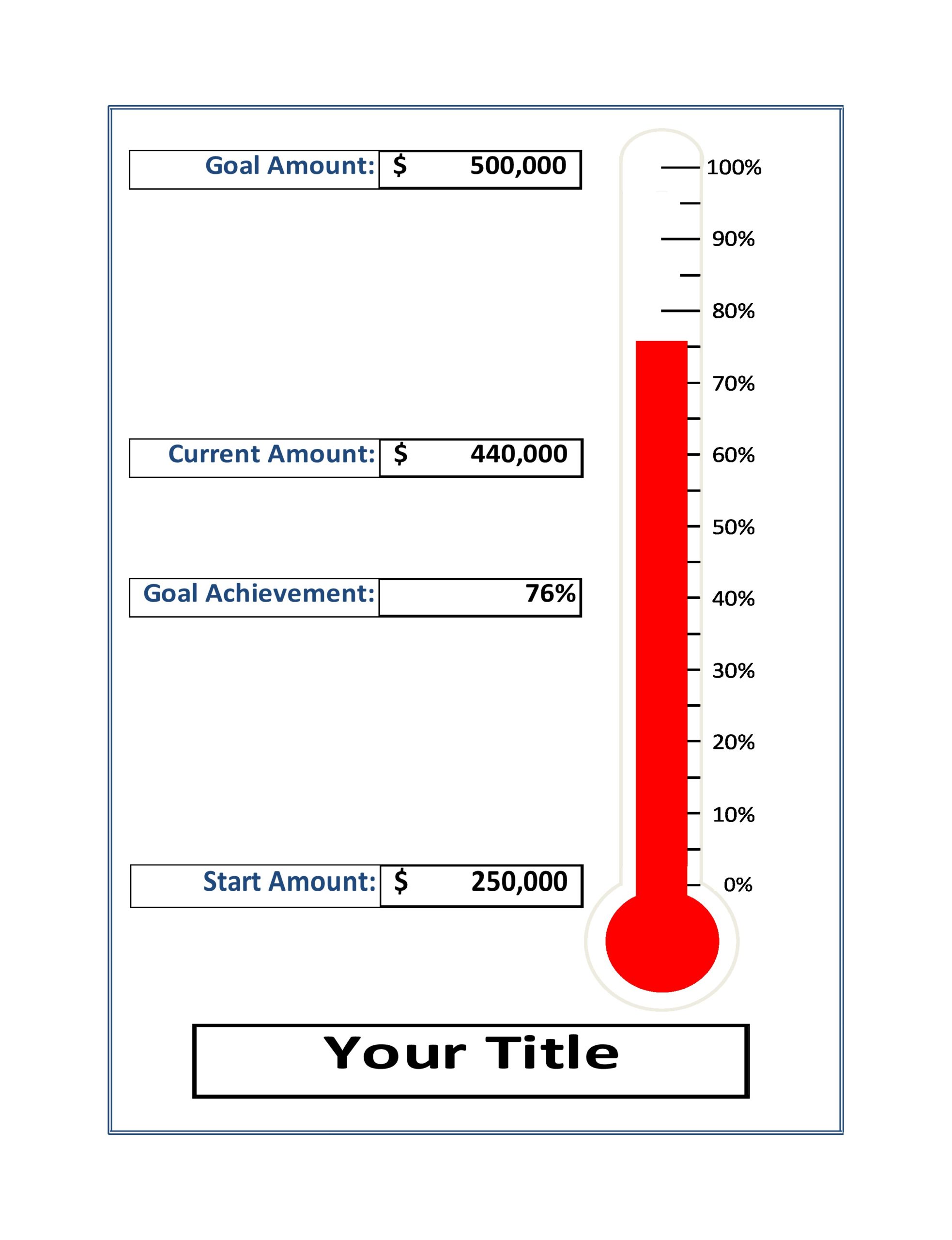

- Set Clear Financial Goals: What are you saving for? A down payment on a home? Retirement? A new car? Define your goals and attach specific dollar amounts and timelines to them. This will provide motivation and a clear direction for your savings efforts.

2. Building the Savings Habit: Strategies for Consistent Saving

Saving money is a habit, and like any habit, it requires consistent effort and discipline. Here are some strategies to help you build and maintain a strong savings habit:

- Automate Your Savings: The easiest way to save consistently is to automate the process. Set up automatic transfers from your checking account to your savings account on a regular basis. Even small, consistent transfers can add up significantly over time.

- Pay Yourself First: Treat your savings like a non-negotiable bill. Before you pay any other expenses, set aside a predetermined amount for savings. This ensures that you prioritize saving and don’t spend all your money on other things.

- Embrace the Power of Small Changes: Small changes in your spending habits can have a big impact on your savings. Cut back on unnecessary expenses like daily coffee runs, takeout meals, or subscriptions you don’t use.

- Find Creative Ways to Save: Look for creative ways to save money in your daily life. Use coupons, shop sales, negotiate bills, and take advantage of free activities and entertainment options.

- Challenge Yourself: Turn saving into a game by setting savings challenges. For example, try saving every $5 bill you receive or participate in a no-spend challenge for a week or a month.

- Use Windfalls Wisely: When you receive unexpected income, such as a tax refund or a bonus at work, resist the urge to splurge. Instead, put a significant portion of it towards your savings goals.

3. Maximizing Your Savings: Strategies for Earning More Interest

Once you’ve established a consistent savings habit, it’s time to focus on maximizing the interest you earn on your savings.

- Choose the Right Savings Account: Not all savings accounts are created equal. Shop around for accounts with the highest interest rates and the lowest fees. Online savings accounts often offer higher rates than traditional brick-and-mortar banks.

- Consider a High-Yield Savings Account: High-yield savings accounts offer significantly higher interest rates than traditional savings accounts. These accounts are typically offered by online banks and may have certain requirements, such as a minimum balance.

- Explore Certificates of Deposit (CDs): CDs are a type of savings account that offers a fixed interest rate for a specific period of time. CDs typically offer higher interest rates than savings accounts, but your money is locked up for the duration of the term.

- Look into Money Market Accounts (MMAs): Money market accounts are similar to savings accounts, but they often offer higher interest rates and may come with check-writing privileges. MMAs may also require a higher minimum balance than savings accounts.

- Take Advantage of Employer-Sponsored Retirement Plans: If your employer offers a 401(k) or other retirement plan, take full advantage of it, especially if they offer a matching contribution. This is essentially free money that can significantly boost your retirement savings.

- Consider Investing (Carefully): Once you have a solid emergency fund and are comfortable with the risks, consider investing a portion of your savings to potentially earn higher returns. Diversify your investments across different asset classes, such as stocks, bonds, and real estate.

4. Protecting Your Savings: Safeguarding Your Financial Future

Growing your savings is important, but it’s equally important to protect your savings from unexpected events and financial risks.

- Build an Emergency Fund: An emergency fund is a cash reserve that covers unexpected expenses, such as job loss, medical bills, or car repairs. Aim to save at least 3-6 months’ worth of living expenses in your emergency fund.

- Get Adequate Insurance Coverage: Protect yourself from financial ruin by having adequate insurance coverage, including health insurance, auto insurance, homeowners or renters insurance, and life insurance.

- Pay Down High-Interest Debt: High-interest debt, such as credit card debt, can erode your savings and make it difficult to reach your financial goals. Prioritize paying down high-interest debt as quickly as possible.

- Protect Yourself from Fraud: Be vigilant about protecting yourself from fraud and scams. Never give out your personal information to unknown sources, and monitor your accounts regularly for suspicious activity.

- Create a Financial Plan: A financial plan is a roadmap for achieving your financial goals. Work with a financial advisor to create a personalized plan that takes into account your income, expenses, assets, liabilities, and risk tolerance.

5. The Power of Compounding: The Magic of Long-Term Savings

Albert Einstein famously called compound interest the "eighth wonder of the world." Compounding is the process of earning interest on your initial investment, as well as on the accumulated interest from previous periods. Over time, compounding can significantly accelerate the growth of your savings.

- Start Saving Early: The earlier you start saving, the more time your money has to grow through compounding. Even small amounts saved consistently over a long period of time can add up to a substantial sum.

- Reinvest Your Earnings: Reinvest any interest or dividends you earn on your savings or investments. This will allow your money to grow even faster through the power of compounding.

- Be Patient: Compounding takes time to work its magic. Don’t get discouraged if you don’t see immediate results. Stay consistent with your savings and investment strategy, and you’ll be amazed at how much your money can grow over time.

Conclusion: A Journey Towards Financial Freedom

Growing your savings is a journey, not a destination. It requires discipline, patience, and a willingness to learn and adapt. By implementing the strategies outlined in this guide, you can take control of your finances, build a solid financial foundation, and achieve your long-term financial goals. Remember, every dollar saved is a step towards a brighter financial future.