Gamify Your Investing Routine

Investing can often feel like a daunting task, filled with complex jargon, fluctuating markets, and the constant pressure to make the right decisions. It’s no wonder many people shy away from it altogether, missing out on the potential for long-term financial growth. But what if there was a way to make investing more engaging, enjoyable, and even addictive? Enter gamification – the art of incorporating game-like elements into non-game contexts to boost motivation and engagement.

By gamifying your investing routine, you can transform it from a chore into an exciting and rewarding experience. This approach can help you stay consistent with your investment goals, learn more about the market, and ultimately achieve greater financial success.

Why Gamify Your Investing?

Before diving into the specifics of how to gamify your investing routine, let’s explore the key benefits of this approach:

- Increased Motivation: Games are designed to be engaging and motivating, often through the use of rewards, challenges, and progress tracking. By incorporating these elements into your investing routine, you can stay motivated to reach your financial goals.

- Enhanced Learning: Gamification can make learning about investing more fun and accessible. Through simulations, quizzes, and challenges, you can deepen your understanding of the market and investment strategies.

- Improved Consistency: Consistency is key to successful investing. Gamification can help you stay on track with your investment plan by providing a structured and engaging framework.

- Reduced Stress: Investing can be stressful, especially during market downturns. Gamification can help alleviate some of this stress by making the process more enjoyable and less intimidating.

- Greater Financial Literacy: By actively participating in a gamified investing routine, you’ll naturally learn more about personal finance and investment principles.

How to Gamify Your Investing Routine

Here are some practical ways to incorporate gamification into your investing routine:

1. Set Clear Goals and Rewards

- Define Specific Goals: Start by setting clear and specific financial goals. Do you want to save for a down payment on a house, retire early, or simply grow your wealth? The more specific your goals, the easier it will be to track your progress and stay motivated.

- Break Down Goals into Smaller Milestones: Big goals can feel overwhelming. Break them down into smaller, more manageable milestones. For example, instead of focusing on a long-term retirement goal, set a monthly savings target.

- Assign Rewards to Milestones: For each milestone you achieve, reward yourself. The rewards don’t have to be extravagant. They could be as simple as treating yourself to a nice dinner, buying a new book, or taking a weekend getaway.

- Track Your Progress: Use a spreadsheet, app, or journal to track your progress towards your goals. Seeing your progress visually can be a powerful motivator.

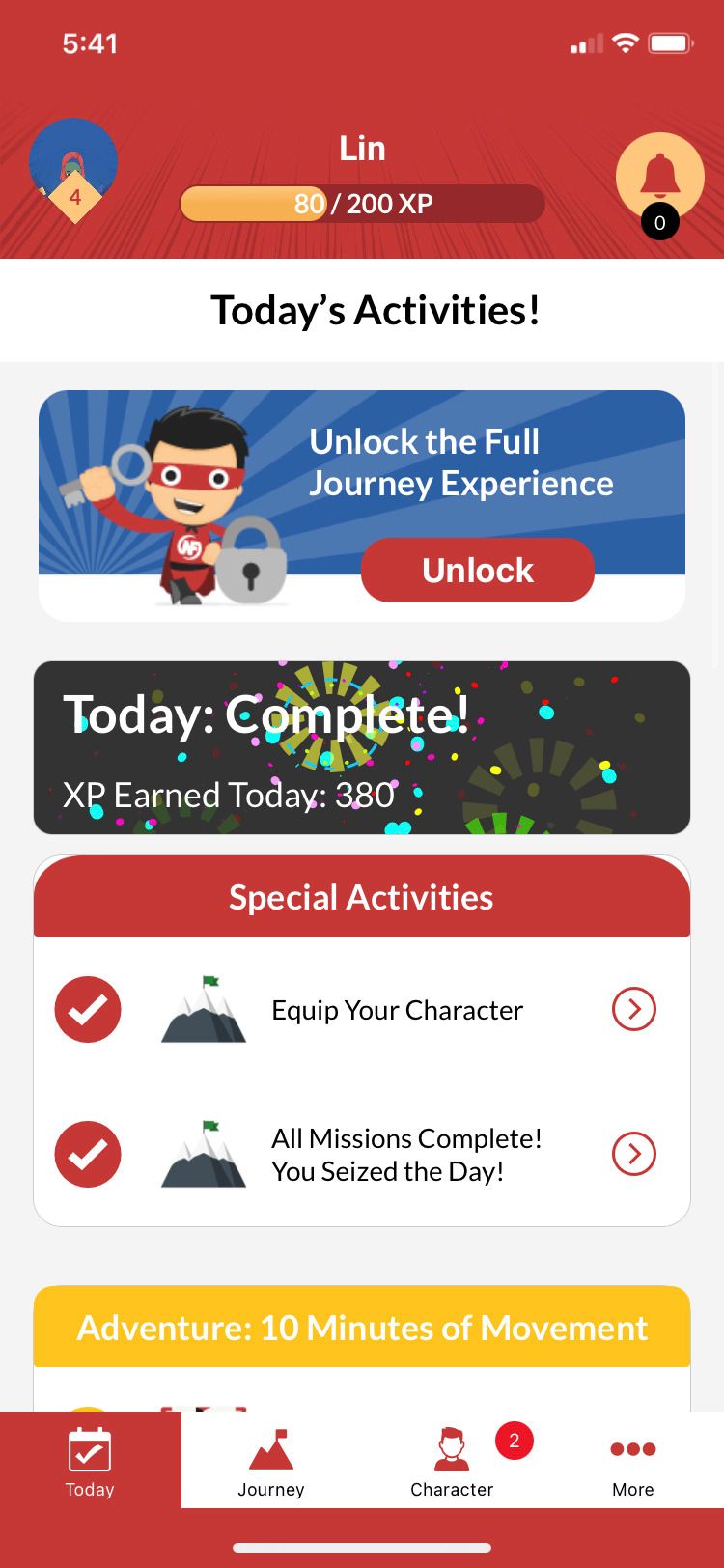

2. Use Investment Apps and Platforms with Gamified Features

- Explore Investment Apps: Several investment apps and platforms offer gamified features, such as badges, leaderboards, and challenges. These features can make investing more fun and engaging.

- Consider "Fantasy Stock Trading": Many platforms let you engage in fantasy stock trading, where you can use virtual money to invest in real-world stocks. This allows you to practice investing strategies without risking actual funds.

- Participate in Challenges and Competitions: Some investment apps offer challenges and competitions where you can compete against other users. This can add a social element to your investing routine and provide additional motivation.

3. Create Challenges and Competitions for Yourself

- Savings Challenges: Challenge yourself to save a certain amount of money each month or quarter. You can even create a "no-spend" challenge to see how much you can save in a week or month.

- Investment Challenges: Challenge yourself to research and invest in a new stock or asset each month. This can help you expand your knowledge and diversify your portfolio.

- Performance Challenges: Set performance goals for your portfolio and challenge yourself to beat the market. This can encourage you to actively manage your investments and make informed decisions.

4. Turn Learning into a Game

- Read Books and Articles: Read books and articles about investing and personal finance. You can turn this into a game by setting a goal to read a certain number of pages or articles each week.

- Take Online Courses: Enroll in online courses to learn more about specific investment topics. Many courses offer quizzes and assessments that can help you track your progress and test your knowledge.

- Listen to Podcasts: Listen to podcasts about investing while you commute or exercise. This can be a convenient way to learn on the go.

- Play Investment Simulation Games: There are many investment simulation games available online that can help you learn about the market in a fun and interactive way.

5. Reward Yourself for Good Investment Habits

- Regular Contributions: Reward yourself for consistently contributing to your investment accounts.

- Diversification: Reward yourself for diversifying your portfolio and reducing your risk.

- Long-Term Investing: Reward yourself for sticking to your long-term investment plan, even during market downturns.

- Avoiding Emotional Decisions: Reward yourself for making rational investment decisions based on research and analysis, rather than emotions.

Examples of Gamified Investing Strategies

- The "Savings Sprint": Challenge yourself to save a certain amount of money in a short period of time, such as a week or month. Reward yourself with a small treat for each milestone you reach.

- The "Stock Scavenger Hunt": Research and identify promising stocks in different sectors. Reward yourself for each successful investment.

- The "Portfolio Power-Up": Make small adjustments to your portfolio each month to optimize your returns. Reward yourself for each improvement you make.

- The "Financial Fitness Challenge": Track your spending and savings habits. Reward yourself for reaching your financial fitness goals.

Potential Downsides of Gamification

While gamification can be a powerful tool for improving your investing routine, it’s important to be aware of potential downsides:

- Overemphasis on Rewards: If you focus too much on the rewards, you may lose sight of your long-term financial goals.

- Increased Risk-Taking: The competitive nature of gamification may encourage you to take on more risk than you’re comfortable with.

- Burnout: Constantly striving for rewards can lead to burnout. It’s important to find a balance between gamification and relaxation.

- Distraction: Gamification can be distracting and take away from the seriousness of investing.

Tips for Successful Gamification

- Start Small: Don’t try to gamify your entire investing routine at once. Start with a few simple challenges and gradually add more as you become comfortable.

- Personalize Your Approach: Tailor your gamification strategy to your individual goals, interests, and personality.

- Stay Focused on Your Goals: Remember that the purpose of gamification is to help you achieve your financial goals. Don’t let the games distract you from what’s important.

- Be Mindful of Risk: Don’t take on more risk than you’re comfortable with just to win a game or earn a reward.

- Have Fun: The most important thing is to enjoy the process. If you’re not having fun, gamification won’t be effective.

Conclusion

Gamifying your investing routine can be a powerful way to boost motivation, enhance learning, improve consistency, and reduce stress. By incorporating game-like elements into your investment plan, you can transform it from a chore into an exciting and rewarding experience. However, it’s important to be mindful of potential downsides and to use gamification responsibly. By setting clear goals, using investment apps with gamified features, creating challenges for yourself, and rewarding yourself for good investment habits, you can unlock the power of gamification and achieve greater financial success. Remember to personalize your approach, stay focused on your goals, be mindful of risk, and have fun along the way. Happy investing!