Interactive Money Goal Charts: Your Visual Roadmap to Financial Success

In the realm of personal finance, setting goals is paramount. Without clearly defined objectives, it’s easy to drift aimlessly, making financial decisions that may not align with your long-term aspirations. However, simply stating your goals isn’t enough. To truly maximize your chances of success, you need a way to visualize your progress and stay motivated along the way. This is where interactive money goal charts come in.

What are Interactive Money Goal Charts?

Interactive money goal charts are dynamic visual tools that help you track your progress toward specific financial objectives. Unlike traditional static charts, these interactive versions allow you to input data, adjust parameters, and receive real-time feedback on your performance. They often come in the form of spreadsheets, web-based applications, or mobile apps, providing a user-friendly interface for managing your financial goals.

Benefits of Using Interactive Money Goal Charts:

-

Enhanced Goal Clarity: By defining your goals and inputting them into an interactive chart, you’re forced to clarify the specifics. You’ll need to specify the target amount, the timeframe for achieving the goal, and the regular contributions required. This level of detail makes your goals more tangible and actionable.

-

Visual Progress Tracking: Interactive charts provide a visual representation of your progress. As you update the chart with your actual savings or investments, the chart will reflect your advancement toward your goal. This visual feedback can be incredibly motivating, especially when you see your progress trending in the right direction.

-

Real-Time Performance Feedback: Interactive charts offer real-time feedback on your performance. They can calculate whether you’re on track to meet your goals, or whether you need to adjust your savings or investment strategy. This feedback helps you stay proactive and make necessary course corrections.

-

Scenario Planning: Interactive charts allow you to explore different scenarios. You can adjust your savings rate, investment returns, or time horizon to see how these changes impact your ability to achieve your goals. This scenario planning helps you make informed decisions and develop a realistic financial plan.

-

Increased Motivation: Seeing your progress visually and receiving real-time feedback can be incredibly motivating. It reinforces positive behavior and encourages you to stay committed to your goals, even when faced with challenges.

-

Improved Financial Awareness: Interactive charts promote greater financial awareness. By regularly tracking your progress and analyzing your performance, you’ll develop a deeper understanding of your finances and how your decisions impact your long-term goals.

-

Personalized Approach: Interactive charts can be customized to fit your specific needs and preferences. You can choose the types of goals you want to track, the level of detail you want to include, and the visual style that appeals to you. This personalized approach makes the charts more engaging and effective.

Key Features of Interactive Money Goal Charts:

-

Goal Definition: The chart should allow you to clearly define your financial goals, including the target amount, timeframe, and regular contributions.

-

Data Input: The chart should provide a user-friendly interface for inputting your actual savings or investment data.

-

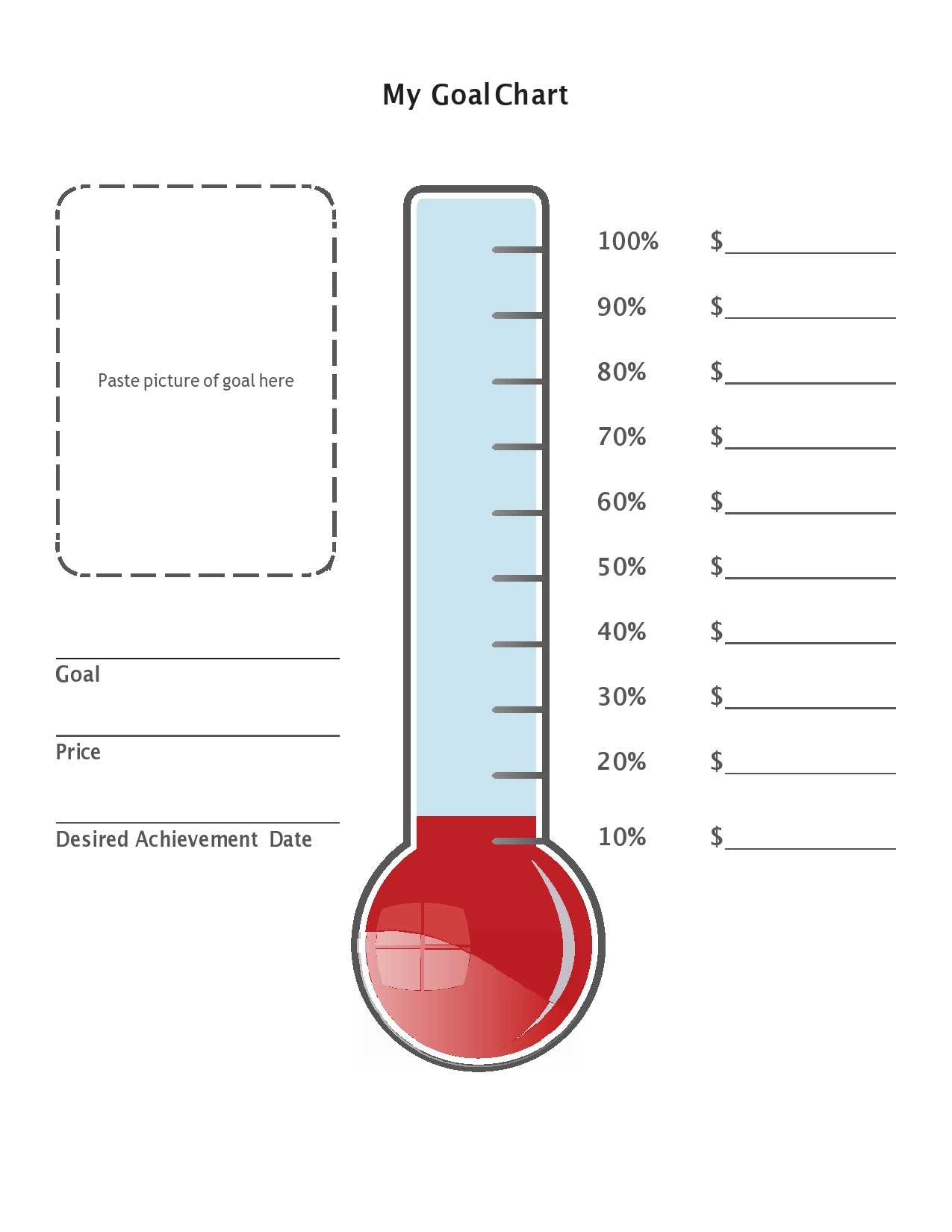

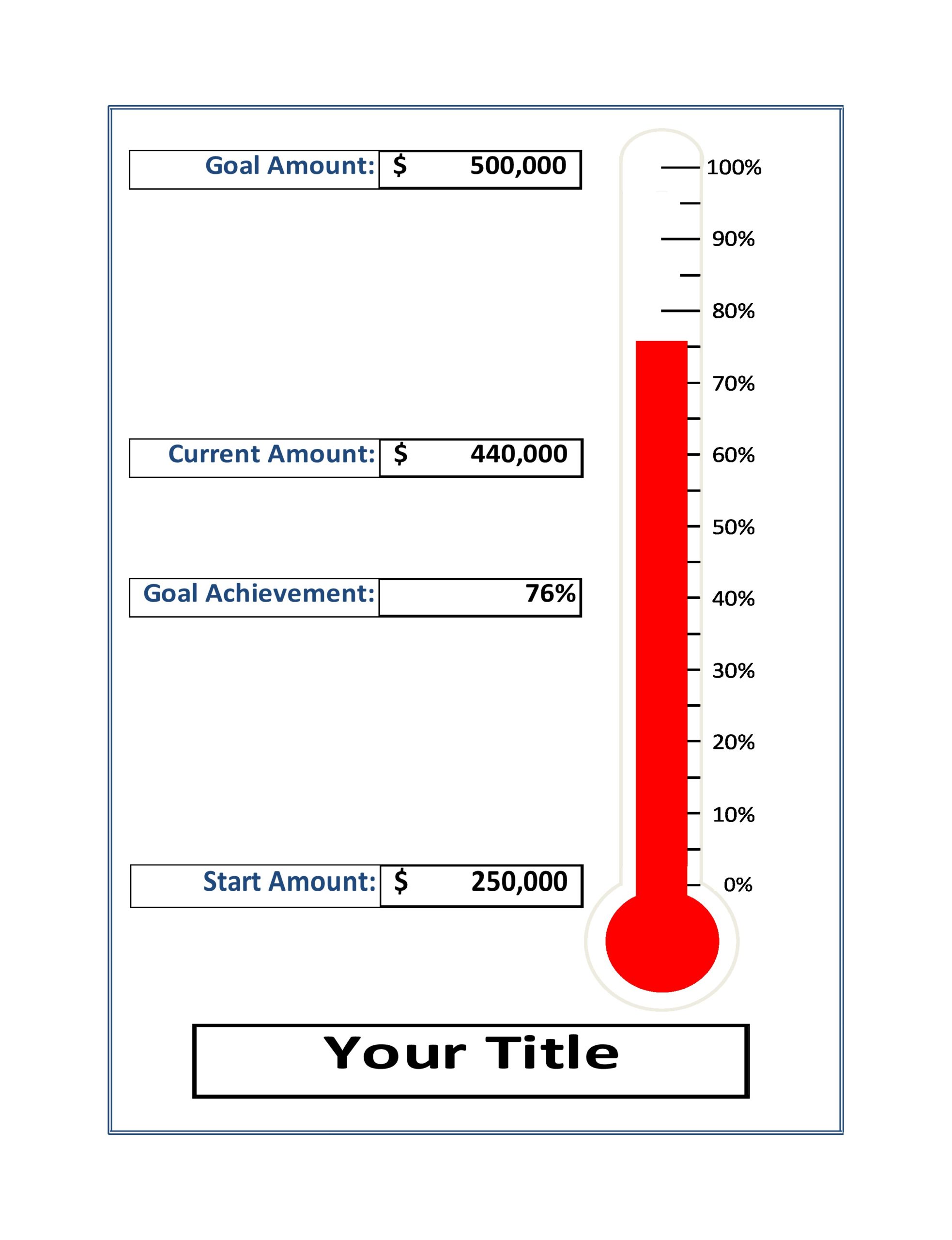

Progress Visualization: The chart should visually represent your progress toward your goals, using graphs, charts, or other visual aids.

-

Performance Tracking: The chart should track your performance against your goals, calculating whether you’re on track or need to make adjustments.

-

Scenario Planning: The chart should allow you to explore different scenarios by adjusting parameters such as savings rate, investment returns, or time horizon.

-

Customization: The chart should be customizable to fit your specific needs and preferences.

-

Reporting: The chart should generate reports that summarize your progress and performance over time.

Types of Financial Goals to Track:

-

Savings Goals:

- Emergency fund

- Down payment for a home

- Vacation fund

- Education fund

- Retirement savings

-

Debt Reduction Goals:

- Credit card debt

- Student loan debt

- Mortgage debt

-

Investment Goals:

- Investing for retirement

- Investing for a specific goal (e.g., buying a car)

- Building a diversified investment portfolio

How to Create Your Own Interactive Money Goal Chart:

- Choose a Tool: Select a tool that suits your needs and preferences. You can use spreadsheets (e.g., Microsoft Excel, Google Sheets), web-based applications, or mobile apps.

- Define Your Goals: Clearly define your financial goals, including the target amount, timeframe, and regular contributions.

- Set Up the Chart: Create a chart with columns for the following information:

- Goal Name

- Target Amount

- Timeframe

- Regular Contributions

- Actual Savings/Investments

- Progress

- Status (e.g., On Track, Behind Schedule)

- Input Your Data: Enter your initial data into the chart.

- Create Formulas: Create formulas to calculate your progress and status. For example, you can use the following formulas:

- Progress = Actual Savings/Investments / Target Amount

- Status = IF(Progress >= 1, "Achieved", IF(Progress >= Expected Progress, "On Track", "Behind Schedule"))

- Visualize Your Progress: Use graphs or charts to visually represent your progress.

- Update Regularly: Update your chart regularly with your actual savings or investment data.

- Analyze Your Performance: Analyze your performance and make adjustments to your savings or investment strategy as needed.

Tips for Success:

- Start with Clear Goals: The more specific your goals, the easier it will be to track your progress and stay motivated.

- Be Realistic: Set realistic goals that are achievable within your timeframe.

- Stay Consistent: Update your chart regularly and analyze your performance.

- Celebrate Milestones: Celebrate your milestones along the way to stay motivated.

- Don’t Be Afraid to Adjust: Don’t be afraid to adjust your goals or strategy as needed.

Conclusion:

Interactive money goal charts are powerful tools that can help you achieve your financial objectives. By providing visual progress tracking, real-time performance feedback, and scenario planning capabilities, these charts empower you to take control of your finances and make informed decisions. Whether you’re saving for a down payment, paying off debt, or investing for retirement, an interactive money goal chart can be your visual roadmap to financial success. So, take the time to create your own chart today and start tracking your progress toward a brighter financial future.