![]()

Interactive Stock Portfolio Tracker: A Comprehensive Guide

In today’s dynamic financial landscape, effective portfolio management is crucial for investors seeking to achieve their financial goals. An interactive stock portfolio tracker serves as an invaluable tool, empowering investors to monitor their investments, analyze performance, and make informed decisions. This comprehensive guide delves into the intricacies of interactive stock portfolio trackers, exploring their benefits, essential features, and how to leverage them for investment success.

Understanding Interactive Stock Portfolio Trackers

An interactive stock portfolio tracker is a sophisticated software application or online platform designed to help investors manage and monitor their stock holdings. Unlike traditional spreadsheets or manual tracking methods, interactive trackers offer real-time data, automated calculations, and comprehensive analytical tools.

Key Benefits of Using an Interactive Stock Portfolio Tracker

- Real-time Monitoring: Interactive trackers provide up-to-the-minute stock prices, market data, and news updates, allowing investors to stay informed about their portfolio’s performance and market trends.

- Automated Calculations: These trackers automatically calculate essential metrics such as portfolio value, gains/losses, asset allocation, and investment returns, saving investors time and effort.

- Performance Analysis: Interactive trackers offer a range of analytical tools to assess portfolio performance, identify strengths and weaknesses, and compare returns against benchmarks.

- Risk Management: By providing insights into portfolio diversification, volatility, and potential risks, interactive trackers help investors manage their risk exposure effectively.

- Informed Decision-Making: With access to comprehensive data and analytical tools, investors can make informed decisions about buying, selling, or rebalancing their portfolio.

- Tax Optimization: Some interactive trackers offer tax-related features, such as tracking capital gains and losses, to help investors optimize their tax strategies.

- Accessibility: Most interactive trackers are accessible via web browsers or mobile apps, allowing investors to monitor their portfolios from anywhere, at any time.

Essential Features of an Interactive Stock Portfolio Tracker

- Real-time Data Feeds: Integration with reliable data providers to ensure accurate and up-to-date stock prices, market data, and news.

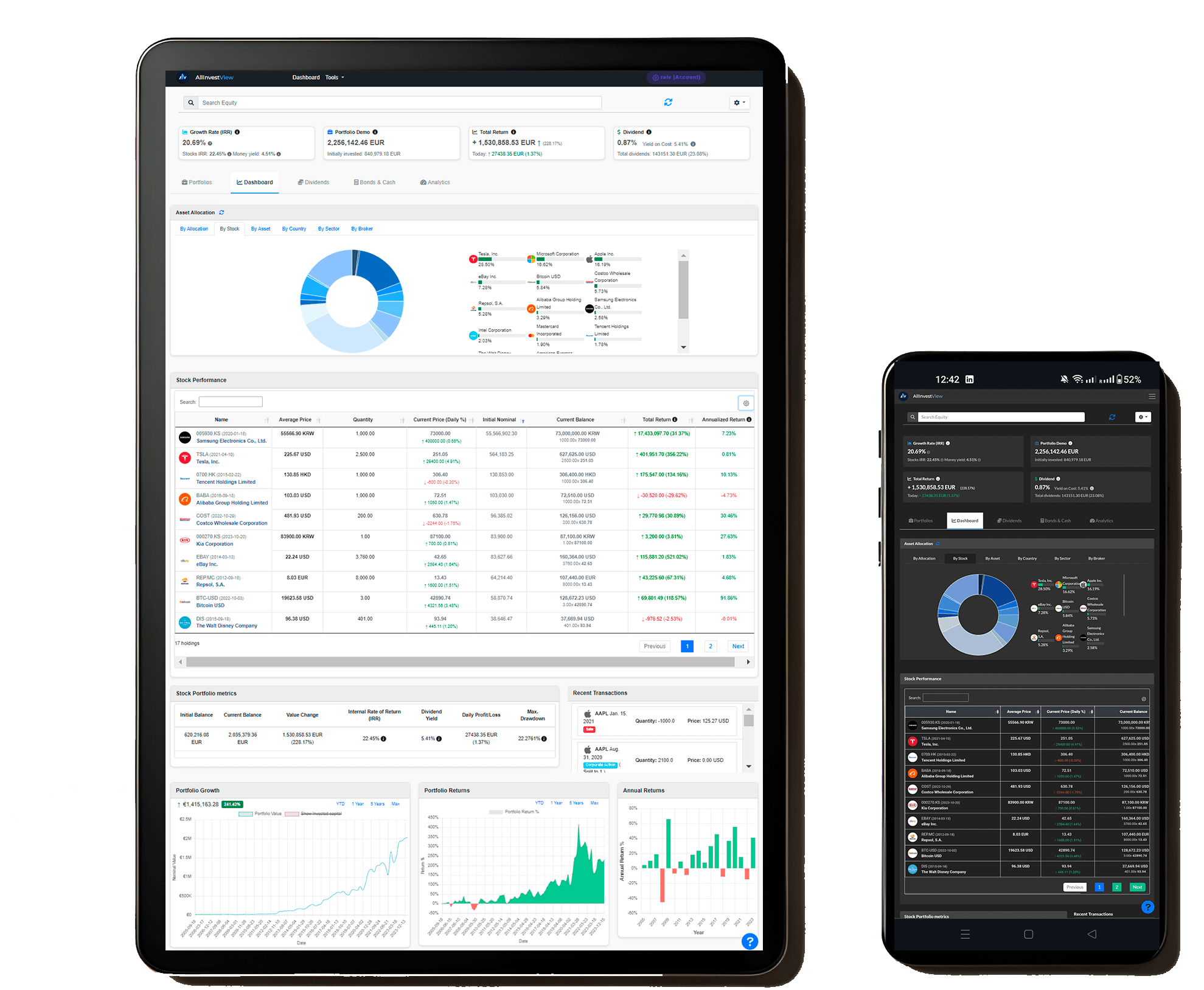

- Portfolio Visualization: Interactive charts and graphs to visualize portfolio performance, asset allocation, and other key metrics.

- Customizable Dashboards: Personalized dashboards to display the most relevant information and metrics according to individual preferences.

- Watchlists: Ability to create and monitor watchlists of stocks or other assets of interest.

- Alerts and Notifications: Customizable alerts for price movements, news events, or other triggers.

- Transaction History: Detailed records of all buy and sell transactions, including dates, prices, and quantities.

- Asset Allocation Analysis: Tools to analyze the distribution of assets across different sectors, industries, or geographic regions.

- Performance Benchmarking: Comparison of portfolio performance against relevant market indexes or benchmarks.

- Risk Metrics: Calculation of risk metrics such as volatility, beta, and Sharpe ratio.

- Tax Reporting: Generation of tax reports for capital gains, dividends, and other taxable events.

- Mobile Accessibility: Compatibility with mobile devices for on-the-go portfolio monitoring.

- Security: Robust security measures to protect sensitive financial data.

- User-Friendly Interface: Intuitive and easy-to-navigate interface for users of all experience levels.

How to Choose the Right Interactive Stock Portfolio Tracker

- Identify Your Needs: Determine your specific investment goals, tracking requirements, and desired features.

- Consider Your Experience Level: Choose a tracker with a user interface and features that match your level of expertise.

- Evaluate Data Accuracy: Ensure the tracker uses reliable data feeds and provides accurate information.

- Assess Analytical Tools: Look for a tracker with comprehensive analytical tools to support your investment decisions.

- Check for Customization Options: Choose a tracker that allows you to customize dashboards, alerts, and other settings to your preferences.

- Consider Mobile Accessibility: If you need to monitor your portfolio on the go, choose a tracker with a mobile app.

- Read Reviews and Compare Options: Research different trackers, read user reviews, and compare features and pricing.

- Try Free Trials: Take advantage of free trials to test out different trackers and see which one best meets your needs.

Tips for Using an Interactive Stock Portfolio Tracker Effectively

- Enter Accurate Data: Ensure that all transaction data is entered accurately and promptly.

- Customize Your Dashboard: Configure your dashboard to display the most relevant information and metrics.

- Set Up Alerts: Set up alerts for price movements, news events, or other triggers to stay informed about your investments.

- Regularly Review Your Portfolio: Review your portfolio performance and asset allocation on a regular basis.

- Use Analytical Tools: Take advantage of the analytical tools to assess your portfolio’s strengths and weaknesses.

- Compare Against Benchmarks: Compare your portfolio’s performance against relevant market indexes or benchmarks.

- Adjust Your Strategy: Make adjustments to your investment strategy based on your portfolio’s performance and market conditions.

- Stay Informed: Keep up-to-date with market news and trends to make informed investment decisions.

- Seek Professional Advice: Consult with a financial advisor for personalized investment guidance.

Popular Interactive Stock Portfolio Trackers

- Google Finance: A free, simple tracker that integrates with other Google services.

- Yahoo Finance: A comprehensive tracker with real-time data, news, and analysis.

- Personal Capital: A free tracker with advanced features for budgeting, retirement planning, and investment management.

- Morningstar Portfolio Manager: A premium tracker with in-depth analysis and research tools.

- Sharesight: A cloud-based tracker designed for investors with complex portfolios.

- Stock Rover: A powerful tracker with extensive research and analysis capabilities.

- Delta Investment Tracker: A user-friendly tracker with a clean interface and mobile app.

Conclusion

An interactive stock portfolio tracker is an indispensable tool for investors seeking to manage their investments effectively and achieve their financial goals. By providing real-time data, automated calculations, and comprehensive analytical tools, these trackers empower investors to monitor their portfolios, analyze performance, and make informed decisions. By choosing the right tracker and using it effectively, investors can gain a competitive edge in the market and maximize their investment returns.