Level Up Your Finances: How Gamification Apps Make Money Management Fun

Personal finance is often seen as a daunting and boring task. Budgets, savings goals, and debt repayment plans can feel restrictive and overwhelming. But what if managing your money could be fun and engaging? Enter the world of gamified personal finance apps, a new generation of tools designed to turn financial management into an enjoyable game.

What is Gamification?

Gamification is the application of game-design elements and game principles in non-game contexts. It involves incorporating elements like points, badges, leaderboards, challenges, and rewards to motivate users and encourage engagement. In the context of personal finance, gamification aims to make money management more interactive, accessible, and ultimately, more effective.

The Appeal of Gamified Finance Apps

The popularity of gamified finance apps is rooted in the psychological principles that make games so compelling. Here’s why they work:

- Motivation and Engagement: Games are inherently engaging. By introducing game-like elements, these apps tap into our natural desire for progress, achievement, and recognition.

- Behavioral Change: Gamification can influence behavior by providing immediate feedback and rewards for positive actions. This encourages users to adopt healthier financial habits.

- Learning and Education: Complex financial concepts can be simplified and made more digestible through interactive games and challenges.

- Fun and Enjoyment: Let’s face it, managing money can be stressful. Gamified apps inject fun and excitement into the process, making it less of a chore.

Key Features of Gamified Finance Apps

Gamified finance apps come in various forms, but they typically share some common features:

- Points and Rewards: Users earn points for completing tasks like tracking expenses, setting budgets, or achieving savings goals. These points can unlock rewards, badges, or virtual items.

- Challenges and Quests: Apps often present users with challenges, such as saving a certain amount of money in a specific timeframe or reducing spending in a particular category.

- Badges and Achievements: Earning badges and achievements provides a sense of accomplishment and motivates users to continue progressing.

- Leaderboards and Social Features: Some apps include leaderboards where users can compare their progress with friends or other users, fostering a sense of competition and community.

- Personalized Goals and Feedback: Apps tailor goals and challenges to individual users based on their financial situation and preferences. They also provide personalized feedback and insights.

- Visualizations and Progress Tracking: Charts, graphs, and other visual aids help users track their progress and understand their financial data at a glance.

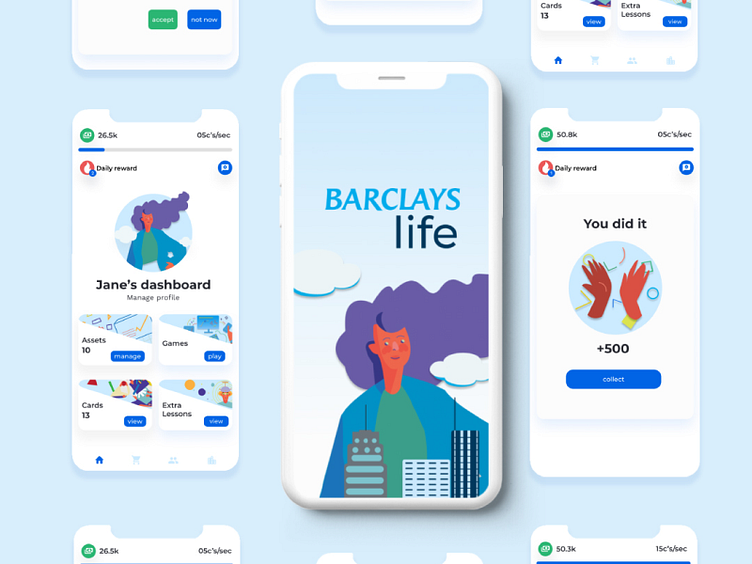

Popular Gamified Personal Finance Apps

Here are some popular gamified personal finance apps that are making waves in the industry:

- Qapital: Qapital focuses on helping users save money through automated rules and challenges. Users can set up "if-this-then-that" (IFTTT) rules to automatically save money based on their spending habits. For example, you can round up every purchase to the nearest dollar and save the difference, or save a set amount every time you visit a specific store.

- Long Game Savings: Long Game Savings combines saving money with lottery-style games. Users earn chances to win cash prizes based on their savings balances. This encourages them to save more money to increase their chances of winning.

- Habitica: Habitica is a habit-building app that gamifies all aspects of your life, including personal finance. You can create tasks and habits related to money management, such as tracking expenses or paying bills, and earn rewards for completing them.

- Fortune City: Fortune City turns budgeting into a city-building simulation game. Users track their expenses by tapping on buildings, and as they manage their finances effectively, their virtual city grows and prospers.

- Monopoly (App Version): While not strictly a personal finance app, the Monopoly app teaches valuable lessons about real estate, investment, and financial management in a fun and engaging way.

- PiggyBot: PiggyBot is designed for parents to teach their children about money management. Parents can set allowances, create chores, and track their children’s savings goals. Children earn virtual money for completing tasks and can redeem it for real-world rewards.

Benefits of Using Gamified Finance Apps

The benefits of using gamified finance apps extend beyond mere entertainment. They can have a significant impact on your financial well-being:

- Increased Financial Awareness: By tracking expenses, setting budgets, and monitoring progress, users become more aware of their financial habits and patterns.

- Improved Budgeting Skills: Gamified apps make budgeting more engaging and less intimidating. They help users create realistic budgets and stick to them.

- Enhanced Savings Habits: The reward systems and challenges in these apps encourage users to save more money and reach their financial goals faster.

- Debt Reduction: Some apps offer features specifically designed to help users pay off debt, such as debt repayment plans and progress trackers.

- Financial Education: Gamified apps often provide educational content and resources to help users improve their financial literacy.

- Long-Term Financial Success: By fostering positive financial habits and promoting financial awareness, these apps can contribute to long-term financial success.

Potential Drawbacks and Considerations

While gamified finance apps offer numerous benefits, it’s important to be aware of potential drawbacks:

- Oversimplification: Gamification can sometimes oversimplify complex financial concepts, leading to a superficial understanding.

- Distraction: The game-like elements can be distracting and may detract from the seriousness of financial management.

- Security and Privacy: It’s crucial to choose reputable apps with strong security measures to protect your financial data.

- Dependency: Users may become overly reliant on the app and lose the ability to manage their finances independently.

- Not a Substitute for Professional Advice: Gamified apps are not a substitute for professional financial advice. Consult with a financial advisor for personalized guidance.

How to Choose the Right Gamified Finance App

With so many gamified finance apps available, it can be challenging to choose the right one. Here are some factors to consider:

- Your Financial Goals: Determine your specific financial goals, such as saving for retirement, paying off debt, or improving your budgeting skills. Choose an app that aligns with your goals.

- Features and Functionality: Evaluate the features and functionality of different apps to see which ones best meet your needs.

- User Interface and Experience: Look for an app with a user-friendly interface and a smooth, intuitive experience.

- Security and Privacy: Ensure that the app has strong security measures to protect your financial data.

- Reviews and Ratings: Read reviews and ratings from other users to get an idea of the app’s quality and effectiveness.

- Cost: Consider the cost of the app, as some apps charge subscription fees or offer in-app purchases.

- Trial Period: Take advantage of any free trial periods to test out the app before committing to a subscription.

Conclusion

Gamified personal finance apps are revolutionizing the way people manage their money. By making financial management fun, engaging, and rewarding, these apps can help users develop positive financial habits, achieve their financial goals, and improve their overall financial well-being. While it’s important to be aware of potential drawbacks and choose the right app for your needs, the benefits of gamified finance apps are undeniable. So, why not level up your finances and turn your money management into a game?

Disclaimer: I am an AI Chatbot and not a financial advisor. This article is for informational purposes only and should not be considered financial advice. Consult with a qualified financial advisor for personalized guidance.