Level Up Your Finances: How Gamified Investing Journal Pages Can Transform Your Wealth Building

In the dynamic world of finance, where market fluctuations and investment decisions reign supreme, staying organized and engaged is paramount. Traditional investment tracking methods, often involving spreadsheets and complex charts, can feel daunting and even discouraging for many. Enter the innovative solution: gamified investing journal pages. These aren’t your grandma’s dusty ledgers; they’re dynamic tools designed to inject fun, motivation, and a sense of accomplishment into the often-serious process of building wealth.

Why Gamification Works in Investing

Gamification, the application of game-design elements and game principles in non-game contexts, has proven remarkably effective across various fields, from education to marketing. Its power lies in its ability to tap into our intrinsic motivations – our desire for progress, recognition, and a sense of control. When applied to investing, gamification can overcome common hurdles like:

- Procrastination: Breaking down complex investment tasks into smaller, manageable "quests" makes them less intimidating and easier to start.

- Lack of Motivation: Earning points, badges, or virtual rewards for achieving milestones provides a tangible sense of progress and encourages continued effort.

- Emotional Investing: Gamified systems can encourage a more rational and disciplined approach by focusing on data-driven analysis and long-term goals, rather than succumbing to impulsive reactions to market fluctuations.

- Lack of Knowledge: Integrating educational elements into the journal pages, such as trivia questions or learning modules, can enhance financial literacy in an engaging way.

- Boredom and Disengagement: The interactive nature of gamified journals keeps users actively involved in their investment journey, making it less of a chore and more of an enjoyable activity.

The Anatomy of a Gamified Investing Journal Page

A well-designed gamified investing journal page goes beyond simply tracking transactions. It incorporates elements that foster engagement, provide valuable insights, and promote positive financial habits. Here’s a breakdown of the key components:

- Goal Setting and Tracking: Clearly defined financial goals are the foundation of any successful investment strategy. Gamified journals allow users to set specific, measurable, achievable, relevant, and time-bound (SMART) goals, such as saving for a down payment, retirement, or a specific purchase. Progress bars, visual trackers, and reward systems celebrate milestones and keep users motivated.

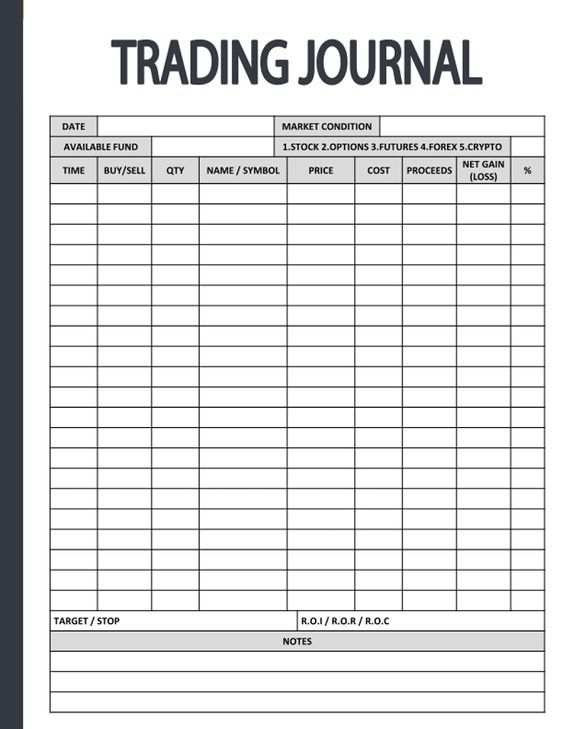

- Transaction Logging and Analysis: While traditional journals focus solely on recording transactions, gamified versions take it a step further by providing automated analysis and insights. This might include:

- Portfolio Performance Tracking: Visual dashboards displaying portfolio value, asset allocation, and overall performance over time.

- Return on Investment (ROI) Calculation: Automatic calculation of ROI for individual investments and the entire portfolio.

- Expense Tracking: Categorizing and tracking investment-related expenses to gain a clear picture of costs.

- Risk Assessment: Tools to assess risk tolerance and evaluate the risk profile of different investments.

- Challenge and Quest Systems: Introducing challenges and quests adds an element of excitement and encourages users to explore new investment strategies or learn about specific financial topics. Examples include:

- "Diversification Quest": Earn points for diversifying the portfolio across different asset classes.

- "Research Challenge": Receive rewards for thoroughly researching a new investment opportunity.

- "Savings Streak Challenge": Maintain a consistent savings schedule for a set period of time to earn bonus points.

- Reward and Recognition Systems: Rewarding progress is crucial for maintaining motivation. Gamified journals can incorporate various reward systems, such as:

- Points and Badges: Earning points for completing tasks, achieving goals, or demonstrating positive financial habits.

- Virtual Leaderboards: (Optional) Comparing progress with other users (anonymously) to foster a sense of competition and community.

- Unlockable Content: Gaining access to exclusive content, such as advanced investment strategies or financial planning tools, as progress is made.

- Personalized Achievements: Customized achievements based on individual goals and progress, providing a sense of accomplishment.

- Educational Content and Learning Modules: Integrating educational elements into the journal pages can significantly enhance financial literacy. This might include:

- Financial Trivia: Fun and engaging trivia questions to test knowledge and reinforce key concepts.

- Mini-Courses: Short, interactive courses on topics such as budgeting, debt management, or investment strategies.

- Glossary of Terms: A readily accessible glossary of financial terms to help users understand complex concepts.

- Links to Reputable Resources: Providing links to trusted financial websites, articles, and tools.

- Personalized Feedback and Insights: Providing personalized feedback based on user data can help identify areas for improvement and guide investment decisions. This might include:

- Spending Analysis: Identifying areas where spending can be reduced to free up more funds for investing.

- Risk Assessment Reports: Providing insights into the risk profile of the portfolio and suggesting adjustments to align with risk tolerance.

- Goal Progress Reports: Tracking progress towards financial goals and providing recommendations for staying on track.

- Community Features (Optional): Some gamified investing platforms incorporate community features, allowing users to connect with other investors, share ideas, and learn from each other. This can foster a sense of belonging and provide valuable support.

Benefits of Using Gamified Investing Journal Pages

The benefits of using gamified investing journal pages extend far beyond mere entertainment. They can have a profound impact on financial outcomes:

- Increased Engagement: The gamified elements make investing more enjoyable and engaging, leading to increased participation and consistency.

- Improved Financial Literacy: The integration of educational content enhances financial knowledge and empowers users to make informed decisions.

- Enhanced Motivation: The reward systems and progress tracking provide a constant source of motivation, encouraging users to stay committed to their financial goals.

- Better Decision Making: The data-driven analysis and personalized feedback provide valuable insights that can lead to better investment decisions.

- Reduced Emotional Investing: The focus on data and long-term goals helps to mitigate emotional reactions to market fluctuations.

- Greater Financial Control: By tracking income, expenses, and investments in a comprehensive and engaging way, users gain a greater sense of control over their financial lives.

- Development of Positive Financial Habits: The consistent use of gamified journals can help to develop positive financial habits, such as saving regularly, diversifying investments, and avoiding unnecessary debt.

Choosing the Right Gamified Investing Journal Page

With the growing popularity of gamified investing, a variety of platforms and apps are available. When choosing a gamified investing journal page, consider the following factors:

- Features: Does the platform offer all the features that are important to you, such as goal setting, transaction tracking, reward systems, and educational content?

- User Interface: Is the platform easy to use and navigate? A well-designed user interface is crucial for maintaining engagement.

- Personalization: Does the platform allow you to personalize your experience, such as setting custom goals and choosing your preferred reward system?

- Security: Is the platform secure and protect your financial data?

- Cost: What is the cost of the platform? Some platforms offer free basic versions, while others require a subscription fee.

- Reviews: Read reviews from other users to get an idea of the platform’s strengths and weaknesses.

Conclusion: Level Up Your Financial Future

Gamified investing journal pages represent a powerful new approach to personal finance. By injecting fun, motivation, and a sense of accomplishment into the investment process, they can help individuals of all ages and backgrounds achieve their financial goals. Whether you’re a seasoned investor or just starting out, consider incorporating gamified elements into your investment journey to level up your finances and build a brighter financial future. It’s time to turn your financial journey into an engaging and rewarding game!