Teaching Money Skills with a Laugh: How Humor Can Make Finance Fun and Engaging

Money. The very word can elicit feelings of anxiety, stress, and even boredom. For many, personal finance is a dry, complicated subject best left to the "experts." But what if we could change that perception? What if we could make learning about money fun, engaging, and even… funny?

Humor, often underestimated in serious contexts, is a powerful tool that can break down barriers, reduce anxiety, and enhance learning. When applied effectively, it can transform financial education from a dreaded chore into an enjoyable experience. This article explores the benefits of using humor to teach money skills and provides practical strategies for incorporating it into various learning environments.

Why Humor Works: The Psychology Behind the Chuckle

Before diving into the "how," let’s understand the "why." Humor works because it taps into several psychological mechanisms that enhance learning and retention:

- Reduces Anxiety: Financial topics can be intimidating, especially for those who feel they lack knowledge or control. Humor creates a relaxed atmosphere, making learners more receptive to new information. A well-placed joke or funny anecdote can diffuse tension and make the subject matter less daunting.

- Enhances Engagement: Let’s face it, lectures filled with complex charts and graphs can be snooze-inducing. Humor injects energy and excitement into the learning process, capturing and maintaining attention. When people are entertained, they’re more likely to stay focused and participate actively.

- Improves Memory: Funny stories and jokes are more memorable than dry facts and figures. Humor creates an emotional connection, which strengthens memory encoding. When we laugh, our brains release dopamine, a neurotransmitter associated with pleasure and reward, which further enhances memory consolidation.

- Facilitates Understanding: Humor can simplify complex concepts by presenting them in relatable and accessible ways. A funny analogy or a satirical scenario can illustrate abstract principles, making them easier to grasp.

- Builds Rapport: Humor fosters a sense of connection between the teacher and the learner. When we laugh together, we create a shared experience that builds trust and camaraderie. This can be particularly important when discussing sensitive topics like money.

Strategies for Infusing Humor into Financial Education

Now that we understand the benefits of humor, let’s explore some practical strategies for incorporating it into your teaching approach:

- Start with Self-Deprecating Humor: Sharing your own financial blunders can be a great way to break the ice and show that you’re human. Admitting your mistakes can make you more relatable and encourage learners to share their own struggles without fear of judgment.

- Example: "I once thought investing in beanie babies was a good idea. Let’s just say, I learned a valuable lesson about diversification the hard way!"

- Use Funny Analogies and Metaphors: Financial concepts can be abstract and confusing. Use humorous analogies to make them more concrete and relatable.

- Example: "Think of your budget like a diet. If you consume more calories than you burn, you’ll gain weight. Similarly, if you spend more money than you earn, you’ll end up in debt."

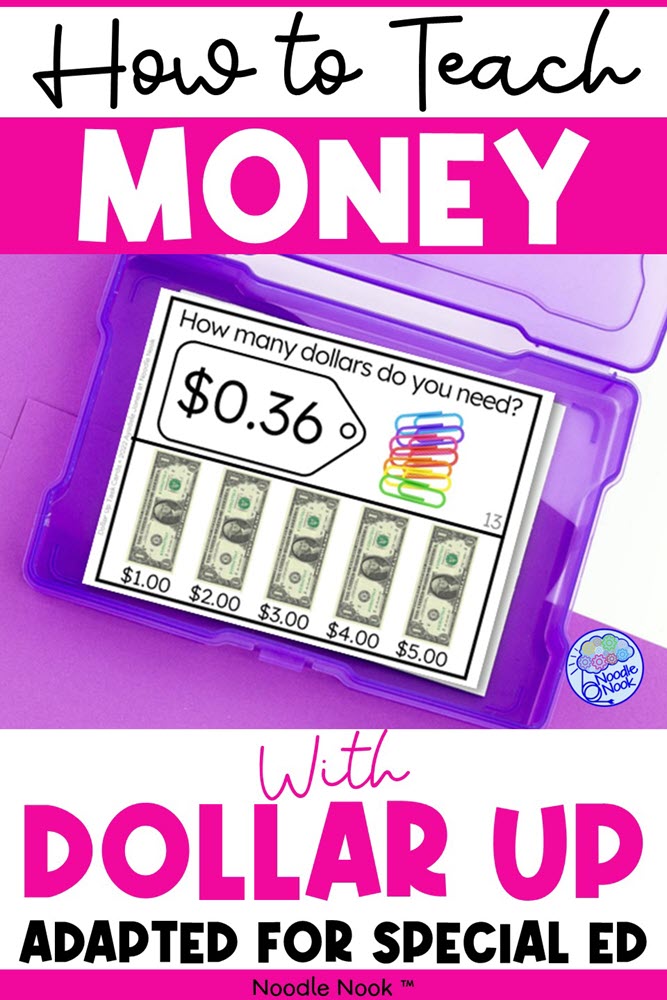

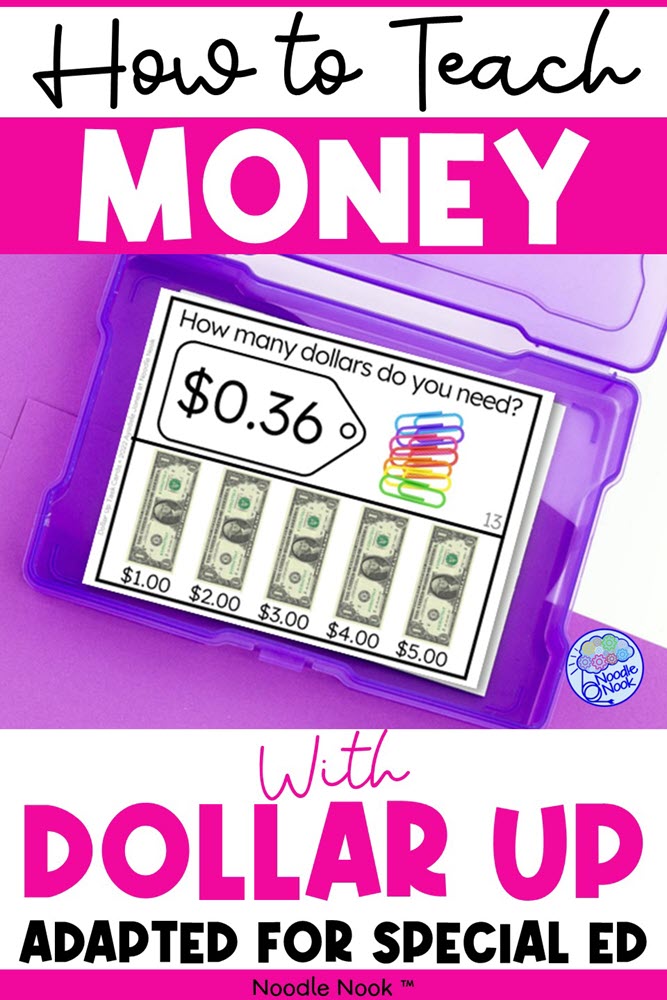

- Incorporate Cartoons and Memes: Visual humor can be incredibly effective. Use relevant cartoons and memes to illustrate key concepts or poke fun at common financial pitfalls.

- Example: A meme of a person looking stressed while holding a stack of bills with the caption, "Me trying to adult."

- Tell Humorous Stories: Anecdotes and stories can bring financial lessons to life. Share funny stories about your own experiences or those of others to illustrate the consequences of good or bad financial decisions.

- Example: A story about a friend who impulse-bought a yacht they couldn’t afford and ended up selling it at a loss.

- Create Funny Scenarios and Role-Playing Exercises: Develop hypothetical situations that require learners to make financial decisions in a humorous context.

- Example: A role-playing exercise where learners negotiate a salary increase with a ridiculously demanding boss.

- Use Financial Puns and Wordplay: Puns can be a fun way to lighten the mood and make financial topics more memorable.

- Example: "Time is money, so invest wisely!"

- Encourage Learners to Share Their Own Funny Experiences: Create a safe space for learners to share their own financial blunders and successes in a humorous way. This can foster a sense of community and make learning more interactive.

- Use Pop Culture References: Incorporate references to popular movies, TV shows, and music to make financial concepts more relatable and engaging.

- Example: "Remember that scene in ‘The Wolf of Wall Street’? That’s a perfect example of what NOT to do with your money!"

- Gamify Learning with Humorous Challenges: Turn financial education into a game with funny challenges and rewards.

- Example: A budgeting challenge where learners compete to see who can save the most money while still living a "luxurious" lifestyle (defined humorously, of course).

- Be Mindful of Your Audience: Humor is subjective, so it’s important to tailor your approach to your audience’s age, cultural background, and level of financial literacy. Avoid jokes that are offensive, insensitive, or overly complex.

Examples of Humor in Action

- Comedy Shows: TV shows like "The Daily Show" and "Last Week Tonight" often use humor to dissect complex economic and financial issues.

- Financial Blogs and Podcasts: Many personal finance bloggers and podcasters use humor to make their content more accessible and engaging.

- Books: Books like "Broke Millennial Takes on Investing" by Erin Lowry use humor to make investing less intimidating for young adults.

Cautions and Considerations

While humor can be a powerful tool, it’s important to use it responsibly and ethically. Here are a few things to keep in mind:

- Avoid trivializing serious topics: Financial hardship is a real issue for many people. Avoid jokes that make light of poverty, debt, or other financial struggles.

- Be respectful: Avoid jokes that are sexist, racist, or otherwise offensive.

- Know your audience: What one person finds funny, another may find offensive. Be mindful of your audience’s background and sensitivities.

- Don’t force it: If you’re not naturally funny, don’t try to be. Forced humor can come across as awkward and uncomfortable.

- Balance humor with substance: Humor should be used to enhance learning, not to distract from it. Make sure your content is still informative and accurate.

Conclusion

Learning about money doesn’t have to be a chore. By incorporating humor into your teaching approach, you can make financial education more engaging, accessible, and memorable. So, go ahead, crack a joke, tell a funny story, and watch your learners’ faces light up. After all, a little laughter can go a long way in helping people achieve their financial goals. Remember, the goal isn’t just to teach people about money, but to empower them to take control of their financial lives with confidence and a smile.