Tracking Your Portfolio: A Comprehensive Guide to Financial Success

In the dynamic world of investing, staying informed and organized is paramount. Tracking your investment portfolio is not just about knowing the current value of your assets; it’s a vital practice that empowers you to make informed decisions, optimize your strategy, and achieve your financial goals. Whether you’re a seasoned investor or just starting your journey, this guide will provide you with the knowledge and tools to effectively track your portfolio and gain a deeper understanding of your financial landscape.

Why Track Your Portfolio? The Core Benefits

Before diving into the "how," let’s understand the "why." Tracking your portfolio offers a multitude of benefits that can significantly impact your investment success:

- Performance Monitoring: The most obvious benefit is knowing how your investments are performing. Are they growing as expected? Are they underperforming compared to benchmarks? Tracking provides a clear picture of your returns.

- Risk Management: By monitoring the allocation of assets in your portfolio, you can identify potential risks. If you are overweight in one sector or asset class, you can adjust your portfolio to mitigate risk.

- Decision Making: Tracking provides the data you need to make informed decisions about buying, selling, or holding investments. It helps you avoid emotional reactions and base your choices on facts.

- Tax Optimization: Tracking capital gains and losses can help you optimize your tax strategy. You can use losses to offset gains and minimize your tax liability.

- Goal Alignment: By tracking your portfolio’s progress, you can assess whether you’re on track to meet your financial goals, such as retirement, a down payment on a house, or funding your children’s education.

- Identifying Trends: Consistent tracking reveals trends in your investments. You can spot patterns in performance, dividend payouts, or market fluctuations that can inform future decisions.

Methods for Tracking Your Portfolio

There are several methods for tracking your portfolio, each with its own advantages and disadvantages. The best choice depends on your preferences, the complexity of your portfolio, and your technical skills:

-

Spreadsheet Software (Excel, Google Sheets):

- Pros: Free, customizable, allows for manual data entry and personalized calculations.

- Cons: Time-consuming for manual updates, prone to errors, requires some spreadsheet skills.

- How to: Create columns for asset name, purchase date, quantity, purchase price, current price, and other relevant data. Use formulas to calculate gains/losses, portfolio value, and asset allocation.

-

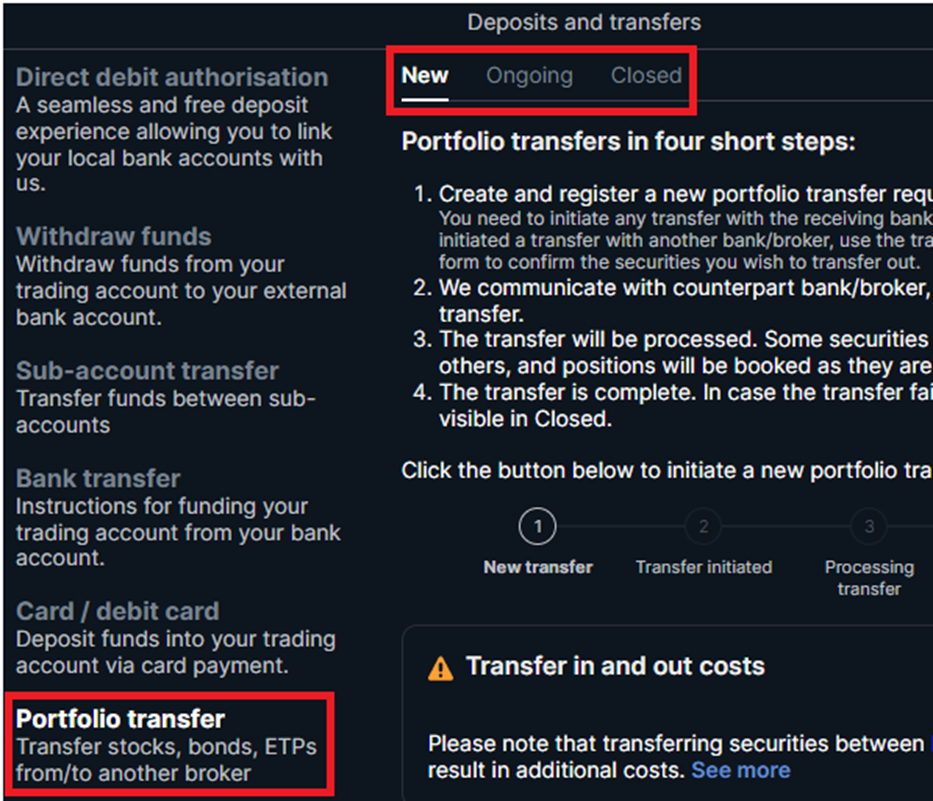

Brokerage Account Tools:

- Pros: Convenient, real-time data, often includes performance reports and analysis tools.

- Cons: Limited to investments held within that brokerage, may not offer comprehensive portfolio analysis.

- How to: Log in to your brokerage account and navigate to the portfolio or performance section. Explore the available reports and tools to track your holdings.

-

Portfolio Tracking Apps and Software:

- Pros: Automated data updates, comprehensive analysis, budgeting and planning tools, integration with multiple accounts.

- Cons: Subscription fees, may require linking financial accounts (security considerations).

- Popular Options:

- Personal Capital: Free for basic tracking, offers wealth management services.

- Mint: Free budgeting and tracking app, integrates with investment accounts.

- Yahoo Finance: Free portfolio tracking with news and analysis.

- Morningstar Portfolio Manager: Robust analysis tools for serious investors (paid).

- Sharesight: Specifically designed for tracking investments across multiple brokers.

-

Hiring a Financial Advisor:

- Pros: Professional expertise, personalized advice, comprehensive financial planning.

- Cons: Fees, may not be suitable for all investors.

- How to: Work with your advisor to establish tracking methods and review your portfolio regularly.

Key Metrics to Track

Tracking your portfolio involves more than just looking at the total value. Here are some key metrics you should monitor:

- Total Portfolio Value: The overall worth of all your investments.

- Asset Allocation: The percentage of your portfolio allocated to different asset classes (stocks, bonds, real estate, etc.).

- Individual Asset Performance: The return on each individual investment.

- Portfolio Return: The overall return on your portfolio, expressed as a percentage.

- Benchmark Comparison: How your portfolio’s performance compares to relevant benchmarks (e.g., S&P 500, bond index).

- Dividend Income: The amount of income you receive from dividends.

- Capital Gains/Losses: The profits or losses you realize from selling investments.

- Expense Ratio: The annual cost of owning a mutual fund or ETF, expressed as a percentage.

- Risk Metrics: Measures of portfolio risk, such as beta and standard deviation.

Tips for Effective Portfolio Tracking

- Choose a Method That Suits You: Select a tracking method that aligns with your technical skills, time commitment, and portfolio complexity.

- Automate Data Updates: Whenever possible, automate the process of updating your portfolio data to save time and reduce errors.

- Track Regularly: Aim to track your portfolio at least monthly, or more frequently if you are actively trading.

- Rebalance Periodically: Rebalance your portfolio regularly to maintain your desired asset allocation.

- Review Your Goals: Periodically review your financial goals and adjust your portfolio strategy as needed.

- Understand Your Risk Tolerance: Make sure your portfolio aligns with your risk tolerance.

- Don’t Obsess Over Short-Term Fluctuations: Focus on long-term trends rather than short-term market volatility.

- Seek Professional Advice: If you’re unsure about any aspect of portfolio tracking or investment management, consult with a qualified financial advisor.

- Keep Records Organized: Maintain accurate records of all your investment transactions for tax purposes.

- Security: If using online tools, enable two-factor authentication and use strong passwords.

Example Scenario

Let’s say you have a portfolio consisting of the following:

- Stocks (60%):

- Apple (AAPL): 10 shares

- Microsoft (MSFT): 5 shares

- Bonds (30%):

- Vanguard Total Bond Market ETF (BND): 20 shares

- Real Estate (10%):

- Real Estate Investment Trust (REIT): 5 Shares

Using a spreadsheet, you would track the purchase price, current price, and the change in value for each holding. You would then calculate the total value of each asset class and the overall portfolio value. By comparing your portfolio’s performance to relevant benchmarks, you can assess whether you are on track to meet your financial goals.

Conclusion

Tracking your investment portfolio is an essential practice for anyone who wants to achieve financial success. By understanding the benefits of tracking, choosing the right methods, and monitoring key metrics, you can gain valuable insights into your investments and make informed decisions that align with your financial goals. Remember to stay disciplined, avoid emotional reactions, and seek professional advice when needed. With consistent tracking and a well-defined investment strategy, you can navigate the complexities of the market and build a secure financial future.