Unleash Your Financial Power: Mastering Interactive Budgeting Spreadsheets

In today’s complex financial landscape, taking control of your finances is more crucial than ever. While traditional budgeting methods can feel rigid and overwhelming, interactive budgeting spreadsheets offer a dynamic and empowering approach. These digital tools transform the often-dreaded task of budgeting into an engaging and insightful experience, allowing you to track your income, manage expenses, and achieve your financial goals with greater ease.

What is an Interactive Budgeting Spreadsheet?

At its core, an interactive budgeting spreadsheet is a digital document – typically created in programs like Microsoft Excel, Google Sheets, or specialized budgeting software – designed to help you manage your money effectively. What sets it apart from a static budget is its ability to respond to your input in real-time.

Here’s how it works:

- Data Input: You enter your income, expenses, and savings goals into the spreadsheet.

- Automated Calculations: The spreadsheet automatically performs calculations, such as summing up expenses, calculating savings rates, and projecting future balances.

- Visualizations: Interactive spreadsheets often include charts and graphs that provide a visual representation of your financial data, making it easier to understand your spending patterns and track your progress.

- Dynamic Adjustments: You can easily adjust your budget as your income or expenses change, and the spreadsheet will automatically update the calculations and visualizations.

- Goal Tracking: Set financial goals (e.g., paying off debt, saving for a down payment) and monitor your progress towards achieving them.

Why Choose an Interactive Spreadsheet Over Other Budgeting Methods?

- Flexibility: Unlike rigid pre-set budgets, interactive spreadsheets adapt to your unique financial situation and changing circumstances.

- Customization: Tailor the spreadsheet to your specific needs and preferences, adding or removing categories as necessary.

- Real-Time Insights: Get instant feedback on your spending habits and progress towards your goals.

- Data-Driven Decisions: Make informed financial decisions based on accurate and up-to-date data.

- Cost-Effective: Many excellent interactive spreadsheet templates are available for free or at a low cost.

- Skill Enhancement: Using spreadsheets can improve your overall financial literacy and analytical skills.

- Automation: Automation features reduce the manual work of tracking your finances.

Key Features of an Effective Interactive Budgeting Spreadsheet

A well-designed interactive budgeting spreadsheet should include the following essential features:

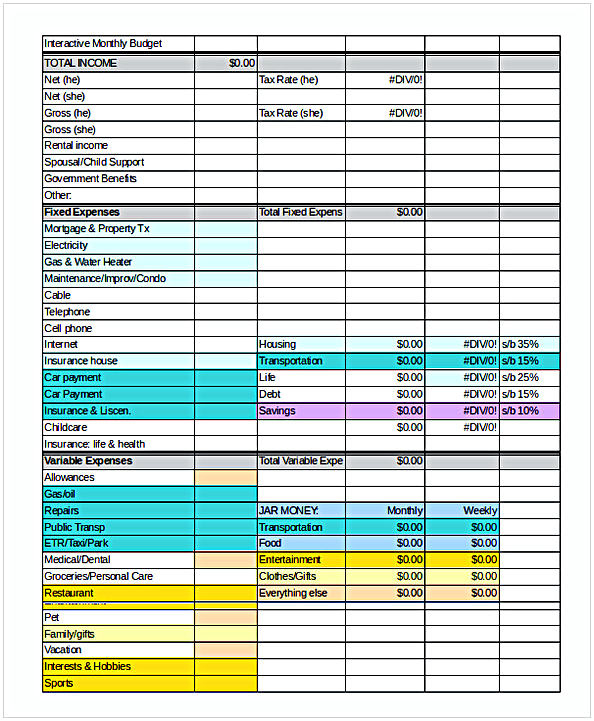

- Income Tracking: A dedicated section to record all sources of income, including salary, freelance earnings, investments, and other income streams.

- Expense Tracking: A comprehensive list of expense categories, such as housing, transportation, food, entertainment, and debt payments. The ability to break down these categories into subcategories for more detailed tracking is ideal.

- Savings Goals: A section to set and track savings goals, such as emergency funds, retirement savings, or down payments on a home.

- Debt Management: A tool to track outstanding debts, including balances, interest rates, and payment schedules.

- Cash Flow Analysis: A summary of your income, expenses, and net cash flow, providing a clear picture of your financial health.

- Budget vs. Actual Tracking: A comparison of your planned budget versus your actual spending, highlighting areas where you are over or under budget.

- Visualizations: Charts and graphs that illustrate your spending patterns, savings progress, and debt reduction.

- Customizable Categories: The ability to add, remove, or modify expense categories to fit your specific needs.

- Automated Calculations: Formulas that automatically calculate totals, balances, and other key financial metrics.

- Goal Setting: The ability to set short-term and long-term financial goals and track progress toward achieving them.

- Scenario Planning: The ability to simulate different financial scenarios (e.g., job loss, unexpected expenses) to see how they would impact your budget.

- Accessibility: Easy to access and update from multiple devices (e.g., computer, smartphone, tablet).

How to Create Your Own Interactive Budgeting Spreadsheet

You can create your own interactive budgeting spreadsheet using programs like Microsoft Excel or Google Sheets. Here’s a step-by-step guide:

- Choose Your Software: Select a spreadsheet program that you are comfortable using. Google Sheets is a free and convenient option, while Microsoft Excel offers more advanced features.

- Set Up Your Income Section: Create a section to track all sources of income. Include columns for the date, source, and amount.

- List Your Expense Categories: Create a comprehensive list of expense categories, such as housing, transportation, food, entertainment, and debt payments. Break down these categories into subcategories for more detailed tracking.

- Add Formulas: Use formulas to automatically calculate totals, balances, and other key financial metrics. For example, you can use the SUM function to calculate your total income and expenses.

- Create Visualizations: Use charts and graphs to illustrate your spending patterns, savings progress, and debt reduction.

- Customize Your Spreadsheet: Add, remove, or modify expense categories to fit your specific needs. You can also customize the appearance of your spreadsheet by changing the fonts, colors, and formatting.

- Test Your Spreadsheet: Enter sample data and make sure that the calculations and visualizations are working correctly.

- Update Regularly: Make it a habit to update your spreadsheet regularly, ideally on a weekly or monthly basis.

Tips for Maximizing the Power of Your Interactive Budgeting Spreadsheet

- Be Consistent: Regularly update your spreadsheet with accurate data to ensure that you are getting a clear picture of your finances.

- Track Everything: Don’t leave out any expenses, no matter how small. Every dollar counts!

- Review Regularly: Set aside time each month to review your budget and identify areas where you can save money or adjust your spending habits.

- Set Realistic Goals: Set achievable financial goals that will motivate you to stick to your budget.

- Automate Where Possible: Use automated features to reduce the manual work of tracking your finances.

- Seek Professional Advice: If you are struggling to manage your finances, consider seeking advice from a financial advisor.

- Be Patient: It takes time to develop good budgeting habits. Don’t get discouraged if you don’t see results immediately.

The Future of Interactive Budgeting

Interactive budgeting is continuously evolving. We can expect to see more sophisticated features, such as:

- AI-Powered Insights: Artificial intelligence will analyze your financial data and provide personalized recommendations for saving money and achieving your goals.

- Seamless Integration: Integration with bank accounts and credit cards will automate the process of tracking income and expenses.

- Gamification: Gamified budgeting apps will make managing your finances more fun and engaging.

- Personalized Financial Advice: Interactive budgeting tools will provide personalized financial advice based on your unique financial situation and goals.

Conclusion

Interactive budgeting spreadsheets are a powerful tool for taking control of your finances. By providing real-time insights, customizable features, and automated calculations, these digital tools can help you track your income, manage expenses, and achieve your financial goals with greater ease. Whether you’re a seasoned budgeter or just starting out, an interactive budgeting spreadsheet can be a valuable asset in your financial journey. So, take the plunge, create your own spreadsheet, and unleash your financial power today!