Unlock Financial Mastery: The Power of Interactive Finance Templates in Notion

Introduction

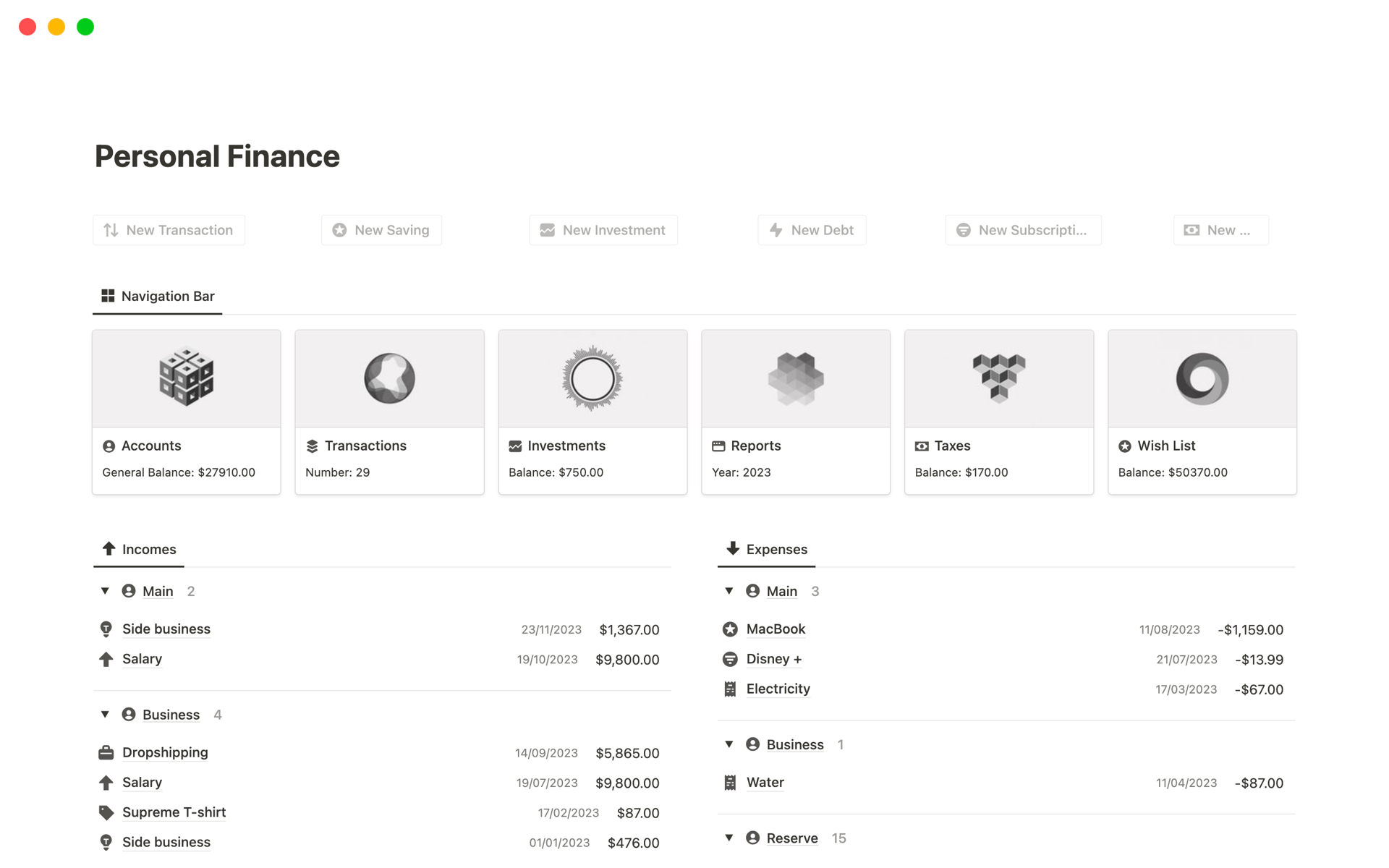

In today’s fast-paced world, managing personal and business finances can feel overwhelming. Spreadsheets, budgeting apps, and complex software often fall short, leaving us yearning for a simpler, more integrated solution. Enter Notion, the all-in-one workspace that’s transforming how we organize our lives. When combined with interactive finance templates, Notion becomes a powerful tool for achieving financial clarity and control.

This article explores the benefits of using interactive finance templates within Notion, showcasing how they can revolutionize your approach to budgeting, tracking expenses, managing investments, and planning for the future.

Why Notion for Finance? A Winning Combination

Notion has surged in popularity due to its flexibility and customizability. Here’s why it’s a fantastic platform for managing your finances:

- All-in-One Workspace: Notion seamlessly integrates notes, databases, calendars, and project management tools. This means you can keep your financial data alongside your goals, tasks, and other important information.

- Customizable Databases: Notion’s database feature is incredibly versatile. You can create custom databases to track income, expenses, investments, and more. Tailor the fields and properties to match your specific needs.

- Interactive and Dynamic: Unlike static spreadsheets, Notion templates can be highly interactive. Use formulas, relations, and rollups to create dynamic dashboards that provide real-time insights into your financial health.

- Visually Appealing: Notion’s clean and modern interface makes it a pleasure to use. Customize the look and feel of your templates with colors, icons, and cover images to create a visually engaging experience.

- Collaboration: Share your Notion workspace with family members, business partners, or financial advisors to collaborate on financial planning and decision-making.

- Accessibility: Access your financial data from anywhere, on any device. Notion’s mobile apps and web interface ensure you’re always connected to your finances.

The Power of Interactive Finance Templates

Interactive finance templates take the power of Notion to the next level. These pre-built or custom-designed templates provide a structured framework for managing your finances effectively. Here’s what makes them so valuable:

- Streamlined Setup: Instead of starting from scratch, interactive templates provide a pre-configured structure for tracking your finances. This saves you time and effort, allowing you to focus on managing your money.

- Automated Calculations: Templates often include built-in formulas that automatically calculate balances, track spending trends, and project future financial outcomes.

- Visual Dashboards: Interactive dashboards provide a bird’s-eye view of your financial health. Charts, graphs, and key metrics make it easy to understand your income, expenses, and net worth.

- Goal Tracking: Set financial goals, such as saving for a down payment or paying off debt. Interactive templates help you track your progress and stay motivated.

- Customization: While templates provide a starting point, they can be easily customized to fit your unique needs and preferences. Add new fields, modify formulas, and adjust the layout to create a personalized financial management system.

Types of Interactive Finance Templates for Notion

Notion offers a wide variety of finance templates to suit different needs and goals. Here are some popular categories:

- Budgeting Templates:

- Monthly Budget Tracker: Track your income and expenses on a monthly basis. Categorize your spending, identify areas where you can save, and monitor your progress toward your budget goals.

- Zero-Based Budget: Allocate every dollar you earn to a specific purpose. This template helps you ensure that your income matches your expenses, leaving you with zero dollars unallocated.

- Envelope Budgeting System: Digitally replicate the traditional envelope budgeting method. Allocate funds to virtual envelopes for different spending categories and track your progress.

- Expense Tracking Templates:

- Daily Expense Log: Record your expenses as they occur throughout the day. Categorize your spending and generate reports to identify your biggest expenses.

- Subscription Tracker: Manage your recurring subscriptions and track their costs. Set reminders to cancel subscriptions you no longer need.

- Debt Tracker: Track your outstanding debts, including credit cards, loans, and mortgages. Set repayment goals and monitor your progress toward becoming debt-free.

- Investment Tracking Templates:

- Portfolio Tracker: Track your investments across different asset classes, such as stocks, bonds, and real estate. Monitor your portfolio’s performance and calculate your returns.

- Dividend Tracker: Track your dividend income and reinvestment. Monitor your dividend yield and growth over time.

- Net Worth Tracker: Track your assets and liabilities to calculate your net worth. Monitor your net worth over time and identify areas where you can improve your financial position.

- Financial Planning Templates:

- Retirement Planner: Estimate your retirement income needs and develop a savings plan to achieve your retirement goals.

- Savings Goal Tracker: Set savings goals for specific purposes, such as a down payment on a house or a vacation. Track your progress and stay motivated.

- Financial Independence Calculator: Calculate the amount of money you need to achieve financial independence. Develop a plan to reach your financial independence goals.

- Business Finance Templates:

- Profit and Loss Statement: Track your business income and expenses to calculate your profit or loss.

- Cash Flow Statement: Track the flow of cash into and out of your business.

- Balance Sheet: Track your business assets, liabilities, and equity.

Creating Your Own Interactive Finance Templates

While pre-built templates are a great starting point, you can also create your own custom templates in Notion. Here’s a step-by-step guide:

- Define Your Needs: Identify the specific financial information you want to track and the goals you want to achieve.

- Create a Database: Create a new database in Notion to store your financial data.

- Add Properties: Add properties to your database to track different aspects of your finances, such as date, amount, category, and description.

- Create Views: Create different views of your database to visualize your data in different ways. For example, you can create a table view to see a detailed list of your expenses, or a calendar view to see your income and expenses over time.

- Add Formulas: Use formulas to automate calculations and generate insights. For example, you can use a formula to calculate your total expenses for a given month, or to track your progress toward a savings goal.

- Create Dashboards: Create dashboards to provide a bird’s-eye view of your financial health. Use charts, graphs, and key metrics to visualize your data and track your progress toward your goals.

Tips for Maximizing Your Notion Finance Templates

- Consistency is Key: Make it a habit to update your templates regularly. The more consistent you are, the more accurate and valuable your financial data will be.

- Automate Where Possible: Take advantage of Notion’s automation features to streamline your financial management processes.

- Use Integrations: Connect your Notion workspace to other apps and services to automate data entry and enhance your workflow.

- Review and Adjust: Regularly review your templates and make adjustments as needed to ensure they continue to meet your evolving needs.

Conclusion

Interactive finance templates in Notion offer a powerful and flexible solution for managing your personal and business finances. By leveraging Notion’s all-in-one workspace, customizable databases, and interactive features, you can gain clarity, control, and confidence in your financial decision-making. Whether you’re a seasoned financial planner or just starting out, Notion provides the tools you need to achieve your financial goals.

![]()