Unlock Your Future: The Power of Financial Dreams Planner Templates

Introduction

In the realm of personal finance, the concept of dreaming often gets overshadowed by the nitty-gritty of budgeting, saving, and investing. However, having financial dreams is the very foundation upon which a secure and fulfilling future is built. These dreams—whether they involve buying a home, traveling the world, retiring early, or starting a business—provide the motivation and direction needed to navigate the complexities of money management.

A Financial Dreams Planner Template is a powerful tool that bridges the gap between aspiration and achievement. It’s more than just a spreadsheet or document; it’s a roadmap designed to help you define, strategize, and ultimately realize your financial goals.

Why You Need a Financial Dreams Planner

-

Clarity and Focus: The first step towards achieving any goal is defining it clearly. A planner template prompts you to articulate your dreams, making them tangible and measurable. This clarity provides focus, ensuring that your financial decisions align with your long-term objectives.

-

Prioritization: Not all dreams are created equal. Some may be more important or time-sensitive than others. A planner template helps you prioritize your dreams based on their significance and feasibility, allowing you to allocate resources effectively.

-

Goal Setting: Once your dreams are defined and prioritized, the planner template guides you in setting specific, measurable, achievable, relevant, and time-bound (SMART) goals. This structured approach transforms vague aspirations into concrete targets.

-

Budgeting and Saving: Achieving financial dreams requires a solid financial foundation. The planner template helps you assess your current financial situation, identify areas for improvement, and develop a budget and savings plan that supports your goals.

-

Investment Strategy: Depending on the nature of your dreams, you may need to consider investment options to accelerate your progress. The planner template can help you explore different investment strategies, assess risk tolerance, and create a diversified portfolio.

-

Motivation and Accountability: Tracking your progress is essential for staying motivated. The planner template provides a visual representation of your achievements, reinforcing positive habits and encouraging you to stay on track. Regular reviews also provide accountability, ensuring that you remain committed to your goals.

-

Flexibility and Adaptability: Life is full of surprises, and financial plans need to be flexible enough to accommodate unexpected events. A planner template allows you to adjust your strategies as needed, ensuring that you remain on course despite unforeseen challenges.

Key Components of a Financial Dreams Planner Template

A comprehensive Financial Dreams Planner Template should include the following components:

-

Dream Definition:

- A space to list all your financial dreams, big or small.

- A description of what each dream entails and why it’s important to you.

- A target date for achieving each dream.

-

Prioritization Matrix:

- A system for ranking your dreams based on their importance and feasibility.

- A method for categorizing dreams as short-term, medium-term, or long-term.

-

Goal Setting Worksheet:

- A template for setting SMART goals for each dream.

- A breakdown of the steps required to achieve each goal.

- A timeline for completing each step.

-

Financial Assessment:

- A snapshot of your current financial situation, including income, expenses, assets, and liabilities.

- A calculation of your net worth.

- An analysis of your cash flow.

-

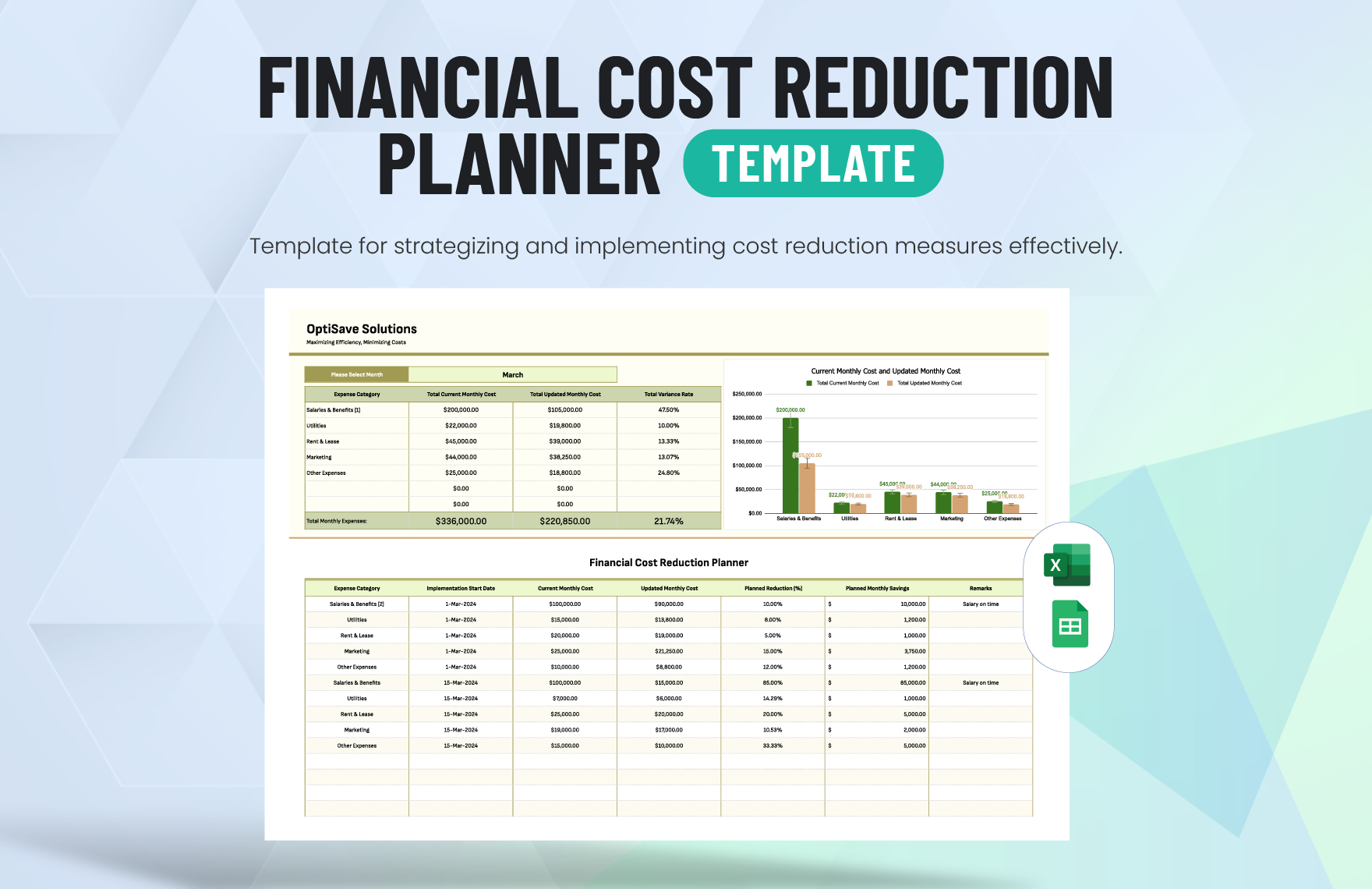

Budgeting and Saving Plan:

- A template for creating a budget that aligns with your financial goals.

- A plan for increasing your savings rate.

- Strategies for reducing debt.

-

Investment Strategy:

- An assessment of your risk tolerance.

- An overview of different investment options.

- A plan for diversifying your portfolio.

-

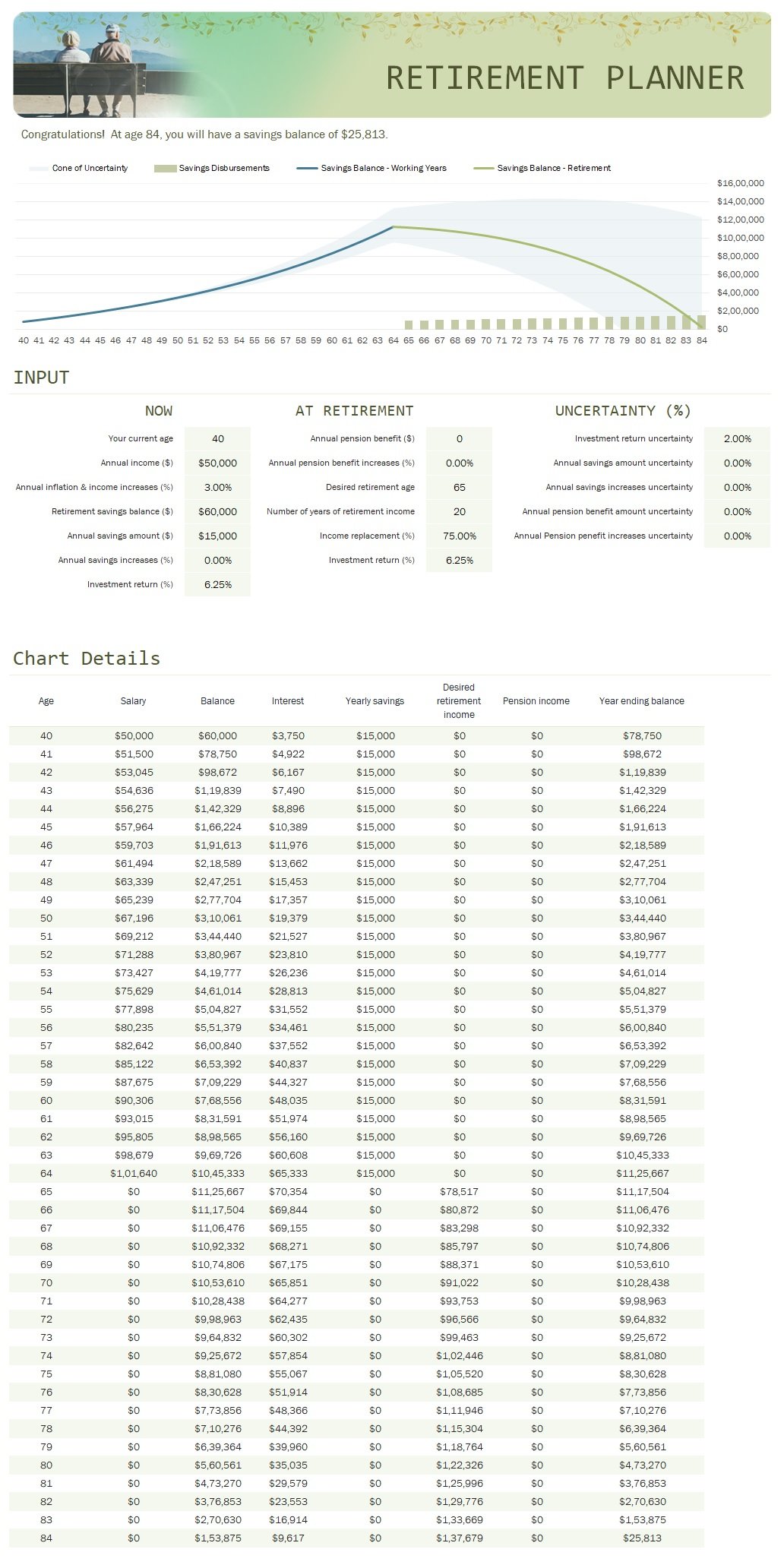

Progress Tracker:

- A visual representation of your progress towards each goal.

- A system for monitoring your budget and savings.

- A record of your investment performance.

-

Review and Adjustment Log:

- A schedule for reviewing your financial plan.

- A log for documenting any adjustments made to your strategies.

- A space for reflecting on your progress and challenges.

Types of Financial Dreams Planner Templates

There are several types of Financial Dreams Planner Templates available, each catering to different needs and preferences:

-

Spreadsheet Templates: These templates are created using software like Microsoft Excel or Google Sheets. They offer flexibility and customization, allowing you to tailor the planner to your specific needs.

- Pros: Highly customizable, easy to use, widely accessible.

- Cons: Can be time-consuming to set up, requires manual data entry.

-

Digital Planner Apps: These apps are designed specifically for financial planning. They offer a user-friendly interface and automated features, such as budgeting tools and investment tracking.

- Pros: Convenient, automated, feature-rich.

- Cons: May require a subscription fee, limited customization.

-

Printable Templates: These templates are designed to be printed and filled out by hand. They offer a tactile experience and can be a good option for those who prefer pen and paper.

- Pros: Simple, affordable, no technology required.

- Cons: Less flexible, requires manual calculations, can be difficult to update.

-

Software-Based Templates: These templates are more robust and provide comprehensive financial planning assistance.

- Pros: Detailed planning, reporting, and analysis

- Cons: Costly and requires some financial knowledge

How to Choose the Right Template

Choosing the right Financial Dreams Planner Template depends on your individual needs and preferences. Consider the following factors:

- Your Financial Literacy: If you’re new to financial planning, opt for a simple and user-friendly template. If you have more experience, you may prefer a more complex and customizable template.

- Your Preferred Format: Do you prefer working with spreadsheets, digital apps, or pen and paper? Choose a template that aligns with your preferred format.

- Your Budget: Some templates are free, while others require a subscription fee. Choose a template that fits your budget.

- Your Goals: Consider the complexity of your financial goals. If you have multiple, long-term goals, you may need a more comprehensive template.

Tips for Using Your Financial Dreams Planner

- Be Realistic: Set achievable goals and be honest about your current financial situation.

- Be Consistent: Regularly update your planner and track your progress.

- Stay Flexible: Be prepared to adjust your strategies as needed.

- Seek Professional Advice: If you’re struggling to create or implement your financial plan, consider consulting with a financial advisor.

- Celebrate Your Successes: Acknowledge and celebrate your achievements along the way.

Conclusion

A Financial Dreams Planner Template is an indispensable tool for anyone who wants to take control of their financial future. By providing clarity, focus, and a structured approach to goal setting, it empowers you to transform your dreams into reality. Whether you choose a simple spreadsheet template or a sophisticated digital app, the key is to find a system that works for you and commit to using it consistently. With dedication and the right tools, you can unlock your financial potential and create the life you’ve always dreamed of.

Additional Tips

- Review Regularly: Set aside time each month to review your progress.

- Stay Updated: Keep your information current and accurate.

- Automate Savings: Set up automatic transfers to your savings accounts.

- Educate Yourself: Learn more about personal finance and investing.

- Stay Positive: Believe in your ability to achieve your financial dreams.

I hope this article is helpful! Let me know if you would like any revisions or further additions.