Unlocking Financial Success: A Comprehensive Guide to Understanding Return on Investment (ROI)

In the realm of business and finance, the ability to make informed decisions is paramount. Whether you’re a seasoned investor, a budding entrepreneur, or simply seeking to manage your personal finances more effectively, one metric stands out as a cornerstone for evaluating the profitability and efficiency of investments: Return on Investment (ROI).

ROI is more than just a number; it’s a powerful tool that provides invaluable insights into the potential gains and losses associated with any investment. Mastering the concept of ROI is essential for making sound financial decisions, allocating resources wisely, and ultimately achieving your financial goals.

What is Return on Investment (ROI)?

At its core, ROI is a financial ratio that measures the profitability of an investment relative to its cost. It expresses the return as a percentage, making it easy to compare the performance of different investments, regardless of their size or duration.

In simple terms, ROI answers the question: "How much money did I make (or lose) for every dollar I invested?"

The ROI Formula: A Simple Calculation with Powerful Implications

The basic formula for calculating ROI is as follows:

ROI = (Net Profit / Cost of Investment) * 100Where:

- Net Profit is the total revenue generated from the investment minus all associated expenses.

- Cost of Investment is the total amount of money spent to acquire or undertake the investment.

Example:

Let’s say you invested $10,000 in a marketing campaign, and it generated $15,000 in revenue. The cost of the campaign, including advertising costs, staff time, and other expenses, totaled $3,000.

To calculate the ROI:

- Net Profit = Revenue – Expenses = $15,000 – $3,000 = $12,000

- *ROI = ($12,000 / $10,000) 100 = 120%**

This means that for every dollar you invested in the marketing campaign, you earned $1.20 in profit.

Why is ROI Important?

ROI is a vital metric for several reasons:

-

Investment Evaluation: ROI allows you to assess the potential profitability of an investment before committing resources. By comparing the expected ROI of different opportunities, you can prioritize those that offer the highest returns.

-

Performance Measurement: After an investment has been made, ROI can be used to track its performance and determine whether it is meeting expectations. This enables you to make adjustments as needed to maximize returns.

-

Resource Allocation: ROI helps you allocate resources efficiently by directing capital to investments that generate the most significant returns.

-

Benchmarking: ROI can be used to compare the performance of your investments against industry benchmarks or competitors, providing valuable insights into your relative success.

-

Communication: ROI is a clear and concise metric that can be easily understood by stakeholders, making it an effective tool for communicating the value of investments.

Factors that Influence ROI

Several factors can influence the ROI of an investment, including:

-

Initial Investment Cost: The higher the initial investment, the more challenging it can be to achieve a high ROI.

-

Revenue Generated: The more revenue generated by an investment, the higher the ROI.

-

Expenses: The lower the expenses associated with an investment, the higher the ROI.

-

Time Horizon: The longer it takes for an investment to generate returns, the lower the ROI may be.

-

Market Conditions: External factors such as economic conditions, competition, and consumer demand can significantly impact the ROI of an investment.

Limitations of ROI

While ROI is a valuable metric, it is essential to be aware of its limitations:

-

Ignores Time Value of Money: ROI does not account for the time value of money, which means that it treats a dollar earned today as equivalent to a dollar earned in the future.

-

Oversimplification: ROI is a simplified measure of profitability that may not capture all the nuances of an investment.

-

Potential for Manipulation: ROI can be manipulated by adjusting the way revenue and expenses are reported.

-

Backward-Looking: ROI is a historical measure of performance and may not be indicative of future results.

-

Qualitative Factors: ROI is a quantitative metric that does not consider qualitative factors such as brand reputation, customer satisfaction, or social impact.

Beyond the Basic Formula: Advanced ROI Calculations

While the basic ROI formula is a useful starting point, more advanced calculations can provide a more nuanced understanding of investment performance:

-

Annualized ROI: This calculation converts ROI to an annual rate, allowing for a more accurate comparison of investments with different time horizons.

Annualized ROI = [(1 + ROI)^(1 / Number of Years)] - 1 -

Adjusted ROI: This calculation adjusts ROI for inflation or other factors that can impact the real value of returns.

-

Risk-Adjusted ROI: This calculation adjusts ROI for the level of risk associated with an investment, providing a more accurate measure of risk-adjusted returns.

Practical Applications of ROI

ROI can be applied in a wide range of contexts, including:

-

Marketing: Evaluating the effectiveness of marketing campaigns and optimizing marketing spend.

-

Real Estate: Assessing the profitability of rental properties or real estate investments.

-

Stock Investing: Measuring the returns on stock investments and comparing the performance of different stocks.

-

Business Operations: Evaluating the efficiency of business processes and identifying areas for improvement.

-

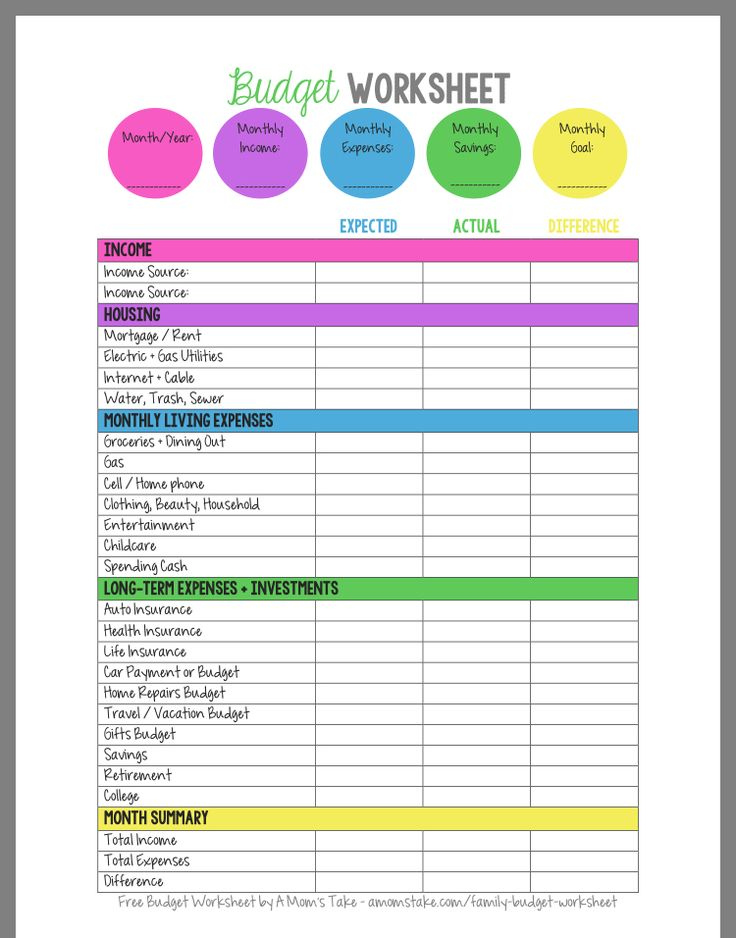

Personal Finance: Assessing the returns on personal investments such as retirement accounts or savings plans.

Tips for Maximizing ROI

Here are some tips for maximizing ROI:

-

Set Clear Goals: Define clear goals for your investments and track your progress regularly.

-

Conduct Thorough Research: Before making any investment, conduct thorough research to understand the risks and potential rewards.

-

Manage Expenses: Keep expenses as low as possible to maximize net profit.

-

Monitor Performance: Regularly monitor the performance of your investments and make adjustments as needed.

-

Seek Professional Advice: Consider seeking advice from a financial advisor to help you make informed investment decisions.

Conclusion

Return on Investment (ROI) is a critical metric for evaluating the profitability and efficiency of investments. By understanding the ROI formula, its importance, limitations, and practical applications, you can make more informed financial decisions, allocate resources wisely, and ultimately achieve your financial goals. While ROI is not a perfect measure, it provides a valuable framework for assessing investment performance and making sound financial decisions. Mastering the concept of ROI is essential for anyone seeking to unlock financial success.